ABN AMRO Bank And Two More Euronext Amsterdam Dividend Stocks To Consider

Amid a fluctuating global economic landscape, the Netherlands market remains a focal point for investors seeking stability and potential growth. Recent trends in the Euronext Amsterdam have shown resilience, making it an opportune time to consider dividend stocks that can offer both yield and security in this environment.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.55% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.57% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.89% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.17% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.36% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

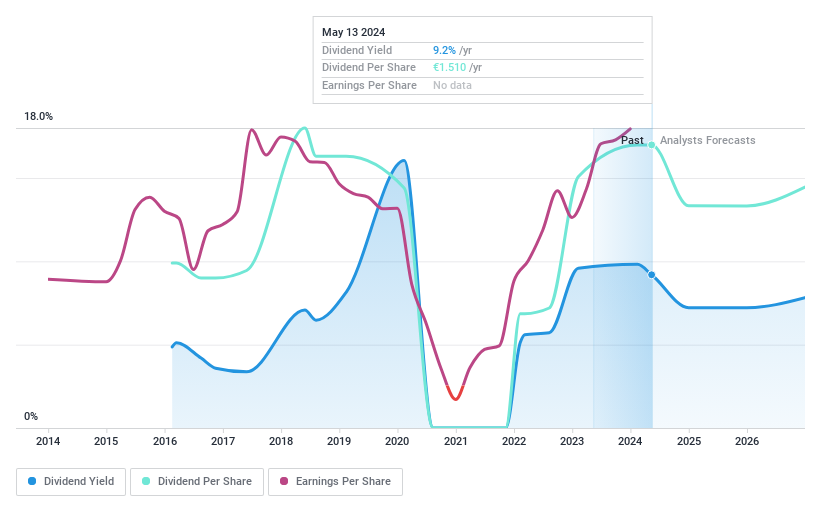

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €12.96 billion.

Operations: ABN AMRO Bank N.V. generates revenue primarily through Personal & Business Banking (€4.07 billion), Corporate Banking (€3.50 billion), and Wealth Management (€1.59 billion).

Dividend Yield: 9.6%

ABN AMRO Bank's dividend yield stands at 9.57%, ranking in the top 25% of Dutch dividend payers. Despite its high yield, the bank has a history of unstable dividends over its 8-year payout period, with volatile payments and an unreliable growth trajectory. However, dividends are currently well-covered by earnings with a payout ratio of 47.9%, projected to remain stable at 48.5% over the next three years. Recent strategic moves include discussions to sell a stake in Neuflize Vie and form partnerships potentially enhancing financial stability but expected to only marginally impact profitability.

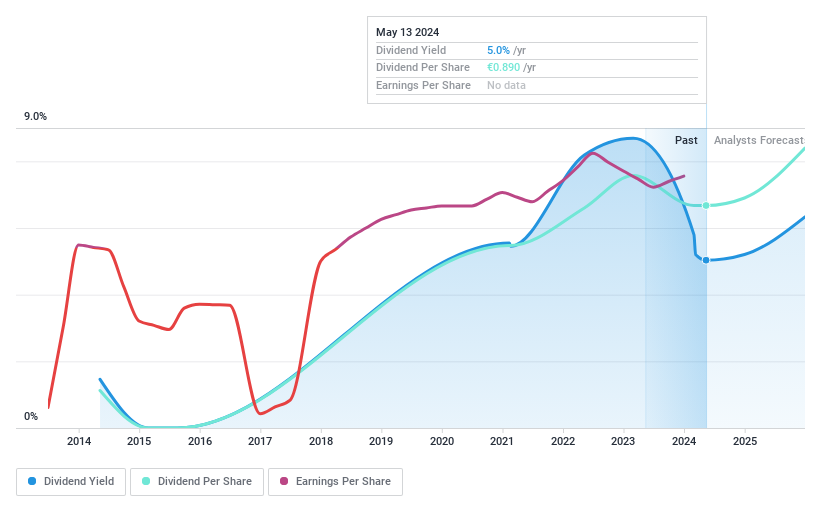

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company involved in property development, construction, and infrastructure projects both domestically and internationally, with a market capitalization of approximately €534.37 million.

Operations: Koninklijke Heijmans N.V. generates revenue from several key segments, including Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

Dividend Yield: 4.3%

Koninklijke Heijmans N.V. has a dividend yield of 4.31%, which is lower than the top quartile of Dutch dividend payers at 5.47%. The company's dividends are supported by earnings and cash flows, with payout ratios of 37.1% and 59% respectively, indicating reasonable coverage. However, Heijmans' dividend history over the past decade has been unstable due to significant volatility in payments and unreliable growth patterns despite a general increase in dividends over the period. Recent corporate actions include a stock split scheduled for May 7, 2024, reflecting potential strategic adjustments ahead of its Q1 earnings report on April 25, 2024.

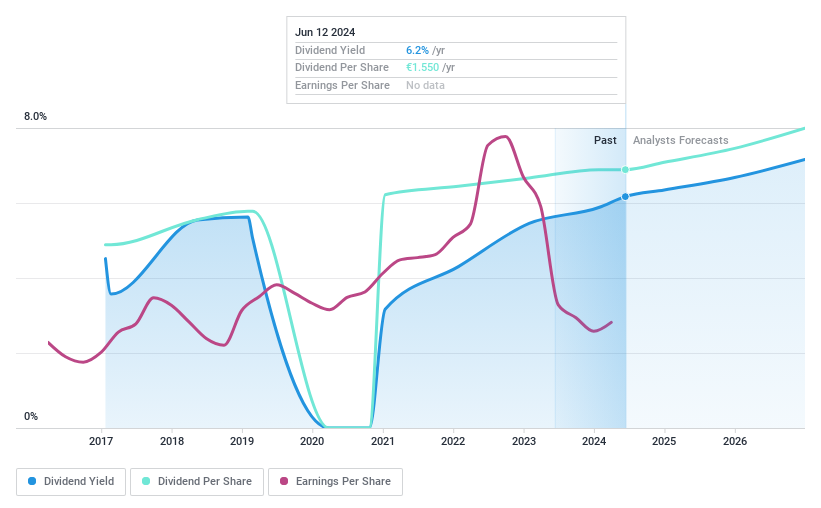

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering lighting products, systems, and services across Europe, the Americas, and other regions with a market capitalization of approximately €3.16 billion.

Operations: Signify N.V. generates €0.56 billion in revenue from its conventional lighting segment.

Dividend Yield: 6.2%

Signify's dividend yield of 6.17% ranks in the top 25% of Dutch dividend payers, offering an attractive return compared to the market average of 5.47%. Despite a less than decade-long history and volatility in its dividend payments, recent financials show dividends are well-supported by both earnings and cash flows, with payout ratios at 88.1% and 32.4%, respectively. However, profit margins have declined from last year's 6.2% to current 3.4%, indicating some potential concerns on sustained profitability amidst aggressive share buyback programs totaling €11 million for employee share plans as announced on April 29, 2024.

Make It Happen

Click this link to deep-dive into the 6 companies within our Top Euronext Amsterdam Dividend Stocks screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABN ENXTAM:LIGHT and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance