AssetMark (AMK) & Morningstar Wealth Form Strategic Alliance

AssetMark Financial Holdings Inc.’s AMK wholly-owned subsidiary AssetMark Inc. entered into a strategic coalition with Morningstar Wealth, a division of Morningstar Inc. MORN. The transaction, approved by the board of directors of both companies, is expected to be closed in the second half of 2024, subject to regulatory approvals.

AssetMark will acquire roughly $12 billion in assets from Morningstar Wealth Turnkey Asset Management Platform ("TAMP") as part of the alliance. AssetMark’s platform, which offers top-tier service, advisor technology, business consulting and a diligently selected group of investment strategists, will be accessible to financial advisors and clients on Morningstar Wealth’s TAMP.

Further, AssetMark’s financial advisors will gain access to a broad range of model portfolios and separately managed accounts managed by the investment management team of Morningstar, having more than $290 billion of assets under management and advisement worldwide. Morningstar Wealth will integrate into AMK’s platform as a third-party strategist and continue broadening its investment services range.

Michael Kim, CEO of AssetMark, said, “This relationship represents best-in-class firms strategically aligning to provide innovative solutions and high-quality service to financial advisors and their clients.”

Daniel Needham, president of Morningstar Wealth, said, “We are aligning our efforts with a clear vision to combine the strengths of our unique capabilities, enabling the advisors we support to serve investors more effectively.”

This move aligns with AMK’s organic growth strategy through competitive and diversified strategies. The company has been engaged in opportunistic buyouts as well.

AssetMark is a seasoned acquirer and integrator with a proven history of executing transactions that boost the value it offers to advisors and enable them to serve their clients holistically and efficiently. In 2022, it acquired Adhesion Wealth Advisor Solutions Inc., a prominent wealth management technology solutions provider, adding $6.9 billion in platform assets. In 2021, AMK acquired Voyant, Inc., a global provider of SaaS-based financial planning solutions, while in 2020, it acquired OBS Financial Services, Inc.

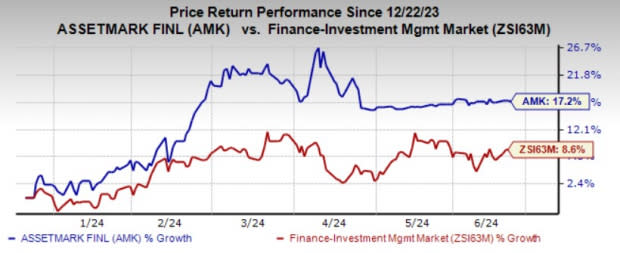

AssetMark’s shares have gained 17.2% in the past six months compared with the industry’s 8.6% growth.

Image Source: Zacks Investment Research

AMK presently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Financial Services Firms Taking Similar Steps

Earlier this month, Stifel Financial Corp. SF and Lord Abbett, LLC entered into a joint agreement to establish a leveraged lending joint venture — SBLA Private Credit. This new entity will concentrate on the origination and management of existing loans to small and mid-sized portfolio companies of financial sponsors, thus augmenting the existing capabilities of both firms.

SBLA Private Credit integrates two of the industry’s most established brands, offering extensive middle-market coverage and is known for its strategic growth and disciplined risk management. Through the combination of SF’s robust full-service platform and established direct lending proficiency with Lord Abbett’s solid leveraged credit presence and substantial capital base, SBLA Private Credit remains uniquely poised for success in the existing origination market.

Last month, T. Rowe Price Group, Inc. TROW announced a partnership with Ascensus to support its 529 business. This collaboration aims to strengthen the company’s commitment to enhancing the education savings journey for 529 account owners.

The partnership between TROW and Ascensus is set to improve the online platform and mobile experience for account holders. This collaboration will also ensure strong investment management while maintaining a high level of security that safeguards customers’ personal information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Stifel Financial Corporation (SF) : Free Stock Analysis Report

Morningstar, Inc. (MORN) : Free Stock Analysis Report

AssetMark Financial Holdings, Inc. (AMK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance