How Putin handed America the keys to the world’s energy market

It did not take long for Vladimir Putin’s invasion of Ukraine to reshape the world’s energy markets, as countries long reliant on Russian gas sought to sever ties as soon as possible.

Yet, while willing to give up apparent control of Europe’s energy market, what the Russian president didn’t foresee was to whom he was giving up the keys.

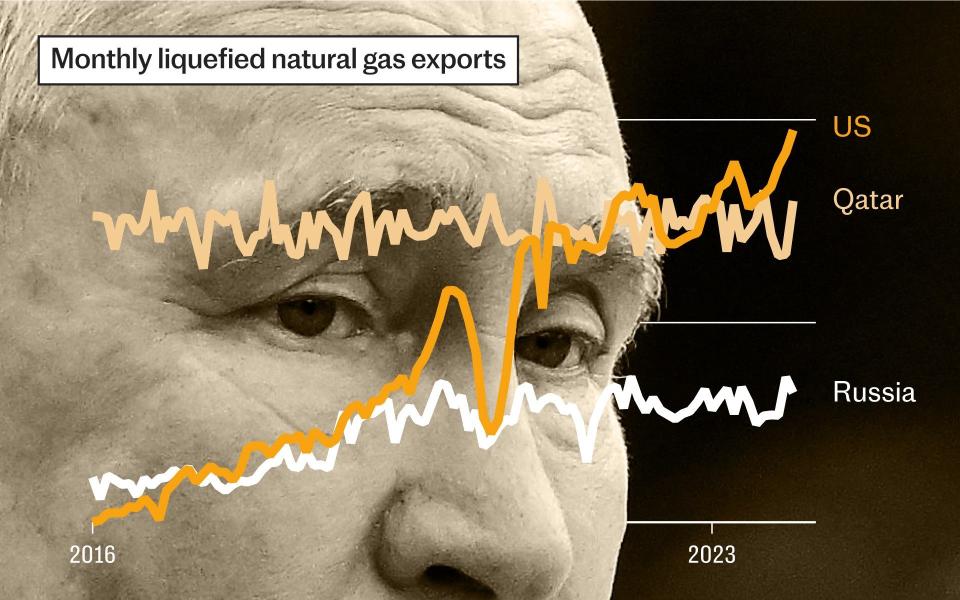

According to a new report, America’s energy industry has emerged as the main beneficiary of the war in Ukraine, as the country’s gas suppliers have filled the void left by Russia.

Underpinning the United States’ resurgence as a global energy hub is a growing demand for liquefied natural gas (LNG), which both Britain and Europe have turned to since cutting themselves off from the Kremlin.

This shift in demand has allowed US energy companies to steal a march on the likes of Gazprom, as they have ramped up LNG exports to be shipped to countries around the world.

The International Gas Union’s (IGU) latest annual report reveals the scale of growth as the global trade for LNG exceeded 400m tonnes for the first time in 2023.

Of this, the US contributed 85m tonnes, making it the world’s largest exporter after increasing its global supplies by 50pc since 2021.

“More than two years have passed since the war broke out in Ukraine, with Europe continuing to depend significantly on LNG imports to replace reduced Russian pipeline gas flow,” the report says.

“Last year was a year of reopening and recovery of the world but the conflict in Ukraine still forced Europe – that built enough LNG infrastructure – and other LNG consumers to diversify from the Russian pipeline gas.

“The US has well played the role of filling the gap that Russia left and become the world’s largest LNG exporter.”

The UK alone spent £7bn buying LNG from the US last year, representing a 33-fold increase since 2018.

This means that Britain, along with much of Western Europe, is now reliant on the US for much of its energy security.

While that may seem more secure than the West’s previous reliance on Putin, experts are warning that this could create problems of its own.

This came to the fore earlier this year after President Joe Biden temporarily paused approvals for new LNG gas terminals, raising questions over how quickly US suppliers could ramp up production to meet growing demand.

However, analysts expect this policy to be reversed should Donald Trump triumph in the November election.

As a fuel growing rapidly in production, LNG is created by cooling natural gas to below -161C to turn it into a liquid. Unlike pipeline gas, which is restricted by geography, it can then be shipped around the world to any country with an import terminal.

Breaking Russia’s stranglehold on the West

Over the last two decades those properties have helped to transform energy markets by unleashing LNG across the world, helping to break Russia’s stranglehold on the West.

While the US dominates the LNG market, figures show that Britain last year also bought fuel from Qatar, Peru, Angola, Egypt and Trinidad.

It meant that 25pc of Britain’s total gas supplies were made up of LNG in 2023, with America by far the largest supplier.

Put another way, the UK secured around 17pc of its gas from the US as LNG, with another 37pc imported as piped gas from Norway.

Overall, it means the UK will this year be more reliant on foreign energy supplies than it has ever been.

That, said the report, is a pattern repeated across Europe – with LNG imports now supplying almost half of the Continent’s gas – and placing it in direct competition with Asia for future supplies.

“Europe is now an LNG importing heavyweight, maintaining the second-largest importing region spot at 121m tonnes of LNG [last year],” said the report.

“With LNG supplying almost half of Europe’s gas, the competition between Asian and European markets remains a key market dynamic.”

Gas industry insiders see the flexibility of LNG and its ability to break regional pipeline-based monopolies as a massive benefit.

Li Yalan, president of the IGU, said: “The LNG industry has demonstrated incredible agility and innovation through some of the toughest tests over recent years.

“This is an industry that continues to play a pivotal role in navigating through an energy crisis that has not yet been fully resolved and an energy transition that has been challenged.

“LNG is a tool that will be critical to providing greater resiliency for rapidly changing energy systems around the world, and it will have an essential role in mitigating the inherent risk of uncertainty through that process.”

However, it is worth noting that the £21bn Britain spent importing LNG last year is money all being shipped overseas, supporting jobs and suppliers elsewhere rather than in the UK.

It costs the country the equivalent of £750 per household to import LNG. And given the dwindling output from the North Sea, that bill can only increase if we stay hooked on gas.

That, says the Labour Party, will undermine the whole economy – which is why Ed Miliband, Labour’s shadow energy secretary, has pledged to “break the link with gas” and move the nation towards low-carbon energies.

He argues that breaking that reliance will bring other benefits, particularly in energy security.

“The case for clean energy is now also a case for energy independence, energy security and lower bills,” Miliband said last week. “That was graphically and tragically demonstrated by the invasion of Ukraine, where we were in the grip of Vladimir Putin.”

However, industry experts warn that Miliband’s plans, which include banning new oil and gas licenses in UK waters, may make the nation even more reliant on LNG and other imports.

That’s because 180 of the UK’s 284 oil and gas fields are expected to cease production in the next five years, and with no one new ones to replace them, domestic production will dwindle by 2030.

LNG is largely expected to fill that void.

Experts describe how the industry is already preparing for a boom in demand by spending billions of pounds on new LNG terminals and fleets of ships to ferry fuel around the world.

Those ships are already some of the world’s largest vessels, with some capable of carrying enough gas to supply the entire UK for almost a full day.

The IGU report said many more of those vessels were under construction.

“The global LNG shipping order book had a staggering 359 newbuild vessels under construction at the end of February 2024, equivalent to over 51pc of the current active fleet.

“This illustrates shipowners’ expectations that LNG trade will continue to grow in line with scheduled increases in liquefaction capacity, particularly from the US. An expected 77 carriers will be delivered in 2024.”

America’s LNG production to triple by 2050

As for where that gas comes from, much of it will be American.

The US Energy Information Administration predicts America’s LNG production alone will triple by 2050 – no matter what the environmental groups say.

America is now even supplying the Middle East, as Sempra, a US energy firm, recently struck an agreement with Saudi Arabia’s Aramco to supply 5m tonnes of LNG a year.

The size of the expansion expected in global LNG trade is evidenced by the fact that 700m tonnes are to be delivered by 2030, up from 401m tonnes today.

“This potential massive increase is an emphatic demonstration that the world still needs more LNG,” said the IGU.

This will be music to the ears of America’s LNG producers, which stand ready to ramp up exports as Russia drifts further into the geopolitical abyss.

Yahoo Finance

Yahoo Finance