American Outdoor Brands (NASDAQ:AOUT) Beats Q1 Sales Targets

Recreational products manufacturer American Outdoor Brands (NASDAQ:AOUT) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 9.7% year on year to $46.3 million. It made a GAAP loss of $0.42 per share, down from its loss of $0.29 per share in the same quarter last year.

Is now the time to buy American Outdoor Brands? Find out in our full research report.

American Outdoor Brands (AOUT) Q1 CY2024 Highlights:

Revenue: $46.3 million vs analyst estimates of $43.15 million (7.3% beat)

EPS: -$0.42 vs analyst expectations of -$0.34 (25.4% miss)

Gross Margin (GAAP): 41.9%, down from 45.2% in the same quarter last year

Free Cash Flow of $19.72 million, up 103% from the previous quarter

Market Capitalization: $109.7 million

Brian Murphy, President and Chief Executive Officer, said, "I am very pleased with our performance for fiscal 2024, a year in which we delivered year-over-year net sales growth that exceeded our expectations and achieved several strategic milestones which, we believe, position our company and our brands well for the future. Innovation remains core to our strategy, and in fiscal 2024, innovation helped drive growth by allowing us to forge strong relationships with our consumers and retailers and expand our access to new markets. Our results were especially notable given the environment of consumer uncertainty that characterized fiscal 2024."

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers firearms and firearm accessories.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

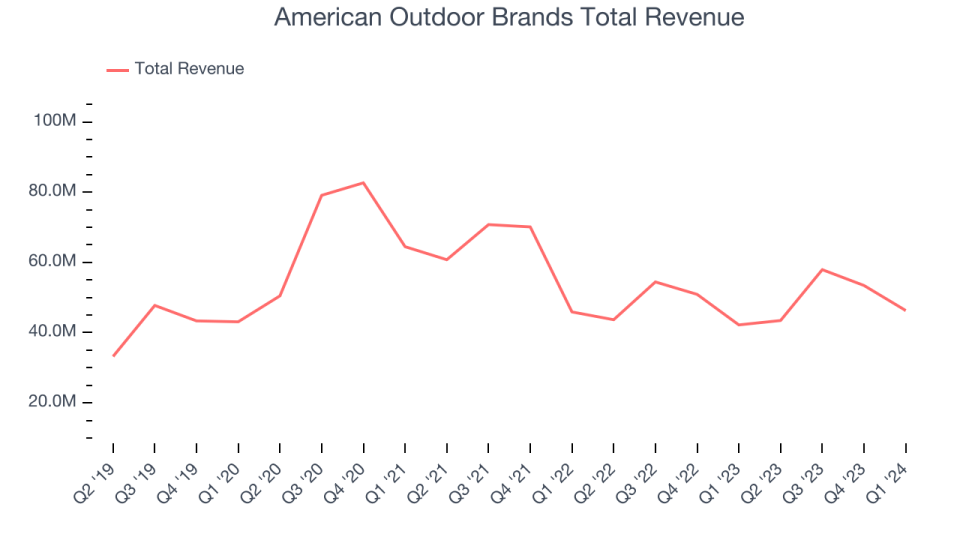

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, American Outdoor Brands's 4.7% annualized revenue growth over the last four years was weak. This shows it failed to expand its business in any major way.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. American Outdoor Brands's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.9% annually.

This quarter, American Outdoor Brands reported solid year-on-year revenue growth of 9.7%, and its $46.3 million of revenue outperformed Wall Street's estimates by 7.3%. Looking ahead, Wall Street expects sales to grow 2.3% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

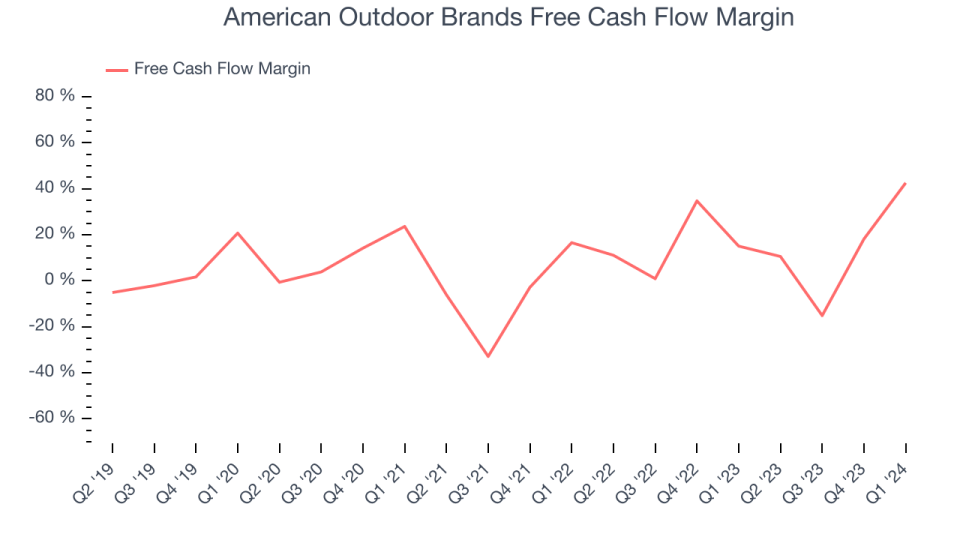

American Outdoor Brands has shown strong cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin averaged 13.9% over the last two years, better than the broader consumer discretionary sector. We'd also point out that the divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. These line items are deducted from GAAP operating profit but not free cash flow.

American Outdoor Brands's free cash flow clocked in at $19.72 million in Q1, equivalent to a 42.6% margin. This quarter's result was good as its margin was 27.5 percentage points higher than in the same quarter last year, but we wouldn't put too much weight on it because a business's working capital needs can be seasonal, causing quarter-to-quarter swings.

Key Takeaways from American Outdoor Brands's Q1 Results

We were impressed by how significantly American Outdoor Brands blew past analysts' revenue expectations this quarter. On the other hand, its EPS missed, but the market seems to care most about sales performance. The stock traded up 2.5% to $9.04 immediately following the results.

So should you invest in American Outdoor Brands right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance