Ambarella (AMBA) Beats Q3 Earnings and Revenue Estimates

Ambarella AMBA reported third-quarter fiscal 2023 non-GAAP earnings of 24 cents per share, which surpassed the Zacks Consensus Estimate of 19 cents. However, the reported figure declined 57.9% from the prior-year quarter’s earnings of 57 cents.

Third-quarter revenues declined 10% year over year to $83.1 million, mainly due to customer inventory reduction actions. However, the top line marginally exceeded the consensus mark of $83.03 million.

Customer & Market Details

Ambarella had two customers that contributed more than 10% in the reported quarter. WT Microelectronics, a fulfillment partner in Taiwan that serves multiple customers in Asia, accounted for 62% of the company’s revenues. Chicony, a Taiwan-based electronics manufacturer serving multiple IOT customers, represented 11% of the company’s revenues.

The momentum in AMBA’s CV flow system-on-a-chip in professional IP cameras continued in the reported quarter. The company expects to achieve its targeted goal of generating 45% of total revenues from the CV portfolio.

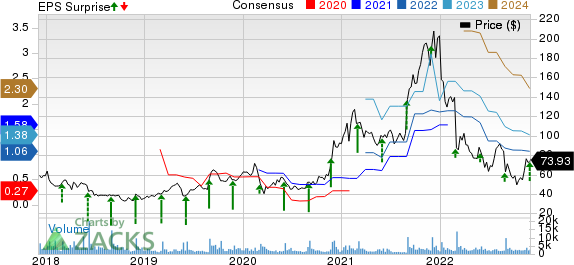

Ambarella, Inc. Price, Consensus and EPS Surprise

Ambarella, Inc. price-consensus-eps-surprise-chart | Ambarella, Inc. Quote

Operating Details

The non-GAAP gross margin was 63.5%, up 40 basis points year over year in the fiscal third quarter.

On a non-GAAP basis, operating expenses were $43.5 million, down 1% sequentially. Non-GAAP operating expenses were below the company’s prior guidance of $44-$46 million, mainly driven by the favorable currency exchange rate impact on its foreign spending.

Net inventory was $45.4 million as of Oct 31, 2022, up 13.2% sequentially.

Balance Sheet

As of Oct 31, 2022, Ambarella had cash and cash equivalents & marketable securities of $199 million compared with $197.9 million as of Jul 31, 2022.

Guidance

For the fourth quarter of fiscal 2023, revenues are expected between $81 million and $85 million. The non-GAAP gross margin is anticipated to be 63-64%.

Non-GAAP operating expenses are projected in the range of $46-$49 million.

Zacks Rank & Key Picks

Currently, Ambarella carries a Zacks Rank #4 (Sell). The stock has lost 63.4% year to date (YTD).

Some better-ranked stocks from the broader technology sector are Celestica CLS, Zscaler ZS and Blackbaud BLKB. Celestica sports a Zacks Rank #1 (Strong Buy) at present, while Zscaler and Blackbaud carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celestica’s fourth-quarter 2022 earnings has increased by 9 cents to 53 cents per share over the past 60 days. For 2022, earnings estimates have moved up 9.4% to $1.86 per share in the past 60 days.

CLS' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 11.8%. Shares of the company have gained 0.3% YTD.

The Zacks Consensus Estimate for Zscaler's second-quarter fiscal 2023 earnings has been revised 5 cents north to 26 cents per share over the past 90 days. For fiscal 2023, earnings estimates have moved a penny south to $1.17 per share in the past 30 days.

ZS’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 28.6%. Shares of the company have declined 58.4% YTD.

The Zacks Consensus Estimate for Blackbaud's fourth-quarter 2022 earnings has been revised 3 cents southward to 58 cents per share over the past 30 days. For 2022, earnings estimates have moved upward by 4 cents to $2.59 per share in the past 30 days.

Blackbaud's earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 4.9%. Shares of BLKB have slumped 24.9% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celestica, Inc. (CLS) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Ambarella, Inc. (AMBA) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance