6 Key Signs You Can’t Afford To Travel This Year

It’s a popular time to book a summer vacation, but a trip isn’t in everyone’s budget. As you start looking into flights, accommodations, and other aspects of your upcoming trip, it’s important to make sure you can comfortably afford it.

Be Aware: Dave Ramsey: 7 Vacation Splurges That are a Waste of Money

Try This: One Smart Way To Grow Your Retirement Savings in 2024

If you can’t, you might be better off with an alternative — or putting off your trip until next year. Here are six signs that it’s not in your budget to take a trip this year.

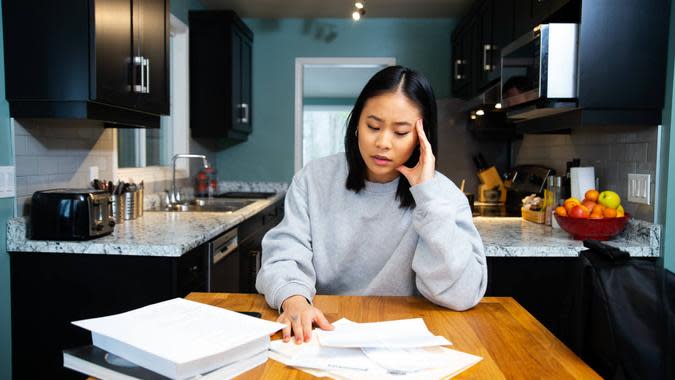

You’re Stressing About the Budget

Perhaps the most obvious sign that a trip isn’t in the cards is that you’re stressing about your budget or simply can’t seem to save up enough money for the trip.

“You’ve been trying to save for months, but your travel fund just isn’t growing,” said Kelly Duhigg, travel expert and founder of Girl with the Passport. “Those flights and hotels are pricey! Between rent, bills, debts, etc., you’re already stretched thin financially at home. Adding in vacation costs on top seems next to impossible.”

Find Out: 8 Tips To Fly Business Class for the Price of Economy

Learn More: 11 Expensive Vacation Destinations That Will Be Cheaper in 2024

Sponsored: Credit card debt keeping you up at night? Find out if you can reduce your debt with these 3 steps

You’re Living Month to Month

If you’re struggling to make ends meet or living paycheck to paycheck, chances are you don’t have the extra money needed for a trip this year.

“We’ve all been there,” said Sarah Murphy, outdoor adventure expert and professional travel photographer with Explore More NC. “But when every cent is already accounted for before your next payday rolls around, it’s tough to scrape together extra for travel.”

Read Next: I’m a Luxury Travel Agent: 10 Destinations My Wealthy Clients Are Booking for 2024

You Don’t Have an Emergency Fund

Traveling requires a good deal of money, especially if you’re taking longer or international trips. But if you don’t even have an emergency fund, you might want to hold off for a while.

An emergency fund is vital since it provides a cushion against unexpected expenses or costs — like medical bills or a lost job. You shouldn’t use it for planned expenses like travel, but it’s good to have just in case.

“Travel disruptions happen — flight delays, hotel overbookings, random illnesses,” said Murphy. “Without a financial buffer, those little emergencies can quickly become big disasters.”

You Have Significant Debt

If you have a lot of debt, or you’re relying on credit cards or small loans to fund your trip, ask yourself if you can truly afford to travel this year. Chances are, the answer’s no.

“If a potential trip would require taking on new debt through credit cards or loans in order to afford it, that’s a red flag,” said Mike O’Neill, CEO and founder of Backspace Travel. “Travel is meant to be an enjoyable experience, not a burden that forces long-term debt. Running up credit to pay for a vacation usually means financial stresses undermining the joy of exploring new places.”

Using a credit card or loan to pay for your trip is generally a sign that you’re living beyond your means and should hold off on the expense — whatever it is. And if you already have a lot of debt, you might be better off paying that down before taking your trip. This is because interest charges really add up and all of those monthly debt payments can cut into your other funds.

You’re Worried About the Little Things

Even if you have a solid travel budget, there’s a good chance that you’re going to end up having to pay for things you didn’t account for. This could be little costs like gas, parking fees, dining out or souvenirs. It could also be event or entry fees.

If these small but essential expenses make you worry, Duhigg said this could be a sign that you aren’t quite ready to travel yet.

Good To Know: 9 American Travel Brands To Stay Away From

Planning Your Trip Feels Like a Chore

If planning your trip feels like more of a hassle than it’s worth, or if you’re not very excited about it, you might want to hold off this year.

“Travel planning and navigating unfamiliar locations takes time and effort that isn’t always matched by genuine excitement. If the thought of making arrangements feels like a chore rather than an adventure, it may be better to postpone and redirect that energy to more immediately rewarding pursuits,” said O’Neill. “Forcing travel when the motivation isn’t truly there often results in an unsatisfying experience that is not worth the costs.”

Alternatives to Travel This Year

Even if traveling isn’t in the cards this year, there are still some alternatives that are worth considering. Here are just a few:

Plan a staycation. A staycation is like a trip except you don’t go anywhere, or you stay closer to home — this could be a completely free or low-cost alternative. “Explore local destinations you’ve never visited before. You might be surprised what hidden gems are in your own backyard,” said Duhigg. “Have a ‘staycation’ where you play tourist in your own town. Visit local museums, eat at new restaurants, and more.”

Go camping. “A little outdoor adventure doesn’t have to cost much,” said Murphy. “Pack food from home and enjoy nature’s beauty.” You might need to buy some basic camping gear and equipment. On the other hand, you can keep your trip local or within driving distance to cut down on other expenses like gas.

Do something new. You can still have a fulfilling vacation without traveling — with a little planning. “Try new hobbies and experiences closer to home like concerts, classes, camping trips. Make every day an adventure,” said Duhigg. You can also take classes or participate in fun workshops, though these will cost some money.

Consider off-season trips. If you’re set on traveling this year, plan your trip during the off-season or shoulder season. “Going when prices are lower means significant savings on airfare, lodging, and more,” said Murphy.

Take a cruise. “If you really want to take a vacation but don’t want to spend a lot of money, consider taking a cruise. You can find 4- and 5-day cruises that range from $200 to $400. That includes food, drinks, accommodation, and activities onboard,” said Jasmin Diaz Marketing Specialist at SmokyMountains.com. “Plus, you get to visit 2-3 different destinations.”

More From GOBankingRates

Suze Orman: 5 Social Security Facts Every Soon-To-Be Retiree Must Know

Avoid These 7 Cars That Will Only Last You Half as Long as the Average Vehicle

The Biggest Mistake People Make With Their Tax Refund -- And How to Avoid It

This article originally appeared on GOBankingRates.com: 6 Key Signs You Can’t Afford To Travel This Year

Yahoo Finance

Yahoo Finance