Will Alibaba's (BABA) Q1 Earnings Gain on Cloud Momentum?

Alibaba Group Holding Limited’s BABA first-quarter fiscal 2024 results, slated for release on Aug 10, are expected to reflect the impacts of its expanding cloud computing business.

The cloud segment has turned out to be one of the key contributors to the company’s overall top-line growth. In the last reported quarter, revenues from the cloud computing segment stood at RMB 18.6 billion ($2.71 billion), which accounted for 9% of the total revenues.

The figure was down 2% on a year-over-year basis due to delays in the delivery of hybrid cloud projects, led by the pandemic-induced disruptions.

Click here to know how the company’s overall fiscal first-quarter results are expected to be.

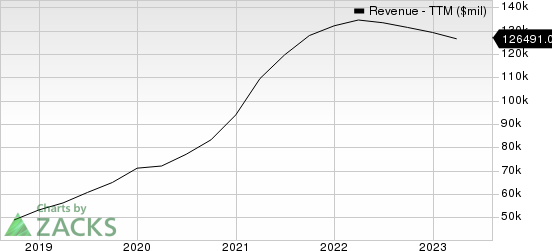

Alibaba Group Holding Limited Revenue (TTM)

Alibaba Group Holding Limited revenue-ttm | Alibaba Group Holding Limited Quote

Factors to Note

The company’s cloud computing business has been gaining traction in China as well as in other international regions. Its strengthening global data center network is anticipated to have been beneficial in the to-be-reported quarter.

Alibaba’s strong cloud services portfolio, powered by advanced technologies like AI, Machine Learning and the Internet of Things, is expected to have aided it in addressing the rising demand for cloud architecture.

This apart, the company’s growing efforts to bolster its generative AI capabilities might have contributed well to the performance of the underlined segment.

The increasing spending from enterprise customers, driven by Alibaba’s continued efforts to add features to its cloud offerings, is likely to have been a positive.

BABA has been taking strong initiatives toward making its key cloud products serverless to prevent customers from worrying about managing servers and infrastructure during the process of product development and deployment. These initiatives are expected to have continued driving Alibaba Cloud’s customer momentum in the quarter under review.

The company has been witnessing solid momentum across the Asia Pacific region for the past few quarters. The trend is expected to have persisted in the quarter under review.

The adverse effects of the coronavirus pandemic in China might have continued affecting the company’s cloud deliverables. Also, global inflation might have been a concern. These are likely to have hurt the top-line growth of the segment during the fiscal first quarter.

Our model estimate for cloud computing revenues is pegged at RMB 17.5 billion, indicating a decline of 1.3% compared with the year-ago actual figure.

Zacks Rank & Other Stocks to Consider

Currently, Alibaba carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are CACI International CACI and BILL Holdings, Inc. BILL, carrying a Zacks Rank #2 (Buy) at present, and NetEase NTES, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of CACI International have gained 17.8% year to date. CACI is set to report its fourth-quarter fiscal 2023 results on Aug 9.

Shares of BILL Holdings have risen 0.2% year to date. BILL is set to report its fourth-quarter fiscal 2023 results on Aug 17.

Shares of NetEase have declined 47.2% year to date. NTES is scheduled to report second-quarter 2023 results on Aug 24.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetEase, Inc. (NTES) : Free Stock Analysis Report

CACI International, Inc. (CACI) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance