Advanced Drainage Systems (WMS) Boosts Dividend by 14%

Advanced Drainage Systems, Inc. or ADS WMS declared a rise in its dividend payout, underscoring its commitment to sustainable expansion and its capacity to generate lasting value for shareholders.

The board of directors approved a 14% hike in its quarterly cash dividend to 16 cents per share (64 cents annually) from 14 cents (56 cents annually). The new dividend will be paid out on Jun 14 to shareholders of record as of May 31, 2024. The dividend yield, based on ADS’ May 16 closing price, is approximately 0.37%.

Shares of this leading provider of innovative water management solutions provider have lost 2.2% during the trading session on May 16.

Consistent Dividend

ADS has consistently demonstrated a pattern of escalating dividend distributions. This upward trajectory can be attributed to its robust financial position, ample liquidity, strong backlog and improved macro backdrop, all of which serve as key drivers for the dividend elevation.

In fiscal 2024, ADS returned $251.3 million to shareholders through dividends and share repurchases. ADS had a total liquidity of $1,079 million, which comprised cash of $490.2 million as of Mar 31, 2024, and $588.9 million of availability under committed credit facilities. As of Mar 31, the company’s leverage ratio was 0.9 times.

Net debt (total debt and finance lease obligations net of cash) was $860.9 million as of Mar 31, 2024, a decrease of $246.9 million from Mar 31, 2023.

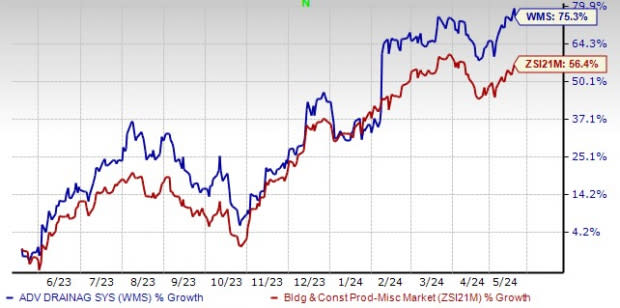

Image Source: Zacks Investment Research

Shares of ADS have risen 75.3% over the past year, outperforming the Zacks Building Products - Miscellaneous industry’s growth of 56.4%. The company is benefiting from solid contributions from Allied Products, Infiltrator and the residential end markets. Also, its focus on strategic partnerships and product innovations bodes well.

Zacks Rank & Key Picks

ADS currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Construction sector are:

Frontdoor, Inc. FTDR: Based in Memphis, TN, the company provides home service plans in the United States. The firm is benefiting from impressive customer retention rates. Thanks to the robust awareness of the Frontdoor brand, it has been shifting its attention toward capitalizing on customer demand.

Frontdoor’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 286.8%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Quanex Building Products Corp. NX: This Houston, TX-based company provides components for the fenestration industry worldwide.

Quanex’s earnings surpassed the Zacks Consensus Estimate in the trailing two quarters, the average being 41.9%. It currently sports a Zacks Rank #1.

Arcosa, Inc. ACA: This Dallas, TX-based company provides infrastructure-related products and solutions. The company remains focused on its long-term vision to lessen the complexity of Arcosa’s overall portfolio and shift its business mix toward less cyclical, higher-margin growth opportunities that leverage core strengths and drive long-term shareholder value creation.

Arcosa’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 43.9%. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Drainage Systems, Inc. (WMS) : Free Stock Analysis Report

Quanex Building Products Corporation (NX) : Free Stock Analysis Report

Frontdoor Inc. (FTDR) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance