Should You Be Adding Nichols (LON:NICL) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Nichols (LON:NICL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Nichols

How Quickly Is Nichols Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Nichols has achieved impressive annual EPS growth of 56%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

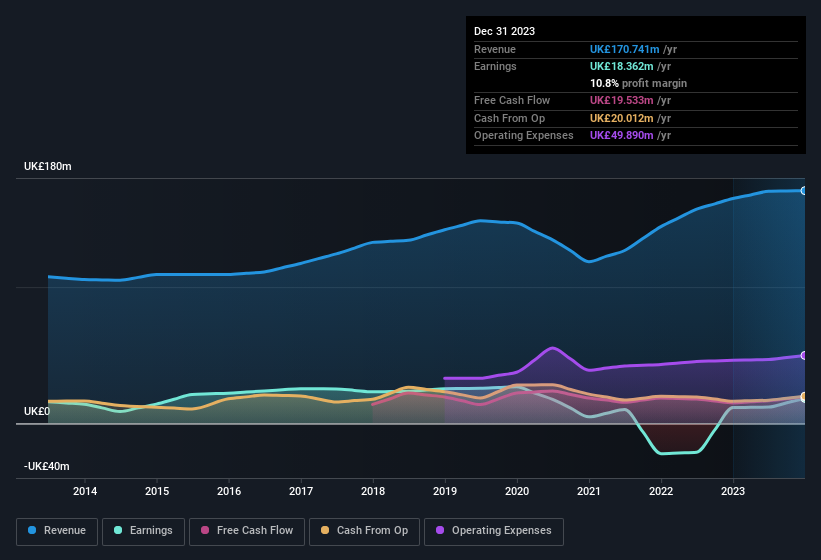

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Nichols remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.5% to UK£171m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Nichols' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Nichols Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in Nichols in the previous 12 months. So it's definitely nice that Independent Non-Executive Chair Elizabeth McMeikan bought UK£29k worth of shares at an average price of around UK£9.83. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Nichols.

The good news, alongside the insider buying, for Nichols bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth UK£104m. This totals to 27% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Does Nichols Deserve A Spot On Your Watchlist?

Nichols' earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Nichols belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Nichols that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Nichols isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance