New York activist investor takes Barclays stake to mount campaign to double share price

A transatlantic corporate raider has built a minority stake in troubled bank Barclays with the goal of doubling its share price, piling more pressure on the lender's under-fire chief executive Jes Staley.

New York-based Sherborne Investors, led by British-born Edward Bramson, has taken a 5pc stake in the lender, Barclays disclosed this morning.

Sherborne has gained a reputation in the City for pursuing aggressive shake-ups of under-performing companies.

Its previous UK campaigns have included ousting the leadership teams at private equity firm Electra and fund manager F&C on the road to turning around their performance.

Sherborne declined to comment on the strategy it wanted Barclays to pursue, but the bank is understood to now be the investor's main focus in the UK as it winds down its interest in Electra. The raider is known to take positions in firms where it believes it can affect dramatic change.

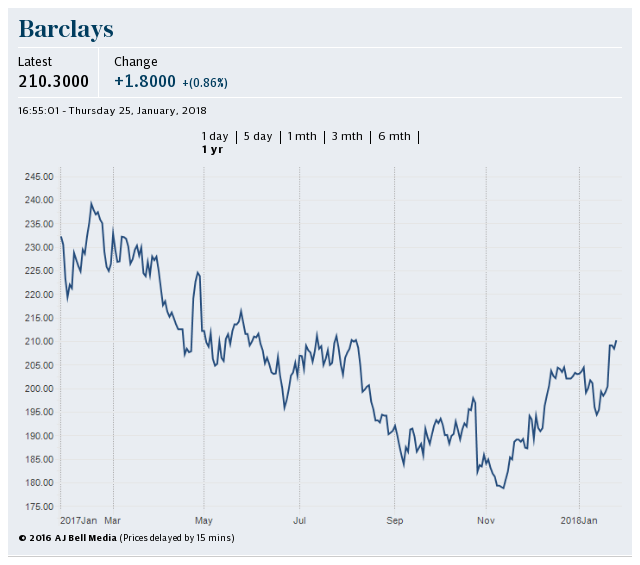

Barclays said in a statement to the stock market that "as with all its shareholders, Barclays will continue to engage with Sherborne, and welcomes them as a shareholder". Its shares rose 4pc in morning trade to 218p.

Members of Barclays' investor relations team have already met with Sherborne as part of a round of meetings following its full-year results last month. The investor has been building its stake in recent weeks, with Barclays forced to disclose the position this morning after it topped the 5pc threshold last week.

The move makes it Barclays' fourth largest shareholder, behind Capital Group, Blackrock and the Qatar Investment Authority.

The bank is Sherborne's biggest and toughest UK target to date, with over a trillion dollars of assets on its books. Sherborne's past campaigns have targeted smaller firms and generally involved taking larger stakes to affect action.

Mr Staley has been under pressure to fire up Barclays' investment bank since taking the helm at the end of 2015, with the division lagging behind its US rivals.

However some in the City sounded a warning note about Sherborne's intentions. An analyst at one major investor said he had "no idea what edge Sherborne think they have" and warned that any major change would create revenue risk.

"Maybe they could push for Barclays to sell the investment bank, but I doubt there would be a willing buyer for a business of that sort of size and complexity," he said. "Closing down large parts of the investment bank would probably be extremely expensive and no doubt mean dividend and buyback restrictions."

Russ Mould, investment director at AJ Bell, said: “Sherborne has built a formidable reputation for squeezing improved financial and operational performance from the companies in which it invests and Edward Bramson clearly feels that Barclays shares are going cheap.

"The question now is what the activist investor thinks Barclays should be doing differently and how he intends to get those views across to the bank’s boss.”

Founded in 1986, Sherborne describes itself as a “turnaround investment firm”. It usually targets board seats on a company before engineering a change in strategy.

It spent £580m on its stake in Barclays, saying the investment indicates "a potential return... in line with Sherborne Investors' customary return objectives".

Mr Bramson is due to step down as interim chief executive of Electra this month, having battled his way on to the board in 2015.

After taking control of Electra Mr Bramson slashed costs and sold off a series of assets, raising some £1.35bn for shareholders.

The coup at F&C Asset Management ended with it being taken private by Bank of Montreal for £708m in 2014.

Other campaigns have included tech firm 3i, telecoms business Spirent Communications and chemicals firm Elementis.

Barclays also confirmed a series of changes to its board this morning ahead of the launch of its ring-fenced UK bank.

Deputy chairman Sir Gerry Grimstone steps up to chairman of Barclays Bank Plc. Sir Ian Cheshire, the former boss of B&Q owner Kingfisher, was confirmed as chairman of the UK retail bank.

Last month Barclays reported a £1.9bn loss for 2017, with Mr Staley pledging to return more cash to shareholders. Mr Staley said the bank was “done” restructuring and could now reward investors.

The Barclays boss is under scrutiny from regulators as well as investors. The Financial Conduct Authority (FCA) is expected to deliver its verdict in the coming weeks on whether he should be sanctioned for attempting to unmask a whistleblower at the bank.

Barclays is also facing criminal charges from the Serious Fraud Office over its 2008 emergency fundraising in Qatar – which it is vigorously defending – and an expected fine for mis-selling toxic mortgage products in the US in the run-up to the financial crisis.

Yahoo Finance

Yahoo Finance