Apogee's (NASDAQ:APOG) Q2 Sales Beat Estimates

Architectural products company Apogee (NASDAQ:APOG) announced better-than-expected results in Q2 CY2024, with revenue down 8.3% year on year to $331.5 million. It made a GAAP profit of $1.41 per share, improving from its profit of $1.05 per share in the same quarter last year.

Is now the time to buy Apogee? Find out in our full research report.

Apogee (APOG) Q2 CY2024 Highlights:

Revenue: $331.5 million vs analyst estimates of $328.5 million (small beat)

Adjusted EBITDA: $52.6 million vs analyst estimates of $40.6 million (29.6% beat)

EPS: $1.41 vs analyst estimates of $0.89 (57.8% beat)

Raised full year EPS guidance

Gross Margin (GAAP): 29.8%, up from 25.7% in the same quarter last year

Free Cash Flow was -$1.78 million, down from $58.68 million in the previous quarter

Market Capitalization: $1.31 billion

“Our team continued to drive operational execution across the business, delivering significant operating income growth and record adjusted EPS, despite continued volume pressure,” said Ty R. Silberhorn, Chief Executive Officer.

Involved in the design of the Apple Store on Fifth Avenue in New York City, Apogee (NASDAQ:APOG) sells architectural products and services such as high-performance glass for commercial buildings.

Commercial Building Products

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

Sales Growth

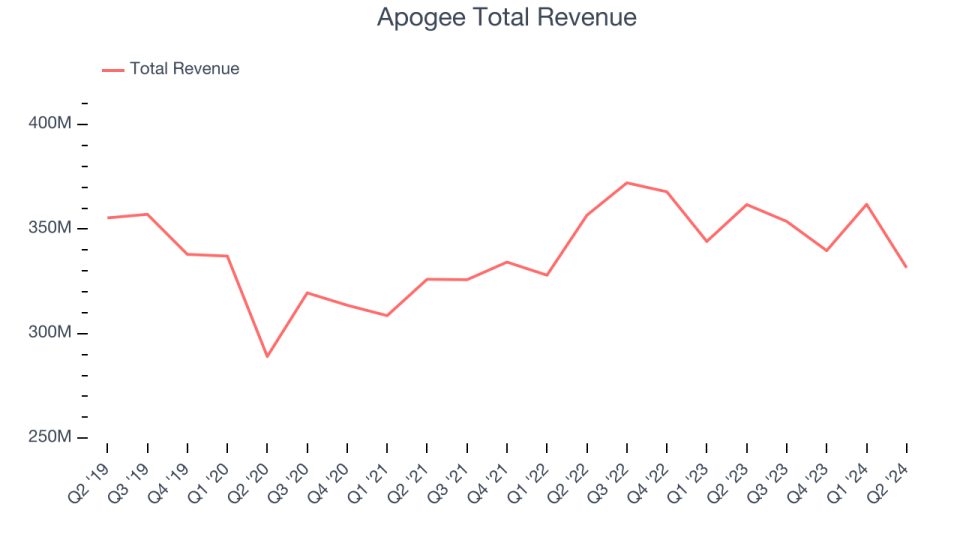

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, Apogee's sales were flat. This shows its demand was soft and is a tough starting point for our quality assessment.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Apogee's annualized revenue growth of 1.6% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Apogee's revenue fell 8.3% year on year to $331.5 million but beat Wall Street's estimates by 0.9%. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Apogee was profitable over the last five years but held back by its large expense base. It demonstrated mediocre profitability for an industrials business, producing an average operating margin of 7.9%. This isn't too surprising given its low gross margin as a starting point.

On the bright side, Apogee's annual operating margin rose by 6.8 percentage points over the last five years.

This quarter, Apogee generated an operating profit margin of 12.5%, up 3.1 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

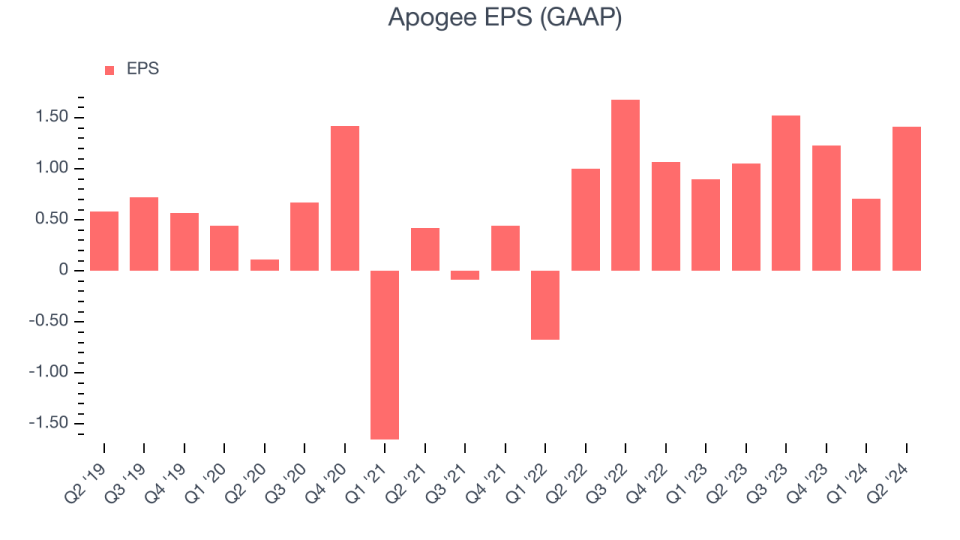

Apogee's EPS grew at an astounding 29.6% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

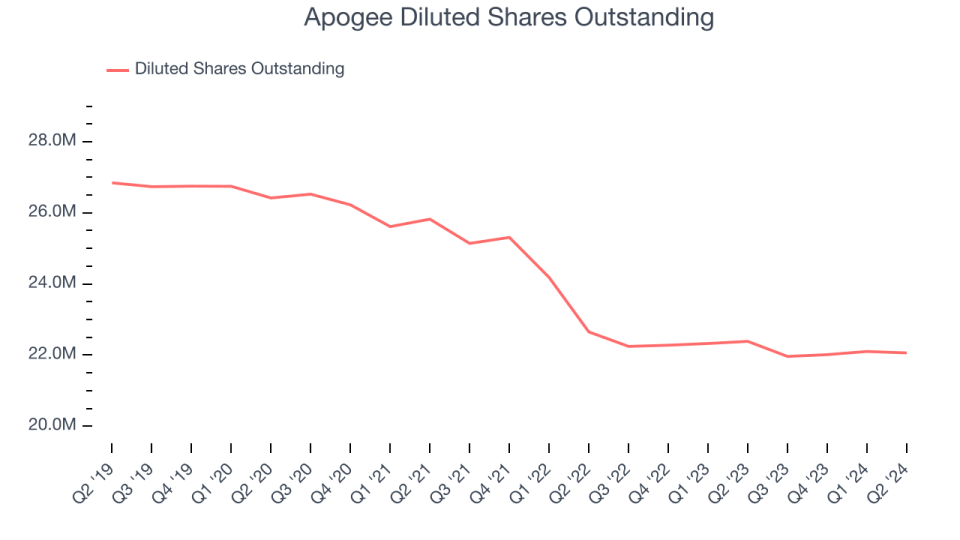

We can take a deeper look into Apogee's earnings to better understand the drivers of its performance. As we mentioned earlier, Apogee's operating margin expanded by 6.8 percentage points over the last five years. On top of that, its share count shrank by 17.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Apogee, its two-year annual EPS growth of 167% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Apogee reported EPS at $1.41, up from $1.05 in the same quarter last year. This print beat analysts' estimates by 57.8%. Over the next 12 months, Wall Street expects Apogee to perform poorly. Analysts are projecting its EPS of $4.87 in the last year to shrink by 5.9% to $4.58.

Key Takeaways from Apogee's Q2 Results

We were impressed by how significantly Apogee blew past analysts' EPS expectations this quarter, driven by a big operating margin outperformance versus Wall Street's estimates. The company raised full year EPS guidance to reflect the profit beat and ongoing margin strength. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock traded up 4% to $61.49 immediately following the results.

Apogee may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance