Alibaba to Invest Extra $2 Billion in Lazada for Expansion

Alibaba Group Holding Ltd. BABA has agreed to pay an additional $2 billion for increasing its stake in e-commerce firm, Lazada. The latest move will bring Alibaba’s investment in Lazada to $4 billion.

Alibaba has been looking to take a share of pie in Lazada since 2016. The company then invested $1 billion in Lazada and boosted its stake to 83% in 2017 with an additional investment of $1 billion.

Alibaba has had an impressive run on the bourse in the last year. The company's shares have gained 81.4%, outperforming the industry’s growth of 67.1%.

We expect international expansion to back the momentum going forward.

Headquartered in Singapore, Lazada is a Southeast Asian e-commerce company founded by Rocket Internet in 2012. The company works with third-party players and develops its own logistics to improve goods delivery. It operates retail websites in Indonesia, Malaysia, Singapore, Thailand, Vietnam and the Philippines.

Important Management Changes

Following the deal, Lucy Peng will now serve as Lazada’s chief executive officer (CEO). She is one of Alibaba’s 18 co-founders and the current chairwoman of Ant Financial, its financial services branch.

Peng will replace Maximilian Bittner, who has served as CEO since 2012. Bittner will now be the senior advisor to Alibaba and help in making future international growth strategies.

Ms Peng said, “With a young population, high mobile penetration and just three per cent of the region's retail sales currently conducted online, we feel very confident to double down on South east Asia. Lazada is well-positioned for the next phase of development and of Internet-enabled commerce in this region."

Why is Alibaba Pushing itself in Lazada?

Historically, the Southeast Asian countries have attracted investors from across the globe, thanks to its solid growth rates, booming populations and generally good governance. In fact, Southeast Asia has started attracting attention due to increasing growth of internet services.

With this recent investment in Lazada, Alibaba will increase its presence in a nascent but populous online retailing market. According to a 2016 report, co-authored by Google, e-commerce in Southeast Asia is on track to grow and reach $88 billion by 2025 from $5.5 billion in 2015. As of now, only 3% of all commerce is carried out online in the region.

The South East Asian e-commerce market is still at a nascent stage but has enormous growth opportunities, which is a huge advantage for Alibaba.

Alibaba is dependent on China for a major portion of its business where growth has already reached its peak. Hence, Alibaba is trying to diversify its revenues and lessen reliance on its business in China.

To counter this and fend off further competition, Alibaba is focusing on international expansion. Its current strategy is to generate earnings through investments outside China where it’s up against well-established players like JD.com JD and Amazon AMZN that have been witnessing great success.

Amazon entered the foray last year but it remains only in Singapore, while Shopee is a two-year-old entrant bankrolled by Sea, formerly Garena that raised more than $1 billion in a U.S. IPO last year.

So, the additional investment in Lazada comes at an opportune time. The deal is in line with Alibaba’s Chairman, Jack Ma’s goal of getting at least half the company’s revenues from overseas over the next few years.

Given that Lazada currently serves six countries in Southeast Asia, the deal will expand Aliababa’s sales in these markets.

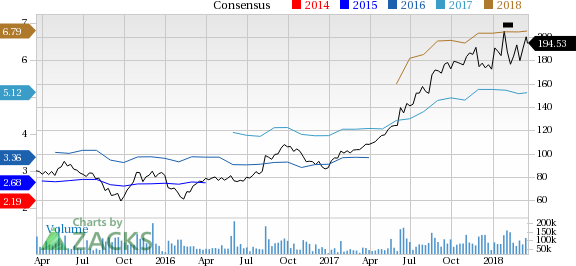

Alibaba Group Holding Limited Price and Consensus

Alibaba Group Holding Limited Price and Consensus | Alibaba Group Holding Limited Quote

Zacks Rank & Stock to Consider

Alibaba carries a Zacks Rank #3 (Hold). A better-ranked stock worth considering in the broader technology sector is Stamps.com Inc. STMP, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Stamps.com is projected to be 15%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance