AbbVie (ABBV) Parkinson's Candidate Faces 2nd FDA Rejection

AbbVie ABBV announced that the FDA has issued a complete response letter (CRL) to its new drug application (NDA) seeking approval for ABBV-951 for the treatment of motor fluctuations in patients with advanced Parkinson's disease (PD). This is the second CRL issued for ABBV-951 by the FDA.

The latest CRL was based on some observations on inspection of one of AbbVie's third-party manufacturing facilities listed in the NDA. The inspection did not involve ABBV-951 or any other AbbVie drug. The FDA has not requested any additional efficacy/safety studies, nor has it identified any issues related to the safety, efficacy or labeling of ABBV-951, including the device.

ABBV-951 is a solution of carbidopa and levodopa prodrugs, which are the standard of care for PD patients. ABBV-951 has been designed to offer continuous subcutaneous delivery of CD/LD prodrugs through a pump device and offer a better patient experience. ABBV-951 has already been launched in 34 countries, including Europe and Japan.

AbbVie’s shares were down 1.2% on Tuesday as the latest CRL has further delayed the candidate’s approval and launch in the United States.

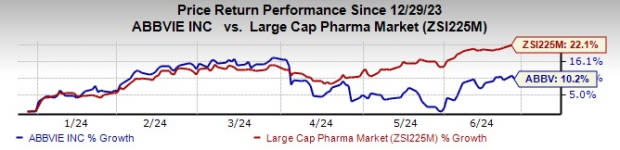

Year to date, AbbVie’s stock has risen 10.2% compared with a rise of 22.1% for the industry.

Image Source: Zacks Investment Research

The FDA issued the first CRL in March last year. In that CRL, the FDA asked for some extra information about the pump device used to administer the medicine. The FDA, back then, had also not requested any additional efficacy/safety studies.

ABBV-951 NDA was based on data from a phase III head-to-head study, which showed that treatment with ABBV-951 led to a statistically significant improvement in "On" time without troublesome dyskinesia compared with oral immediate-release CD/LD. Per the press release, "On" time is cited as the period when symptoms are well controlled without dyskinesia or involuntary movements. The goal of PD patients and physicians is to extend the amount of "On" time.

Zacks Rank & Stocks to Consider

AbbVie currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Aligos Therapeutics, Inc. ALGS, ALX Oncology Holdings ALXO and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, shares of ALGS have declined 39.3%.

Aligos Therapeutics’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for ALX Oncology Holdings’ 2024 loss per share have narrowed from $3.33 to $2.89. Loss per share estimates for 2025 have narrowed from $2.85 to $2.73. Year to date, shares of ALXO have plunged 55.9%.

ALXO’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 8.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, shares of RAPT have plunged 87.6%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance