Alibaba Projects $60B GMV for 2024, Plans New Business Model Breakthroughs

Alibaba Group Holding Limited (NYSE:BABA) projects $60 billion in GMV for its B2B platform Alibaba.com in 2024, marking a 20% increase from last year’s $50 billion.

President Zhang Kuo explained that growth slowed after a sevenfold increase over five years and emphasized the need for new business model breakthroughs, SCMP reports from an interview.

Established in 1999 to connect overseas buyers with Chinese manufacturers, Alibaba.com now links Chinese suppliers with global businesses, contributing to $350 billion in exports last year.

Also Read: Alibaba’s New AI Model Claims to Beat OpenAI’s GPT-4 in Language Skills

With over 200,000 suppliers, 90% of whom are in China, the platform sees faster growth in non-consumer goods like machinery and construction materials.

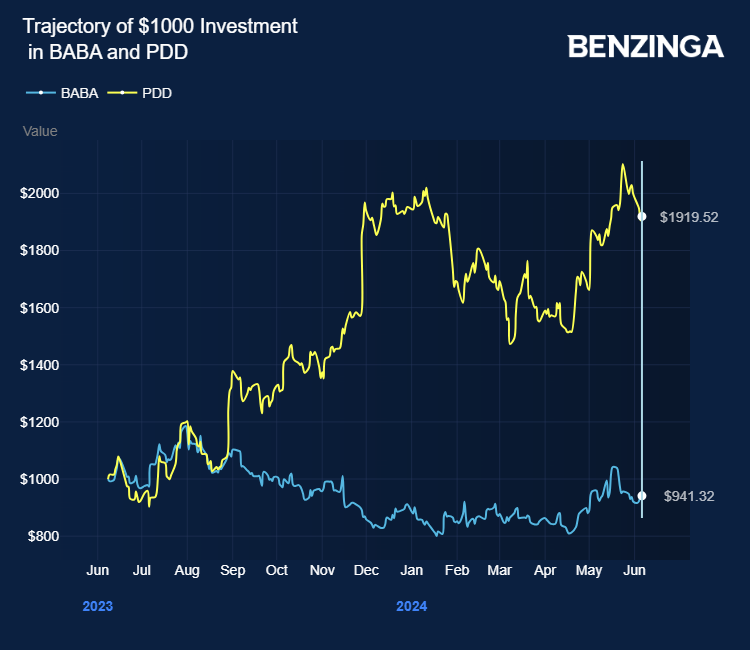

Despite competition from apps like PDD Holdings Inc (NASDAQ:PDD) Temu, Alibaba.com focuses on small business sourcing and local ecosystems. PDD's value-for-money strategy and Temu marketplace helped it beat Alibaba in market value.

Recently, it launched Alibaba Guaranteed, a service to simplify B2B sourcing with fixed prices and shipping fees. The platform also introduced AI tools, including a chatbot for exporters and a product-finding tool for buyers, enhancing its capabilities and appeal to users.

In May, Alibaba reported fiscal fourth-quarter 2023 revenue growth of 7% year-on-year to $30.73 billion, beating the analyst consensus of $30.40 billion. Adjusted earnings per ADS of $1.40 missed the analyst consensus of $1.41. Net income dropped 86% Y/Y to $453 million due to net loss from its investments in publicly traded companies.

Price Action: BABA shares were trading lower by 1.22% at $79.04 at the last check on Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Alibaba Projects $60B GMV for 2024, Plans New Business Model Breakthroughs originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance