ABN AMRO Bank And Two More Top Dividend Stocks On Euronext Amsterdam

As global markets experience modest gains and signs of economic resilience, investors are increasingly focused on stable income streams, making dividend stocks particularly appealing. In the context of Euronext Amsterdam, companies like ABN AMRO Bank offer potential opportunities for those looking to enhance their portfolio with assets that can provide regular dividend payouts amidst fluctuating market conditions.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.73% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.80% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.16% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.54% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.18% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.61% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

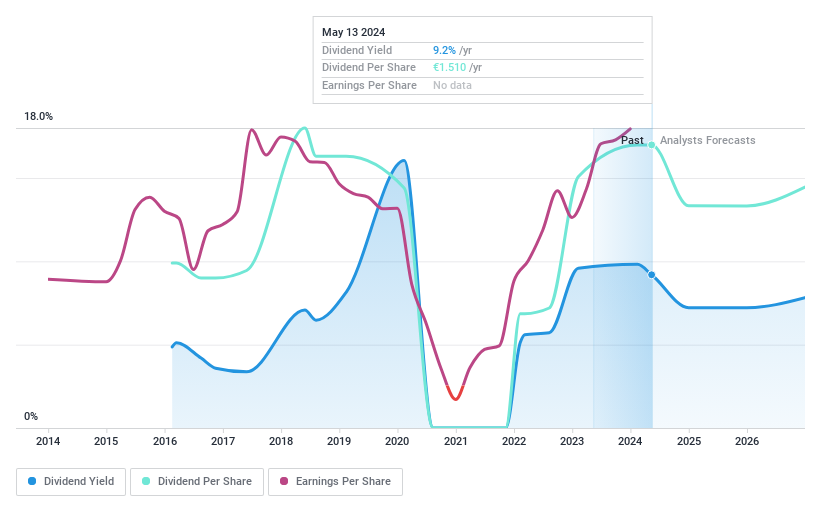

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €12.84 billion.

Operations: ABN AMRO Bank N.V. generates revenue primarily through its Corporate Banking, Wealth Management, and Personal & Business Banking segments, with earnings of €3.50 billion, €1.59 billion, and €4.07 billion respectively.

Dividend Yield: 9.8%

ABN AMRO Bank has a mixed track record with dividends, having paid them for just 8 years with some volatility. Currently, its dividend coverage is reasonable with a payout ratio of 47.9%, suggesting sustainability from earnings. However, earnings are expected to decline by an average of 11.1% annually over the next three years, potentially impacting future payouts despite a high current yield of 9.8%. Recent strategic acquisitions may influence its financial stability and market position in wealth management.

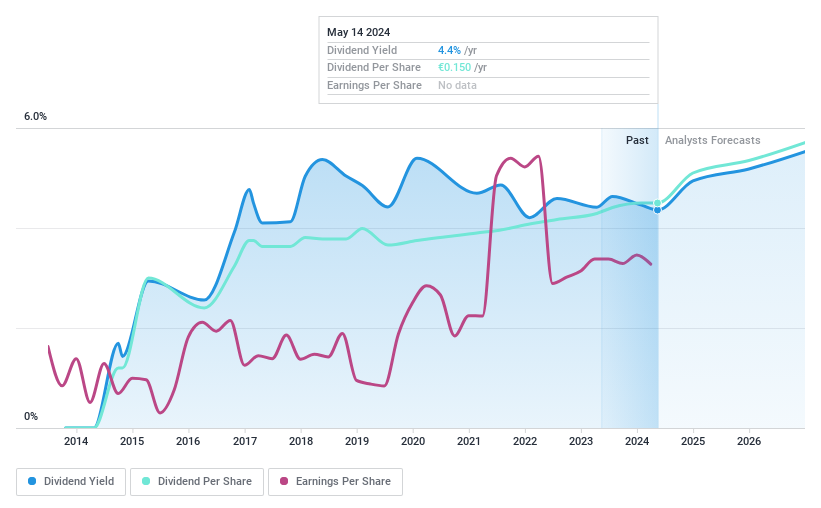

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider based in the Netherlands, with a market capitalization of approximately €14.12 billion.

Operations: Koninklijke KPN N.V. generates revenue primarily through three segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.2%

Koninklijke KPN has a 78.4% payout ratio, indicating its dividends are currently supported by earnings, though the dividend history has been inconsistent over the past decade. With a dividend yield of 4.18%, it falls short of the top quartile in the Dutch market at 5.57%. Despite this, earnings have grown by an annual rate of 13.6% over five years and are projected to increase by 7.27% annually moving forward, suggesting potential for future dividend stability and growth if current trends persist.

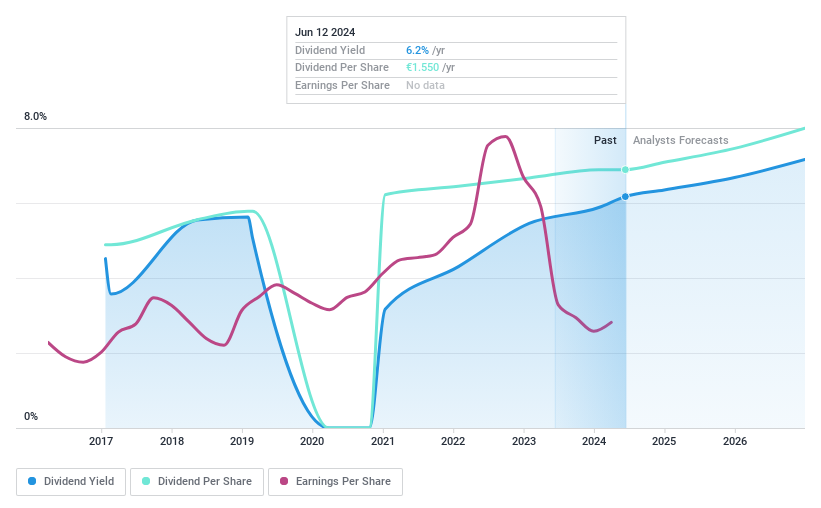

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a global provider of lighting products, systems, and services across Europe, the Americas, and other international markets, with a market capitalization of approximately €2.99 billion.

Operations: Signify N.V. generates revenue primarily through its conventional lighting segment, which accounted for €0.56 billion.

Dividend Yield: 6.5%

Signify's dividend yield of 6.54% ranks in the top 25% of Dutch dividend payers, reflecting a strong current return to shareholders. However, its dividend history is marked by volatility and unreliability over its seven-year payout period. Earnings are expected to grow by 16.95% annually, supporting future dividends with a payout ratio of 88.1%. Recent share buybacks totaling €11 million underscore management's confidence but also highlight the use of capital for purposes other than dividends.

Navigate through the intricacies of Signify with our comprehensive dividend report here.

Our valuation report unveils the possibility Signify's shares may be trading at a discount.

Summing It All Up

Investigate our full lineup of 6 Top Euronext Amsterdam Dividend Stocks right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABN ENXTAM:KPN and ENXTAM:LIGHT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance