What's in the Cards for Geron (GERN) This Earnings Season?

Geron Corporation GERN is expected to report fourth-quarter 2017 results on Mar 7.

In the last reported quarter, the company delivered a positive earnings surprise of 20%.

Geron’s shares have outperformed the industry in the past year. The stock has gained 8.2% while the industry witnessed a decline of 1.9% in the said time frame.

Pipeline in Focus

Geron’s revenues solely comprise license fees and royalties as it has no approved product in its portfolio. Moreover, it has only one candidate in its pipeline, imetelstat. Hence, investor focus will remain on any updates related to it.

Geron is developing imetelstat in collaboration with Johnson & Johnson’s JNJ for treating patients with hematologic myeloid malignancies like myelofibrosis (“MF”), myelodysplastic syndromes (“MDS”) and acute myelogenous leukemia (“AML”).

Two late-stage studies for imetelstat are ongoing – IMbark (phase II) for the treatment of MF, and IMerge (phase II/III) for the treatment of MDS.

Following second internal review of data from IMbark and IMerge in April last year by J&J, the studies continued unmodified. In November 2017, Geron initiated dosing in the expanded part 1 of the ongoing phase II/III IMerge study. The expanded part is being conducted to confirm the clinical benefit and safety observed earlier.

Janssen will decide on continuation of part 2 of IMerge based on data from expanded part 1.

Janssen is expected to evaluate maturing data from the IMbark study in 2018, including an assessment of overall survival. An internal review of the data is expected in the first quarter of 2018. However, the continuation of the study will depend on a protocol-specified primary analysis, which will be done in the third quarter of 2018 or on reaching a pre-specified number of deaths.

We expect the company to provide an update on the path forward for imetelstat development on the fourth-quarter conference call.

Surprise History

Geron’s performance over the last four quarters has been fairly decent, with the company surpassing expectations thrice and meeting the same once. The average positive surprise over the last four quarters is 14.17%.

Earnings Whispers

Our proven model does not conclusively show that Geron is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat estimates. But that is not the case here, as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 4 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Although Geron’s Zacks Rank #3 increases the predictive power of ESP, its 0.00% ESP makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

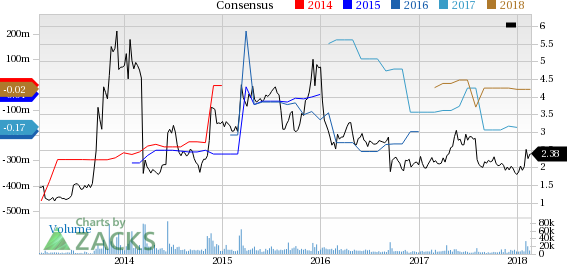

Geron Corporation Price and Consensus

Geron Corporation Price and Consensus | Geron Corporation Quote

Stocks That Warrant a Look

Here are a couple of health care stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Exelixis EXEL is scheduled to release results on Feb 26 after market close. The company has an Earnings ESP of +8.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Exact Sciences EXAS has an Earnings ESP of +7.32% and a Zacks Rank #3. The company is scheduled to release results on Feb 22 after market close.

Can Hackers Put Money INTO Your Portfolio?

Earlier this month, credit bureau Equifax announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Geron Corporation (GERN) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance