Affirm (AFRM) & FlightHub Partner to Expand Payment Options

Affirm Holdings, Inc. AFRM recently announced its collaboration with a Canadian travel agency — FlightHub. The deal enables Affirm to provide flexible and transparent payment options, like buy now pay later (BNPL), to eligible consumers for travel bookings, which will boost its transaction volumes.

AFRM’s business model of not charging any late or hidden charges further enhances its offerings. This partnership is an extension of AFRM’s existing partnership with FlightHub in the United States.

The deal comes at an opportune time for AFRM as demand for flexible payment options in travel booking is rapidly increasing. Per a 2023 FlightHub survey, Canadians are prioritizing travel compared to essential expenses. Almost half of Canadians are saving money by reducing other expenses to afford travel. The latest move is expected to make Affirm’s payment options available at the checkout for qualifying FlightHub customers.

Customers will be able to divide the total cost into monthly payments for purchases of more than 200 CAD. Hence, providing affordable and transparent travel alternatives poses AFRM’s revenues well for growth.

This move bodes well for AFRM as it aims to achieve a medium-term target of $50 billion in GMV by expanding the reach of its card and its merchant network internationally. Deepening adoption of AFRM’s cards through a rising number of partnerships should help the company improve its profit margins in the future.

AFRM’s adjusted operating income margin improved 1,600 basis points in the fiscal third quarter of 2024. AFRM’s recent cohort is spending at a higher annual spend rate compared with the year-ago quarter, highlighting improved engagement and continued innovation in offerings. Its number of active merchants grew 19% year over year to 292,000.

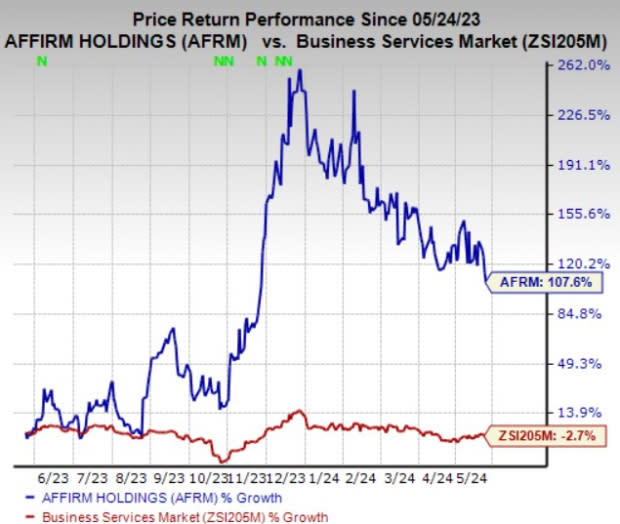

Price Performance

Over the past year, shares of Affirm have surged 107.6% against the 2.7% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Affirm currently has a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Business Services space are SPX Technologies, Inc. SPXC, CRA International, Inc. CRAI and Barrett Business Services, Inc. BBSI. While SPX Technologies and Charles River sport a Zacks Rank #1 (Strong Buy), Barrett Business Services carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of SPX Technologies outpaced estimates in three of the last four quarters and matched the mark once, the average beat being 13.9%. The Zacks Consensus Estimate for SPXC’s 2024 earnings suggests an improvement of 24.4% from the 2023 reported figure. The consensus mark for revenues suggests growth of 14.7% from the 2023 figure. The consensus mark for SPXC’s 2024 earnings has moved 6.1% north in the past 30 days.

Charles River’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 19.1%. The Zacks Consensus Estimate for CRAI’s 2024 earnings suggests an improvement of 11.7% from the 2023 reported figure. The consensus mark for revenues suggests growth of 6.2% from the 2023 figure. The consensus mark for CRAI’s 2024 earnings has moved 3.7% north in the past 30 days.

The bottom line of Barrett Business Services outpaced estimates in each of the last four quarters, the average beat being 38.6%. The Zacks Consensus Estimate for BBSI’s 2024 earnings suggests an improvement of 7.6% from the 2023 reported figure. The same for revenues suggests growth of 7% from the 2023 number. The consensus mark for BBSI’s 2024 earnings has moved 2.2% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance