Arm Listing Set to Be Turning Point for IPO Market, SoftBank

(Bloomberg) -- Arm Ltd. is expected to unveil its filing for an initial public offering as soon as Monday, giving the market a peek at the chip designer’s financial health seven years after it was acquired by SoftBank Group Corp.

Most Read from Bloomberg

Powell Signals Fed Will Raise Rates If Needed, Keep Them High

NYC’s Most Exciting New Fine Dining Restaurant Is in a Subway Station

The IPO, planned for September, is on track to be the year’s largest and could be one of the biggest tech listings ever on a US exchange. While Bloomberg News reported Arm was aiming to be valued at $60 billion to $70 billion in an IPO raising $8 billion to $10 billion, that target could be lower since SoftBank has decided to hold onto more of the company after buying Vision Fund’s stake in it.

Arm won’t have to disclose the proposed size and price of the share sale until later filings with the US Securities and Exchange Commission.

The listing is set to be the largest in the US since electric-vehicle maker Rivian Automotive Inc.’s $13.7 billion offering in November 2021. An all-time high of $339 billion was raised in more than 1,000 IPOs that year before the window for new major listings was all but closed.

Arm’s debut could spur dozens of startups such as online grocery delivery company Instacart Inc. and marketing and data automation provider Klaviyo to follow through — or further delay — their own IPO plans.

Read more: Instacart Said to Plan for September IPO

It’s also the latest twist for Arm, which had a deal to be acquired by Nvidia Corp. that was called off last year after opposition from customers and regulators. The listing may lead to a payday for SoftBank, which is looking for a win after an expansion into startup investing that went awry. SoftBank isn’t ready to part ways with Arm just yet though, and will float only about 10% of the company’s stock, Bloomberg News has reported.

Revenue Fall

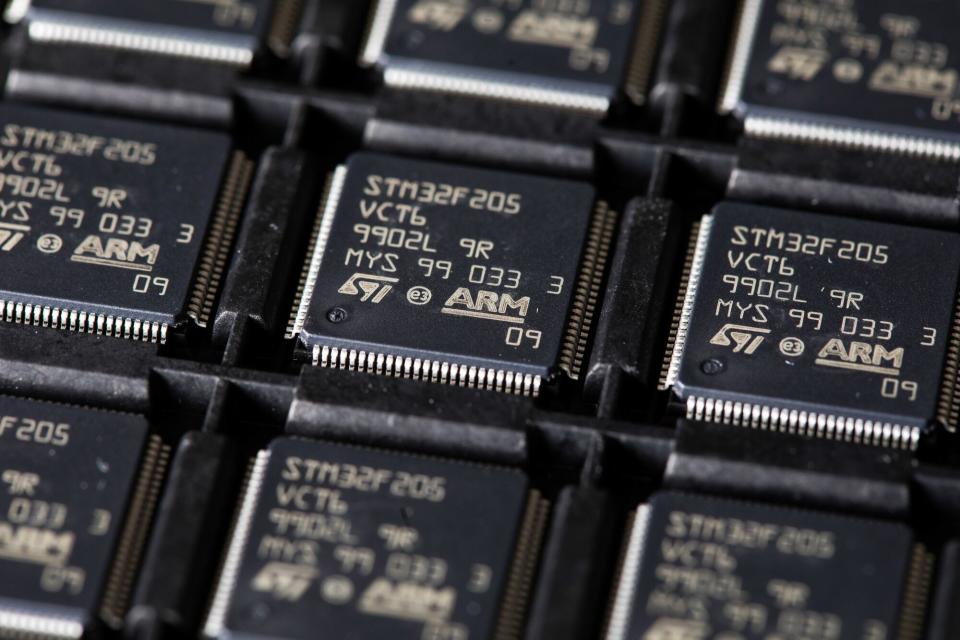

Arm sells the blueprints needed to design microprocessors, and licenses technology known as instruction sets that dictate how software programs communicate with those chips. The power efficiency of Arm’s technology helped make it ubiquitous in phones, where battery life is critical.

Potential investors will be scrutinizing how Cambridge, UK-based Arm plans to diversify beyond its mobile-chip designs, which are used by technology heavyweights such as Apple Inc. and Amazon.com Inc. Though Arm’s influence has steadily grown, the company faces a broader slump in chip demand. Draft documents show Arm’s annual revenue fell 1% in its last fiscal year.

Chief Executive Officer Rene Haas has been steering the company to sign up more customers that make chips for computers, servers and data centers, a more lucrative area than the mobile market.

The listing will be a welcome event for fee-starved investment bankers, whose commissions and bonuses have shrunk with the dearth of IPOs this year.

In what is the worst year for US IPOs at this point since the depths of the financial crisis in 2009, Johnson & Johnson spinoff Kenvue Inc. alone accounts for almost a third of the $14.4 billion raised by it and 109 other companies since Jan. 1, according to data complied by Bloomberg.

28 Banks

There are at least 28 banks signed onto Arm’s IPO, Bloomberg News has reported.

Arm’s listing is taking some cues from previous high-profile technology companies. In a twist reminiscent of Alibaba Group Holding Ltd.’s landmark $25 billion US IPO almost a decade ago, Arm won’t be using a “lead-left” bank and has decided to pay its top four underwriters equally.

The IPO will include several strategic investors, who will buy about $100 million of common stock each, according to people familiar with the matter. Though it involves smaller sums, that’s in the same vein as a 2012 deal in which ASML Holding NV brought in some of its biggest customers — Samsung Electronics Co., Intel Corp. and Taiwan Semiconductor Manufacturing Co. — as investors.

The lineup hasn’t been set, but customers and partners of Arm such as Intel, Nvidia and Amazon have all been candidates to invest, Bloomberg News has reported.

Under founder Masayoshi Son, SoftBank has invested more than $140 billion in unprofitable startups beginning in 2017, inflating valuations worldwide before they were punctured by the Covid pandemic, China’s tech crackdown and the US Federal Reserve’s rate hikes. Last year, its Vision Fund lost a record $30 billion.

READ MORE: How Arm Aims to Ride AI Wave to Year’s Biggest IPO: QuickTake

--With assistance from Ian King, Michael Hytha and Fion Li.

Most Read from Bloomberg Businessweek

Lyme Disease Has Exploded, and a New Vaccine Is (Almost) Here

Stock Pickers Never Had a Chance Against Hard Math of the Market

The Next Wave of Scams Will Be Deepfake Video Calls From Your Boss

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance