Alphabet (GOOGL) Boosts YouTube TV With Shortcut Feature

Alphabet’s GOOGL Google recently rolled out the “Last Channel Shortcut” feature for YouTube TV users.

Notably, the shortcut feature enables users to easily switch between their last-viewed channels, allowing them to do so without interacting with the on-screen UI.

Further, the feature pops up with a small animation and a message and can be accessed by long-pressing the "Select" or "OK" button on their remote. It works across live, on-demand and DVR content.

The company also partnered with Roku ROKU to bring this feature to all Roku devices.

Alphabet is likely to expand its YouTube TV subscriber base on the back of its latest move.

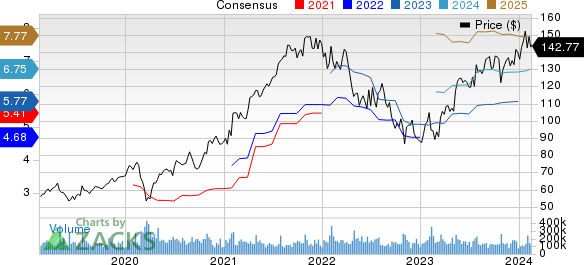

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

YouTube TV in Focus

Apart from the “Last Channel Shortcut” feature, Alphabet introduced the "Build a Multiview" feature for YouTube TV, allowing users to create their own combos with up to four pre-selected games, exclusively for subscribers with NBA League Pass and can be accessed from the Home tab.

The company also extended its Roku partnership to bring a clock icon in the live guide of all Roku devices. The clock is a convenient addition that was commonplace among traditional TV services.

Alphabet also launched a new Channel Guide for YouTube TV, aligning with Google TV's Live tab. The new feature enables users to view free built-in channels from the Live tab, allowing them to inject their favorite channels into the page.

Further, Google, via YouTube TV, recently partnered with Peloton Interactive’s PTON streaming service platform, Peloton Entertainment, in a bid to expand its subscriber base.

Per the terms of the partnership, Peloton All-Access members can stream their favorite television content from their Peloton Bike, Peloton Row or Peloton Tread. It would also require Peloton All-Access members to have a YouTube TV subscription.

All the above-mentioned endeavors will likely strengthen the company’s footing in the global video streaming space, presenting a significant growth opportunity for Alphabet.

Per a Fortune Business Insights report, the video streaming market is expected to reach $1.9 trillion by 2030, indicating a CAGR of 19.3% between 2023 and 2030.

Moreover, growing momentum in YouTube TV will aid Alphabet in competing well with industry peers like Disney DIS, which is also making concerted efforts to capitalize on the growth opportunities in the video streaming space.

Disney is riding on the success of its streaming service business, Hulu.

Notably, the company’s Hulu Plus Live TV offers East and West Coast feeds for various channels, allowing viewers in the West to watch with their friends in the East.

Recently, Hulu partnered with Fox News to bring Fox Weather on Hulu Plus Live TV, expanding the Live TV platform’s 95-channel core lineup.

To Conclude

Growing YouTube TV efforts will likely aid this Zacks Rank #3 (Hold) company to bolster its Google Services segment, which remains the key growth driver for the company. Its shares have rallied 51.3% in the past year compared with the Zacks Computer & Technology sector’s growth of 48%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the fourth quarter of 2023, Google Services revenues increased 12.5% year over year to $76.31 billion, accounting for 88.4% of total revenues.

The strengthening Google Services segment will likely bolster the company’s overall top-line performance in the near term.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $65.88 billion, indicating growth of 13.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

Peloton Interactive, Inc. (PTON) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance