Andreas Halvorsen's Strategic Reduction in APi Group Corp Holdings

Overview of Recent Transaction by Andreas Halvorsen (Trades, Portfolio)

On June 17, 2024, Viking Global Investors, under the leadership of Andreas Halvorsen (Trades, Portfolio), executed a significant transaction involving APi Group Corp (NYSE:APG). The firm reduced its holdings by 1,951,782 shares, which resulted in a 6.73% decrease in their previous stake. This adjustment brought the firm's total shares in APi Group Corp to 27,032,516, impacting the portfolio by -0.28%. The shares were traded at a price of $38.15 each. This move adjusted Viking Global Investors' position in APG to 3.85% of its portfolio, representing 9.86% of the company's outstanding shares.

Profile of Andreas Halvorsen (Trades, Portfolio) and Viking Global Investors

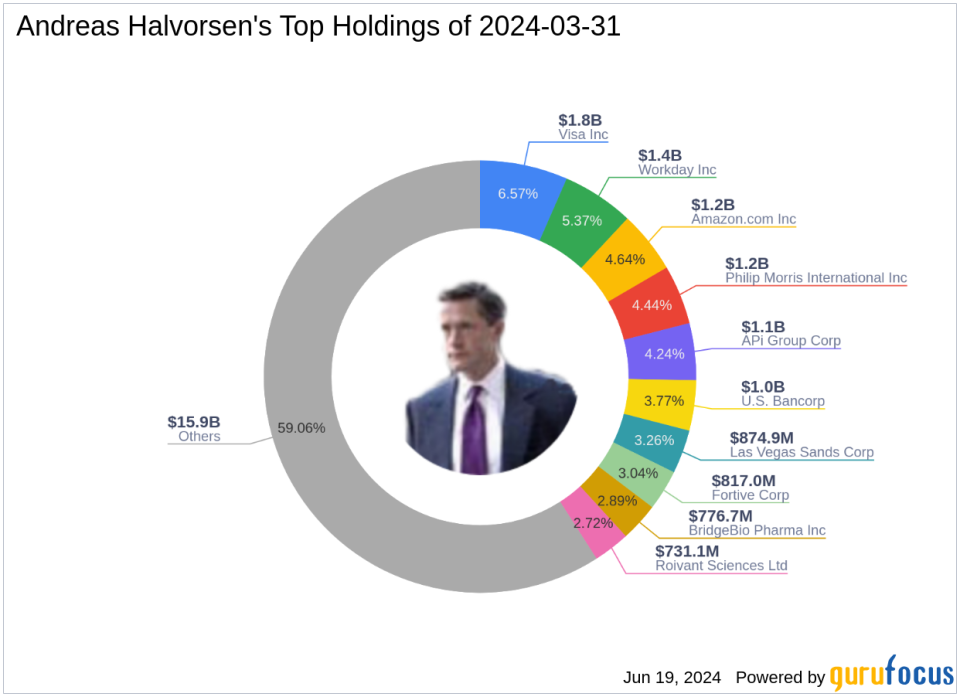

Andreas Halvorsen (Trades, Portfolio), a founding partner of Viking Global Investors LP, has established a formidable reputation in the investment world. Viking, now managed by CIO Ning Jin since its inception in 1999, is known for its research-intensive and long-term focused investment approach. The firm's strategy emphasizes fundamental analysis and decentralized investment research, coupled with centralized risk management. Viking Global Investors has a diverse portfolio, with top holdings including giants like Amazon.com Inc (NASDAQ:AMZN) and Visa Inc (NYSE:V).

Insight into APi Group Corp

APi Group Corp, traded under the symbol APG, operates primarily through its Safety Services and Specialty Services segments. The company offers a range of safety and infrastructure services across various industries, including commercial and industrial sectors. Since its IPO on October 5, 2017, APi Group Corp has shown significant growth, with a current market capitalization of $10.58 billion. Despite being currently valued as significantly overvalued with a GF Value of $29.04, the stock has demonstrated robust year-to-date growth of 17.34%.

Analysis of the Trade's Impact

The recent transaction by Viking Global Investors has slightly reduced its exposure to APi Group Corp, yet the firm maintains a substantial stake in the company. This move might reflect a strategic adjustment based on current market valuations and the firm's portfolio management objectives. Given the stock's current price of $38.58 against a GF Value of $29.04, and its classification as significantly overvalued, this reduction could be seen as a cautious approach to risk management.

Market Context and Stock Performance

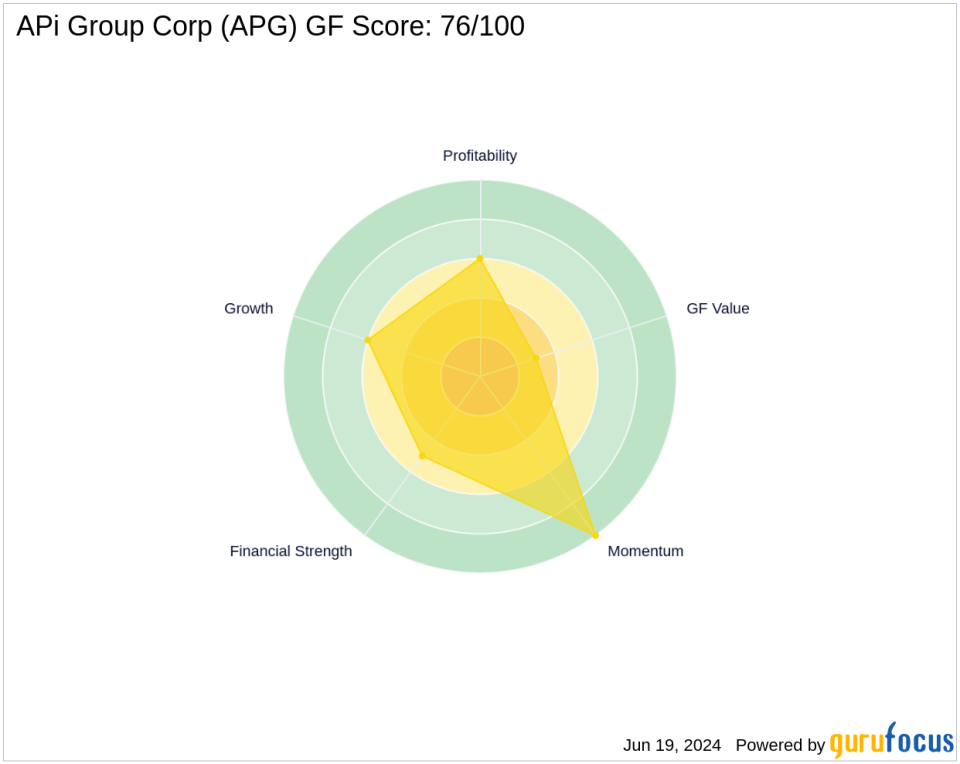

APi Group Corp's stock has shown impressive momentum, with a Momentum Rank of 10/10. The stock's resilience is also reflected in its GF Score of 76/100, indicating potential for above-average performance. However, the stock's valuation metrics suggest that it is trading above its intrinsic value, which might have influenced Viking's decision to trim its position.

Broader Investment Implications

The adjustment in Viking Global Investors' stake in APi Group Corp could signal to other market participants a cautious stance towards the stock at its current valuation. Notably, other significant investors like Fisher Asset Management, LLC and Joel Greenblatt (Trades, Portfolio) also hold positions in APG, which could lead to heightened market scrutiny of their subsequent investment moves in this context.

Conclusion

Andreas Halvorsen (Trades, Portfolio)'s recent reduction in APi Group Corp shares through Viking Global Investors reflects a nuanced strategy in portfolio management, especially considering the stock's high valuation relative to its GF Value. This move could have broader implications for market perceptions and the strategic approaches of other investors in APG.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance