Applied Industrial (AIT) Q3 Earnings Beat, Revenues Rise Y/Y

Applied Industrial Technologies AIT reported third-quarter fiscal 2024 (ended Mar 31, 2024) earnings of $2.48 per share, which surpassed the Zacks Consensus Estimate of $2.40. The bottom line jumped 4.2% year over year.

Net revenues of $1,146 million underperformed the consensus estimate of $1.148 million. The top line inched up 1.3% year over year. Acquisitions boosted the top line by 1.2% while foreign-currency translation had a positive impact of 0.2%. Organic sales increased 0.7% year over year. However, selling days had an adverse impact of 0.8% year over year in the quarter.

Segmental Discussion

The Service Center-Based Distribution segment’s revenues, which contributed 68.9% to net revenues, totaled $789.4 million in the quarter under review. On a year-over-year basis, the segment’s revenues increased 3.6%. Our estimate for segmental revenues was $789.8 million. Organic sales grew 2.6%. Foreign currency translation increased sales by 0.3% while acquisitions boosted sales by 1.5%. However, selling days had an adverse impact of 0.8% year over year. Segmental revenues were driven by benefits from sales process initiatives, solid growth across national accounts and strength in fluid power maintenance, repair and U.S operations.

The Engineered Solutions segment’s revenues (formerly Fluid Power & Flow Control segment), which contributed 31.1% to net revenues, totaled $357.0 million in the reported quarter. On a year-over-year basis, the segment’s revenues decreased 3.6%. Our estimate for the Engineered Solutions segment’s revenues in the fiscal third quarter was $377.8 million. Acquisitions boosted the top line by 0.4%. Organic sales decreased 3.2% due to reduced activity across the technology sector. However, selling days had an adverse impact of 0.8% year over year.

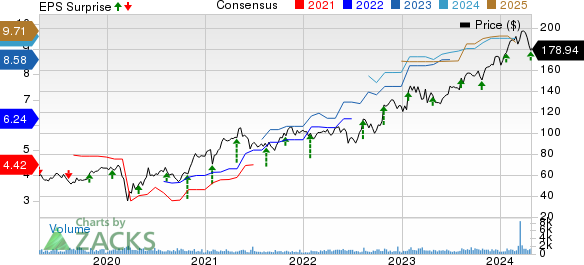

Applied Industrial Technologies, Inc. Price, Consensus and EPS Surprise

Applied Industrial Technologies, Inc. price-consensus-eps-surprise-chart | Applied Industrial Technologies, Inc. Quote

Margin Profile

In the reported quarter, Applied Industrial’s cost of sales increased 1.2% year over year to $808.1 million. Gross profit in the quarter increased 1.5% year over year to $338.2 million while the gross margin increased to 29.5% from 29.4% in the year-ago quarter. Selling, distribution and administrative expenses (including depreciation) climbed 5.3% year over year to $217.0 million. EBITDA was $135.7 million, suggesting a decrease of 2.5%.

Balance Sheet & Cash Flow

In the first nine months of fiscal 2024, Applied Industrial had cash and cash equivalents of $456.5 million compared with $344 million at the end of fiscal 2023. Long-term debt was $571.9 million compared with $596.9 million at the end of fiscal 2023.

At the end of the reported quarter, it generated net cash of $252.2 million from operating activities, indicating an increase of 53.7% from the year-ago period. Capital expenditures totaled $17.4 million, down 16.6% year over year. Free cash flow in the fiscal first nine months surged 64% year over year to $234.8 million.

In the first nine months of fiscal 2024, AIT, sporting a current Zacks Rank #1 (Strong Buy), rewarded shareholders with dividends of $41.5 million, up 4.3% year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dividend Update

Applied Industrial’s board approved a quarterly cash dividend of 37 cents per share, payable to shareholders on May 31 of record as of May 15, 2024.

Fiscal 2024 Guidance

For fiscal 2024 (ending June 2024), Applied Industrial anticipates adjusted earnings of $9.55-$9.70 per share compared with $9.35-$9.70 per share expected earlier.

The company predicts sales to increase 1.5-2.5% year over year compared with 1-3% rise anticipated earlier.

AIT expects an EBITDA margin of 12-12.1% for fiscal 2024. Previously, the same was expected in the range of 12.1-12.3%.

Performance of Other Industrial Companies

IDEX Corporation’s IEX first-quarter 2024 adjusted earnings of $1.88 per share surpassed the Zacks Consensus Estimate of $1.75. On a year-over-year basis, the bottom line decreased approximately 10.1%.

In the quarter under review, IDEX’s net sales of $800.5 million underperformed the consensus estimate of $805 million. The top line also decreased 5.3% year over year.

A. O. Smith Corporation’s AOS first-quarter 2024 adjusted earnings of $1.00 per share surpassed the Zacks Consensus Estimate of 99 cents. The bottom line increased 6% on a year-over-year basis.

Net sales of $978.8 million missed the consensus estimate of $995 million. However, the top line inched up 1% year over year, driven by strong demand for commercial water heaters in North America.

W.W. Grainger, Inc. GWW reported earnings per share of $9.62 in first-quarter 2024, beating the Zacks Consensus Estimate of $9.58. The bottom line improved 0.1% year over year.

Grainger’s quarterly revenues rose 3.5% year over year to $4.24 billion. The top line missed the consensus estimate of $4.27 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance