Are Raspberry Pi shares a once-in-a-lifetime chance to get rich?

Raspberry Pi (LSE:RPI) shares proved to be a sweet addition to the London Stock Exchange in last week’s initial public offering (IPO).

Fresh UK stock market listings have slumped to a 10-year low, but this tech company has attracted significant investor interest. In its first day of trading, the Raspberry Pi share price skyrocketed as much as 40%.

So, should investors consider grabbing a slice of this new stock today?

Here’s my take.

New kid on the block

Despite the name, Raspberry Pi has nothing to do with edible treats.

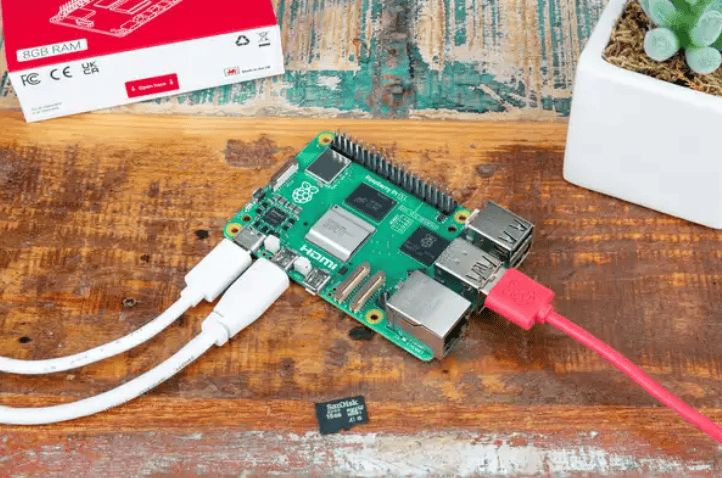

The Cambridge-based business started life as the commercial arm of a charity to promote computer science education. It’s now best-known for designing and manufacturing miniature single-board computers with prices starting at just $35.

Since its inception, Raspberry Pi’s sold an impressive 60m units. Today, industrial customers account for 72% of sales. The remainder come from tech enthusiasts and educators.

Commercial applications for its computers include smart home devices, seismometers, synthesisers, cardiology device monitors, and much more.

Growth credentials

Unusually for a tech startup, Raspberry Pi’s already a profitable enterprise with zero debt. Last year, pre-tax profit rose 90% to reach $38.2m.

It’s also backed by major players, including the likes of Sony and ARM. These strategic partnerships are crucial for the fledgling company and add weight to the investment case.

In addition, the group already has an attractive degree of geographic diversification. Europe’s the largest market, representing 38% of shipped units, followed by North America (29%), and Asia (26%). The rest of the world accounts for 7%.

To add a cherry on top, the potential market opportunity is huge and growing. Currently, Raspberry Pi estimates its combined target market is worth around $21bn.

All good so far, then.

Things could turn sour

However, I have some concerns about investing in the shares. Three major risks spring to mind, although it’s far from an exhaustive list.

First, the valuation. As I write, Raspberry Pi shares trade at a price-to-earnings (P/E) ratio around 29. The company has a £720m market cap.

While it’s not unusual for tech stocks to attract higher multiples, that puts the firm in the same ballpark as Alphabet, Apple, and Meta.

Whether a stock market minnow with plenty to prove deserves to trade for a similar P/E ratio as established US tech titans is a moot point. In short, it doesn’t look like a particularly cheap buy to me.

Second, there are notable competition risks. Raspberry Pi doesn’t appear to have a wide moat. Arguably, there’s little stopping other companies from eating into its market share with lower prices or better products.

Third, while the business has admirable non-profit roots, I’m concerned that its loyal community of enthusiasts may be dismayed by the decision to go public. Balancing shareholder interests with an ethically-conscious fanbase won’t be easy.

A rare chance to get rich?

Overall, I think Raspberry Pi is a fascinating company and I hope it does well. That said, I have too many doubts about the challenges it faces to invest today.

I think there are better opportunities to invest in wealth-creating stocks elsewhere, but brave investors who disagree with me might be handsomely rewarded for taking on the risks.

The post Are Raspberry Pi shares a once-in-a-lifetime chance to get rich? appeared first on The Motley Fool UK.

More reading

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Charlie Carman has positions in Alphabet, and Meta Platforms. The Motley Fool UK has recommended Alphabet, Apple, and Meta Platforms. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance