Amazon's (AMZN) AWS Momentum to Drive Growth in Q2 Earnings

Amazon’s AMZN second-quarter 2019 results, which are scheduled to be released on Jul 25, are likely to be aided by strengthening cloud services offerings and dominant position in cloud market.

Amazon Web Services (AWS), the company’s cloud computing arm, enjoys solid momentum across customers backed by its robust services portfolio. Moreover, AWS offers strong discounts for long-term deals which help it in attracting customers.

Further, expanding customer base contributes well to the top-line growth of AWS. This in turn aids AWS in generating significantly higher margins compared with Amazon’s retail business. Consequently, it has become an integral division of the company.

Notably, AWS revenues came in at $ 7.69 billion, accounting for 13% of the net sales of Amazon in the last reported quarter. We further note that AWS operating income surged 58.8% year over year to $2.22 billion.

The Zacks Consensus Estimate for AWS revenues in the to-be-reported quarter is pegged at $8.49 billion.

Click here to know how Amazon’s overall second-quarter performance is likely to be.

Portfolio Strength: A Key Catalyst

Amazon’s continued efforts toward expansion of its service portfolio remains a major positive and is likely to contribute to AWS revenues in the to-be-reported quarter.

During the second quarter, the company made Amazon Personalize generally available to customers in order to enhance its ML enabled cloud service offerings. Notably, the service is a fully managed one which allows developers to build applications with the same machine learning technology utilized by Amazon.com for real-time personalized recommendations.

Further, it announced the general availability of AWS Control Tower and AWS Security Hub. While the former offers an automated landing zone, the latter provides a central place to manage security and compliance across an AWS environment.

AWS also made Amazon Managed Streaming for Apache Kafka (Amazon MSK) generally available to customers. Additionally, AWS Ground Station, Amazon Managed Blockchain and Amazon Textract were also made generally available in the quarter under review.

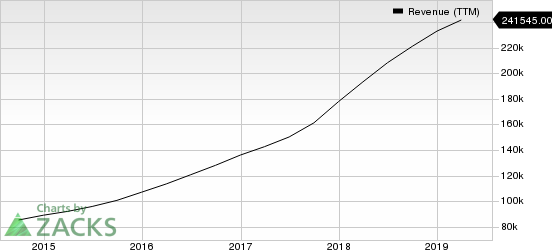

Amazon.com, Inc. Revenue (TTM)

Amazon.com, Inc. revenue-ttm | Amazon.com, Inc. Quote

Growing Clientele to Aid Growth

The abovementioned strong endeavors are likely to strengthen AWS customer base in the to-be-reported quarter.

A few customers utilizing AWS services include AT&T, Nestle — Amazon Managed Blockchain; NSLComm, D-Orbit — AWS Ground Station; PwC, Informed — Amazon Textract; Vonage, Secureworks — Amazon MSK; Subway, Yamaha — Amazon Personalize; California State University, Deutsche Börse Group — AWS Control Tower and GoDaddy, Rackspace — AWS Security Hub.

Apart from these, AWS has been selected by National Association for Stock Car Auto Racing (NASCAR) as its preferred cloud computing, cloud ML and cloud AI Provider during the second quarter.

Further, Vertafore chose AWS to migrate its business-critical products and workloads to the latter.

Per a report from Synergy Research Group, AWS continued to lead the cloud market in first-quarter 2019 with 33% share despite increasing competition from Microsoft MSFT, Alphabet’s GOOGL Google Cloud and Alibaba’s BABA cloud platform which are striving to decrease the gap.

We believe growing adoption rate of AWS as evident from the abovementioned facts are likely to aid AWS’ dominance in the cloud market in the quarter to be reported.

Currently, Amazon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance