Here's Why You Should Buy New Oriental (EDU) Stock Right Now

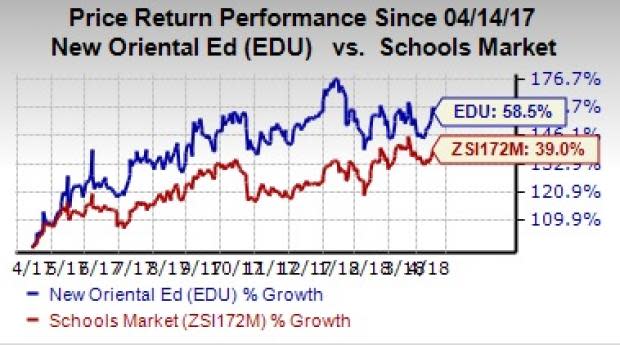

New Oriental Education & Technology Group Inc.’s EDU shares have lately been riding high. Shares of China's largest after-school tutoring network have gained more than 58% in the past year, outperforming the 39% growth of its industry.

Moreover, the Zacks Consensus Estimate for earnings for the current as well as next year has increased 0.9% and 2.5%, respectively, in the last 60 days, thus reflecting optimism in the stock’s earnings prospects (and share price), and substantiating its Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

What Makes New Oriental a Solid Pick?

Solid Performance & Healthy Growth Prospects: Guided by its well-proven 'Optimize the Market' strategy, New Oriental is steadily facilitating its capacity expansion across cities with strong growth potential. The company’s last reported quarter registered 36.9% year-over-year growth in total net revenues in the second quarter of fiscal 2018. The solid top-line growth is mainly driven by 43% year-over-year improvement in student enrollments.

New Oriental is increasing the pace of its learning center network expansion. The company’s strong guidance seems to be encouraging enough, keeping in view its expansion plans. New Oriental expects total net revenues in the third quarter of fiscal 2018 to be in the range of $591.1-$604.2 million, representing year-over-year growth of 35-38%.

Solid Estimated EPS Growth: The company’s fiscal 2018 earnings are expected to increase 15.5% year over year. For fiscal 2019, earnings are expected to grow an impressive 35.2%.

Meanwhile, the company’s sales are expected to increase 32.8% in the current year and 30.9% for the next year.

Moreover, the stock has a solid long-term (3-5 years) expected EPS growth rate of 31.8%, higher than the industry average of 16.9%.

Solid ROE: New Oriental’s trailing 12-month return on equity (ROE) supports its growth potential. ROE in the trailing 12 months is 16.2%, while the industry gained 6.7%, reflecting the company’s efficient usage of shareholders’ funds.

Other Key Picks

Other top-ranked stocks in the industry are American Public Education, Inc. APEI, Grand Canyon Education, Inc. LOPE and Capella Education Company CPLA.

American Public and Grand Canyon sport a Zacks Rank #1, while Capella carries a Zacks Rank #2.

American Public is expected to witness 18.6% growth in 2018 earnings.

Grand Canyon’s earnings for 2018 are expected to increase 18.7%.

Capella’s earnings for 2018 are anticipated to increase 23%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Capella Education Company (CPLA) : Free Stock Analysis Report

New Oriental Education & Technology Group, Inc. (EDU) : Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance