Alphabet: The Discreet AI Leader

Alphabet Inc.'s (NASDAQ:GOOGL) (NASDAQ:GOOG) access to data is unrivalled and the artificial intelligence revolution has higher probability to transit at some point through the company. Google has a 90% market share in search activity, and there lies its competitive advantage (or moat) in the AI race. The stock's valuation is still within the historical valuation range it has been subject to since 2010, despite being on the verge of a potential earnings breakout. Analysts expect double-digit growth in the next couple of years, and a breakout from the valuation range is also expected if growth accelerates.

However, the real catalyst for Alphabet's stock is the continued growth of its AI capabilities. The first looks we have gotten on the Gemini AI model are promising and the valuation of the stock is not yet taking into account the AI wave. Alphabet has advanced access to global data and its integration of AI in users' search activity drive up the returns of ad-paying companies. The company, therefore, is one of the most attractive AI plays to own in a tech-oriented portfolio.

Alphabet to lead the AI revolution

All AI models, from Microsoft Inc.'s (NASDAQ:MSFT) OpenAI to Nvidia's (NASDAQ:NVDA) chips and Tesla's (NASDAQ:TSLA) robotaxis, have one single point of departure: data collection. The way the data is interpreted (the output) varies of course from model to model, but the input differs significantly. Nvidia's chips are currently leading in the hardware of the data inputs and outputs; however, Alphabet's dominant access to data inputs and their funnelling to Google DeepMind should lead - under proper management- to the company leading the AI revolution.

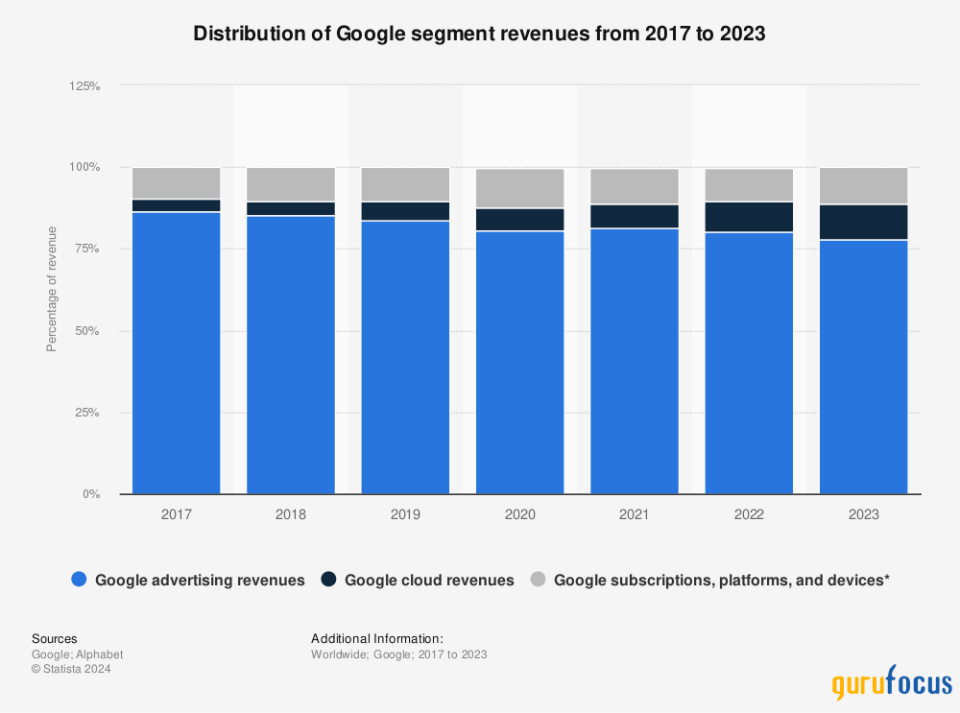

Google's 90% market share in search activity (or data collection) puts Gemini in a first-mover advantage position in a segment where users typically stick with their favored search tools. Given the market share, Google is a natural destination of a large portion of online advertising revenues. Although the nominal amount of advertising revenues has been increasing, its decline in the revenue share of Google is noticeable.

The decline is not worrisome per se, as it is largely compensated by a high growth cloud segment. The spreading of the revenue sources indicates a healthier growth path for the company and lower dependence on one single revenue source. Where AI comes into play is the Gemini model developed by Google's DeepMind drastically improves the search experience of prospective customers. With improved functions, Google would lead consumer to the specific result, page, website or business that he or she is looking for. This brings to ad-paying companies the benefit of a higher conversion rate of prospective customers into actual customers. Essentially, the companies paying for ads on Google will be paying for its ability to target warmer leads, hence largely improving the return on advertising investments. In turn, the growing demand and spending for Google's AI-targeted advertising would lead to an increase of advertising revenue.

A promising improvement in the search experience of Google users is the chatbots. According to a Wall Street Journal article, 36% of Google's Gemini users use the chatbot for shopping, compared to 23% of ChatGPT users. This shows Google already has a lead in the shopping experience of users. To predict which company will lead and win the AI race, the question that needs to be asked is which company has more access to data. Google seems to have the lead.

We will now look at the hard figures to determine whether or not the stock is currently attractively priced despite the recent rise.

The hard figures

Shares of Alphabet have been outperforming the broader market. The stock gained over 25% in the first five months of the year first-quarter earnings smashed Wall Street's expectations ($1.89 per share versus $1.50 expected).

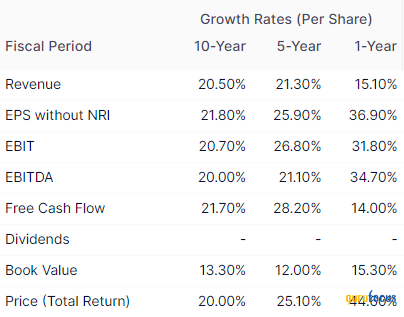

Alphabet even announced its first ever dividend payment. If we compare this performance with Apple (NASDAQ:AAPL), which has had a significantly lower earnings growth rate in the last five years and is expected to remain low over the next five years, Alphabet's stock still has room to grow. Apple trades at a forward price-earnings ratio of 28, while Alphabet trades at 22 times. This comes despite the impressive growth rates in revenue, earnings per share, Ebitda and free cash flow over the past decade.

Source: GuruFocus

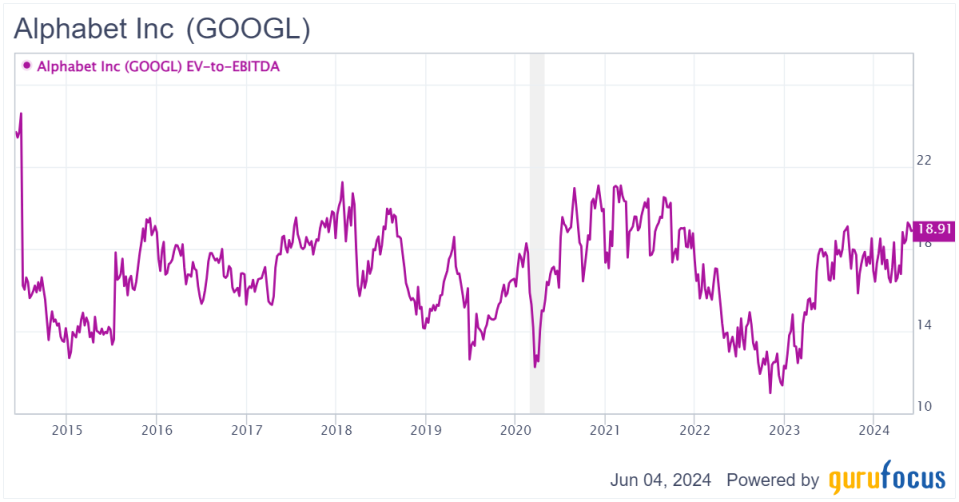

The enterprise value-to-Ebitda multiple is also on a rising trend, but has not broken out of the median range.

The stock is trading at a reasonable 19 times last 12 months Ebitda (14 times forward Ebitda), in line with the last 10 years - before the emergence of AI. Although there has been a catch-up in price since the start of the year to reflect higher earnings and the start of a dividend payment, it appears that no AI premium is yet allocated to the valuation of the stock. Therefore, it may be undervalued in light of its AI leadership.

Last but not least, the expected growth rates ranging from 11.20% to 30.80% (depending on which metric is observed), though conservative (in line with past growth rates and hence not reflecting AI as a growth catalyst), make the stock likely to outperform the broader market and the S&P 500 Index over the next three years.

The stock appears, therefore, attractively valued, in line with the historical range, and is expected to rise, on average, by double digits every year over the next three years. The risk-reward ratio for the stock is appealing to investors that want to ride the AI wave and that have potentially missed some of the stock price spikes across the market.

Risk factors to my case

The main risk factor is the catch-up from competition, particularly Microsoft's OpenAI model. If Microsoft improves the search experience provided to users, this could divert a portion of the revenue from Google. It is unlikely for competitors to beat the company in the browsing experience, where the latter has a long-held advantage. The main danger here lies in competitors using chatbots to divert user activity from the Google browser. However, it is not obvious at the moment that competitors have been able to do so. The fact that, as previously mentioned, 36% of Google's Gemini users use the chatbot for shopping, compared to 23% of ChatGPT users, may indicate Google offers a better chatbot experience and may have a competitive advantage there as well. Only time will tell, so the main risk for Alphabet is the competition introducing a better offering in the advertising space that would attract both users and ad-paying companies away from Google and Gemini.

Bottom line

Alphabet's valuation is still within the historical valuation range it has been subject to since 2010, or within the 15 to 20 times Ebitda median. This is despite being on the verge of a potential earnings breakout with its AI advancements. Alphabet's leading position in data collection gives its DeepMind Gemini AI model an advantage over the competition.

Given the high growth rates in the past decade and the likely continued double-digit growth in the next three years, Alphabet is in a good position to continue outperforming the broader market. And even more so if its AI capability continues to materialize in its earnings, in turn increasing dividend payments and share buybacks.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance