Aluminum Foam Global Market Report 2023: Superior Properties of Aluminum Foams Drive Demand

Global Aluminum Foam Market

Dublin, March 15, 2023 (GLOBE NEWSWIRE) -- The "Aluminum Foam Market by Type (Open-Cell, Closed-Cell), Application (Anti-Intrusion Bars, Heat Exchangers, Sound Absorbers, Filters), End-Use Industry (Automotive, Construction & Infrastructure, Industrial), and Region - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

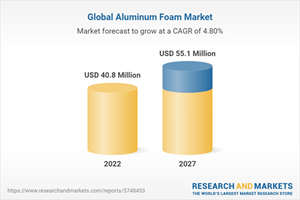

The aluminum foam market size is expected to grow from USD 40 million in 2021 to USD 55 million by 2027 growing at a CAGR of 4.8% between 2022 to 2027.

Aluminum foam has applications in different end-use industries, such as automotive, construction & infrastructure, industrial, and others. Advantages like cost-effectiveness and low weight make aluminum foam popular in the automotive and construction & infrastructure industries. The superior features offered by aluminum foam like high porosity, thermal conductivity and corrosion resistance are enabling its usage in various end-use industries.

Anti-intrusion bars application accounted for the largest share, in terms of value, of the overall aluminum foam market.

Anti-intrusion bars lead the overall aluminum foam market in 2021. Aluminum foam have characteristics such as cost-effectiveness, less weight, durability, resistance to fire, good thermal behavior, and reduced maintenance expenditure. Anti-intrusion bars are used in the automotive industry to keep passengers safe at the time of collision. Aluminum foam acts as a good kinetic energy absorber and hence is a well liked material for anti-intrusion bars.

Open-cell aluminum foam type dominated the market of aluminum foam, in terms of value and volume.

Open-cell aluminum foam dominated the overall aluminum foam market in 2021 and is projected to dominate in the forecasted period. The use of open-cell aluminum foam offers numerous advantages such as sound absorption, fragmentation capture, heat sinks & exchangers, catalyst surface, and spacers. Open-cell aluminum foam can absorb sound and hence is a very good sound insulator, as it possesses air bubbles created during the manufacturing process. All these advantages make open-cell aluminum foam to be the most widely used type in the aluminum foam market.

The aluminum foam market in the automotive end-use industry is expected to register the highest CAGR between 2022 to 2027.

The aluminum foam market in automotive end-use industry is to witness the fastest CAGR during the forecast period. As the automotive market is shifting toward electric cars, there is a huge demand for lightweight and strong materials in the automotive industry. With the growing demand for lightweight material, the demand for effective crash-resistant products is on the rise after considering the safety point for lightweight automotive vehicles. These factors are driving the aluminum foam market in the automotive industry around the globe.

The aluminum foam market in Asia Pacific is the largest market and projected to register the highest CAGR, in terms of value and volume, between 2022 and 2027.

Asia Pacific region dominated the global aluminum foam market where China being one of the prominent markets for aluminum foam due to the presence of world largest automotive industry. The region has the presence of many manufacturers of aluminum foam and its products. China accounted for the largest share of the market in Asia Pacific and is expected to register the highest growth during the forecast period. The growth of the aluminum foam market in this region is driven mainly by the growing automotive and building & infrastructure end-use industries.

Market Dynamics

Drivers

Superior Properties of Aluminum Foams

Increasing Usage of Aluminum Foams in Applications Such as Heat Exchangers and Anti-Intrusion Bars

Restraints

Difficulty in Bonding, Welding, and Soldering Aluminum Foams

High Cost of Aluminum Foam Compared with Substitutes

Opportunities

Increasing Usage of Aluminum Foams in the Automotive Industry

Increasing Demand for Lightweight Structural Materials in Construction Industry

Challenges

Development Needed to Control Pore Size and Shape of End Products

Developing Cost-Efficient Manufacturing Methods

Key Attributes:

Report Attribute | Details |

No. of Pages | 176 |

Forecast Period | 2022 - 2027 |

Estimated Market Value (USD) in 2022 | $40.8 Million |

Forecasted Market Value (USD) by 2027 | $55.1 Million |

Compound Annual Growth Rate | 4.8% |

Regions Covered | Global |

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Metal Foam Market, by Type

6.1 Introduction

6.2 Open-Cell Aluminum Foam

6.3 Closed-Cell Aluminum Foam

7 Aluminum Foam Market, by Application

7.1 Introduction

7.2 Anti-Intrusion Bars

7.3 Heat Exchangers

7.4 Sound Absorbers

7.5 Filters

7.6 Others

8 Aluminum Foam Market, by End-Use Industry

8.1 Introduction

8.2 Automotive Industry

8.3 Construction & Infrastructure

8.4 Industrial

8.5 Other End-Use Industries

8.5.1 Aerospace

8.5.2 Defense

8.5.3 Medical

9 Aluminum Foam Market, by Region

10 Competitive Landscape

11 Company Profile

12 Appendix

Companies Mentioned

Alantum Corporation (South Korea)

Aluminum King Co., Ltd (China)

CYMAT Technologies Ltd. (Canada)

ERG Aerospace Corporation (US)

Liaoning Rontec Advanced Material Technology Co., Ltd. (China)

Mayser GmbH & Co. KG (Germany)

Pohltec Metalfoam GmbH (Germany)

Shanxi Putai Aluminum Foam Manufacturing Co., Ltd. (China)

For more information about this report visit https://www.researchandmarkets.com/r/25rcmu

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance