Apple Stock’s Safe-Haven Status at Risk as Headwinds Mount

(Bloomberg) -- Apple Inc.’s status as a relative haven in this year’s bear market is under threat amid growing concern that iPhone sales are weakening, portending further declines for technology stocks more broadly.

Most Read from Bloomberg

Sam Bankman-Fried’s $16 Billion Fortune Is Eviscerated in Days

US Inflation Slows More Than Forecast, Gives Fed Downshift Room

Stocks Skyrocket in Best Post-CPI Day on Record: Markets Wrap

Over the weekend, the Cupertino, California-based company said Covid-related lockdowns in China would cause shipments of its newest premium handsets to be lower than previously expected. Bloomberg News also reported that due to weaker demand, Apple expects to produce at least 3 million fewer iPhone 14s this year than first anticipated.

The stock rose 0.6% on Tuesday, bringing its year-to-date decline to 21%. The Nasdaq 100 Index is down 32%. Other major technology and internet stocks -- including Microsoft Corp., Amazon.com Inc., and Alphabet Inc. -- are down between 32% and 46%.

Apple was the only megacap to rally in the wake of its results this quarter, and the report kept analysts from dramatically slashing earnings estimates, in contrast to widespread cuts elsewhere. Now the consensus for Apple is too optimistic, according to UBS Group AG. That represents a risk to the market’s biggest company at a time when it already trades at a premium to the Nasdaq 100.

Brian Frank, chief investment officer of Frank Funds, called the lack of estimate cuts “a flashing red light” for investors.

“I don’t see any reason why Apple estimates won’t be cut at the same scale as tech overall, and because it trades with a multiple above 20, this seems like a massive risk,” he said. “Given its global exposure and the fact that consumers are facing a difficult environment because of inflation, I don’t see anything to get excited about. I think there’s a lot more downside risk for megacaps.”

Analysts expect earnings of $6.29 per share for Apple in 2023, an estimate that has only declined by 2.6% over the past quarter. To compare, 2023 estimates have fallen 5.8% for Microsoft in the same period, 5.6% for Alphabet, and 14% for Amazon. Companies that supply to Apple have also seen estimates slashed -- predicted 2023 earnings for Skyworks Solutions Inc. have fallen 11% over the past month while Qorvo Inc. estimates are down more than 20%. Both reported last week.

For the overall tech sector, Bloomberg Intelligence data show analysts expect 2023 earnings will fall 0.2%, compared with the 8% growth that was expected three months ago.

Apple trades at about 22 times estimated earnings, above its 10-year average of 17 and the 19.7 multiple of the Nasdaq 100. Should consensus estimate get slashed further, shrinking the denominator in the price-to-earnings equation, Apple would screen as more expensive than it currently does.

“It’s overvalued relative to the rest of tech, even if there is something to be said for its cash flow and brand,” said Jim Worden, chief investment officer of Wealth Consulting Group. “The big question is how much growth could slow, since I think a recession will hurt Apple more than analysts are projecting. I like it as a long-term play, but have no idea if we’re close to bottoming and in the short term there will be a lot more volatility ahead.”

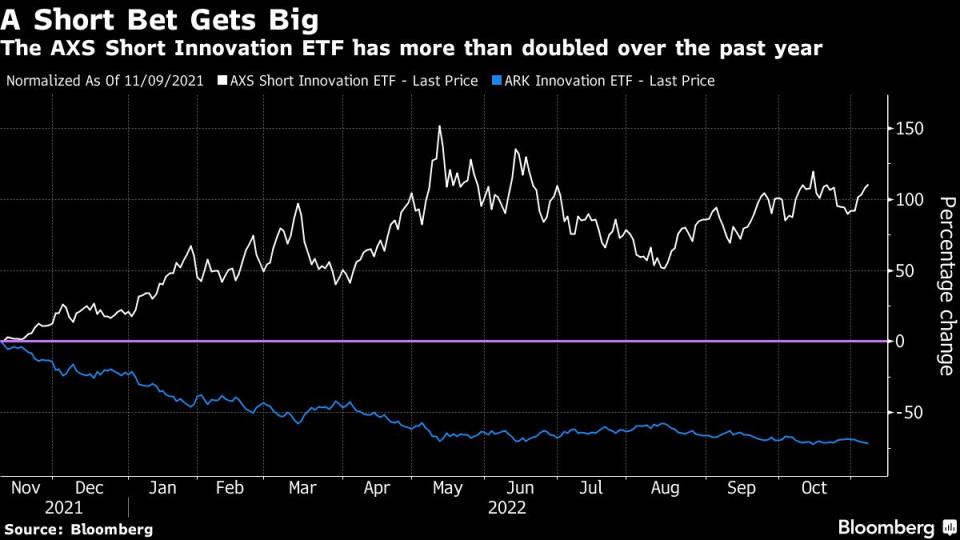

Tech Chart of the Day

Cathie Wood’s ARK Innovation ETF is a long way from its pandemic-era heyday, as rising interest rates and a rotation out of high-growth and high-valuation tech stocks has resulted in a 72% selloff over the past year. However, that has made for an ideal environment for the AXS Short Innovation Daily ETF, which tracks the inverse performance of Wood’s fund. The fund has more than doubled since it launched a year ago.

Top Tech Stories

Covid cases have more than doubled in the central Chinese city of Zhengzhou, damping hopes that authorities will lift a lockdown of the area surrounding the world’s largest iPhone factory.

Morgan Stanley analysts have put a value on how much revenue is at risk for Foxconn Technology Group if its Zhengzhou operation is unable to ship any iPhones for the rest of the year as it battles a coronavirus outbreak.

Nvidia Corp., the most valuable chipmaker in the US, has begun producing a processor for China that conforms to new rules aimed at limiting that country’s access to artificial-intelligence computing.

Nintendo Co. cut its fiscal-year forecast for Switch video-game console sales by 10% to 19 million after reporting earnings in line with expectations.

German chipmaker Elmos Semiconductor SE said the country’s economy ministry is likely to block the sale of its wafer facility to a Swedish subsidiary of China’s Sai MicroElectronics Inc. after previously indicating the deal would be approved.

Renault SA is deepening its collaboration with Alphabet Inc.’s Google in a bid to extend capabilities on remote software updates to new vehicle models such as the electric Megane E-Tech and Austral. “We want to make the car an intelligent object that learns and one that can be upgraded over the air like a mobile phone,” Renault Chief Executive Officer Luca de Meo said.

Lyft Inc. fell more than 15% in extended trading after reporting weaker-than-expected ridership growth, signaling that it’s losing ground to rival Uber Technologies Inc. in a rocky recovery from the pandemic.

(Updates to market open.)

Most Read from Bloomberg Businessweek

One of Gaming’s Most Hated Execs Is Jumping Into the Metaverse

A Narrow GOP Majority Is Kevin McCarthy’s Dream/Nightmare Come True

Peter Thiel’s Strategy of Pushing the GOP Right Is Just Getting Started

Binance’s Thumping of FTX Shows How Centralized Crypto Can Be

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance