Air Transport (ATSG) Rewards Investors With Share Buyback

In a shareholder-friendly move, Air Transport Services Group ATSG announced its new share repurchase authorization. ATSG’s board of directors has approved a new share repurchase authorization of $150 million shares, offsetting its previously exhausted share buybacks.

ATSG resumed share repurchases during October 2022, acquiring 1.6 million, or almost 2% of its issued and outstanding shares in open-market and private transactions. Prior to this, ATSG was restricted to buyback shares under provisions of a federal grant program to offset pandemic effects on employment for passenger airline companies.

Rich Corrado, ATSG president and CEO, stated, "ATSG’s Board of Directors believes that share repurchases, when used effectively as one component of a carefully considered capital allocation program, are in the best interest of all shareholders of ATSG."

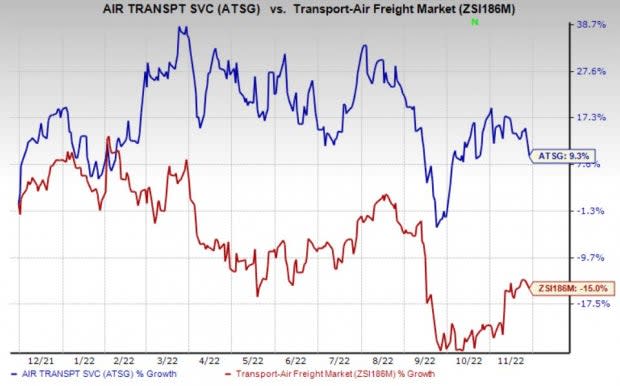

ATSG’s management’s decision to increase its share buyback program after a long gap reflects ATSG’s commitment toward boosting shareholder value apart from underlining confidence in its business. This shareholder-friendly initiative should boost investor confidence and positively impact the company’s bottom line. Notably, shares of Air Transport have gained 9.3% over the past year against the 15% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Another player from the same Zacks Transportation - Air Freight and Cargo industry who opted for an accelerated share repurchase program is FedEx Corporation FDX. During October 2022, FDX entered into an accelerated share repurchase (ASR) agreement with Morgan Stanley & as part of FDX's previously announced share repurchase program.

Under the terms of the ASR, FedEx has agreed to repurchase an aggregate of $1.5 billion of its common stock from Morgan Stanley, with an initial delivery of approximately 7.9 million shares based on current market prices. Purchases under the scheme are expected to be completed prior to the end of FedEx’s current fiscal year.

Zacks Rank and Other Stocks to Consider

Air Transport currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader Zacks Transportation sector areRyder Systems R and Teekay Tankers Ltd. (TNK).

Ryder has an expected earnings growth rate of 67.12% for the current year. R delivered a trailing four-quarter earnings surprise of 30.13%, on average.

The Zacks Consensus Estimate for R’s current-year earnings has improved 6.9% over the past 90 days. Shares of R have gained 12.7% over the past year.

Teekay Tankers has an expected earnings growth rate of 214.91% for the current year. TNK delivered a trailing four-quarter earnings surprise of 42.23%, on average. Teekay Tankers has a long-term expected growth rate of 3%.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved 95% over the past 90 days. Shares of TNK have soared 190% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance