Apple's (AAPL) Animation Film Emerges Winner at 2023 Oscars

Apple AAPL continues its winning stride at the Academy Awards with its animation movie The Boy, the Mole, the Fox and the Horse winning an Oscar for Best Animated Short Film. Last year, Apple won three Academy Awards for CODA.

Based on the book by Charlie Mackesy, The Boy, the Mole, the Fox and the Horse has already won a BAFTA award, four Annie Awards including Best Special Production, and an NAACP Image Awards nomination for Outstanding Short Form (Animated) film.

Apple’s impressive run at the Oscars has been instrumental in driving recognition of Apple TV+ in the saturated streaming market currently dominated by the likes of Amazon AMZN Prime Video, Netflix NFLX and Disney’s DIS Disney+.

Nevertheless, the growing popularity of Apple TV+ and services like Fitness+ have been beneficial for Apple’s Services business, which has become a major revenue-generating source in recent times.

The Services portfolio currently has more than 935 million paid subscribers and accounted for 17.7% of sales in the fiscal first quarter. Services revenues increased 6.4% from the year-ago quarter to $20.77 billion.

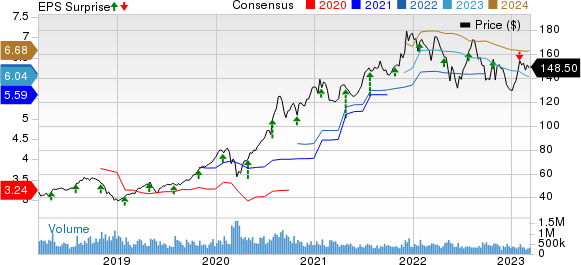

Apple Inc. Price, Consensus and EPS Surprise

Apple Inc. price-consensus-eps-surprise-chart | Apple Inc. Quote

For the fiscal second quarter, Services revenues are expected to grow year over year despite challenging macroeconomic conditions, as well as weakness in digital advertising and gaming.

Apple shares have outperformed the Zacks Computer and Technology sector in the past year. While AAPL shares have declined 1.4%, Netflix, Disney and Amazon shares have declined 11.5%, 27.4% and 36%, respectively.

Estimates on the Rise

The Zacks Consensus Estimate for Apple’s fiscal second-quarter earnings has increased by a penny to $1.44 over the past 30 days.

Apple expects the fiscal second quarter’s year-over-year revenue growth to be similar to that of the December (fiscal first) quarter due to unfavorable forex. In the previous quarter, net sales decreased 5.5% year over year to $117.15 billion. Unfavorable forex hurt revenues by more than 800 basis points.

For iPhone, Apple expects the March quarter’s year-over-year revenue growth to accelerate relative to the December quarter’s year-over-year revenue growth.

For Mac and iPad, this Zacks Rank #3 (Hold) company expects revenues to decline double digits on a year-over-year basis due to challenging comparison and macroeconomic headwinds. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance