Ambarella (AMBA) Launches CV75AX and CV72AX AI-Based SoCs

Ambarella AMBA recently unveiled its latest generation of artificial intelligence-based systems-on-chip (SoCs) named CV75AX and CV72AX. These chips are designed for in-vehicle fleet telematics systems.

Users can now efficiently monitor and manage their vehicles with AI dash cams, front-facing Advanced Driver Assistance Systems and driver monitoring systems by using these chips. The CV75AX improves the AI performance by two times from its predecessors. This reduces the incidents of false positives while increasing accuracy.

The CV72AX is designed to support up to 10 cameras and deliver an AI performance of six times that of its previous generation. The chip will be able to support multi-modal vision language models and natural-language searches.

The chips feature AMBA’s CVflow 3.0 AI engine, LPDDR5 support with 2x the DRAM bandwidth, USB 3.2 interface for 5G modems and H.264/5 video encoder. All these integrations will improve the chips’ performance and make them faster, increase their performance and bandwidth and deliver high-quality videos.

Moreover, the CV75AX consumes minimal power in sleep mode as it is designed to consume less than 5mw of power, saving battery life and cutting costs. For instance, the CV75AX’s on-chip microcontroller core utilizes extremely low power sleep mode so that the system consumes less than 5mw.

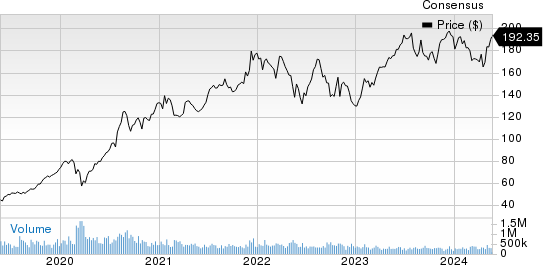

Ambarella, Inc. Price and Consensus

Ambarella, Inc. price-consensus-chart | Ambarella, Inc. Quote

Ambarella Gains From the Growing ADAS Market

AMBA is growing due to the rising demand for camera-based SoCs and computer vision technology in the Automated Driver Assistance Systems (“ADAS”) market.

The ever-increasing rise in the number of automakers who are participating in the ADAS space is helping the company innovate and roll out CVFlow SoCs like CV3, CV2, CV5, CV25 and CV22. Moreover, AMBA is receiving positive feedback for its products from its customers.

Moreover, the company has been continuously growing its collaboration with companies in the Autonomous Driving segment, including Applied Intuition, Continental and Kodiak.

There is continuous growth in the number of Automakers who are taking part in the development of ADAS, consistently driving up the demand for Ambarella’s offerings.

Nevertheless, the company is facing some near-term challenges that include customers cutting down their inventory. AMBA is also facing weak demand in specific market segments.

Zacks Rank & Stocks to Consider

Currently, Ambarella carries a Zacks Rank #3 (Hold). Shares of AMBA have dropped 31.3% over the past year.

Some better-ranked stocks from the broader technology sector are AppFolio APPF, Arista Networks ANET and Alphabet GOOGL, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AppFolio’s 2024 earnings per share has been revised upward by 13 cents to $3.97 in the past 30 days. Shares of APPF have surged 78.7% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 earnings per share has been revised upward by 43 cents to $7.92 in the past 30 days. Shares of ANET have surged 125.7% in the past year.

The Zacks Consensus Estimate for Alphabet’s 2024 earnings per share has been revised upward by 80 cents to $7.57 in the past 30 days. Shares of GOOGL have jumped 45.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ambarella, Inc. (AMBA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance