AstraZeneca's (AZN) Imfinzi Meets Study Goal in Bladder Cancer

AstraZeneca AZN announced positive results from the phase III NIAGARA study, which evaluated Imfinzi in patients with muscle-invasive bladder cancer (MIBC).

Study participants who were enrolled in the NIAGARA study were randomized to receive Imfinzi plus chemotherapy or chemotherapy alone before cystectomy (bladder removal surgery), followed by Imfinzi or no further treatment after surgery.

The study achieved statistically significant and clinically meaningful improvement in its primary endpoint of event-free survival (EFS) and the key secondary endpoint of overall survival (OS). Treatment with the Imfinzi-chemotherapy regimen improved survival and reduced the rate at which patients experience disease recurrence or progression. The safety profile of this combination was also safe and well-tolerated by study participants.

A type of bladder cancer, MBIC, occurs when cancer cells spread into or through the bladder wall's muscle layer. Management estimates that MBIC accounts for nearly 25% of all bladder cancer cases. Though the current standard of care (SoC) for MBIC patients includes neoadjuvant chemotherapy and radical cystectomy, nearly half of the patients who receive SoC still experience disease recurrence or progression.

However, AstraZeneca did not provide any numerical data supporting these results. Management intends to discuss the above results with regulatory authorities and also present the same at a future medical meeting.

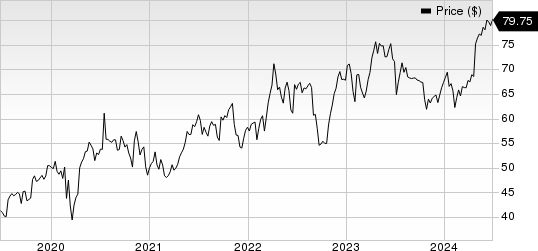

AstraZeneca’s shares have risen 18.4% year to date compared with the industry’s 23.2% growth.

Image Source: Zacks Investment Research

If approved, this will be the first approval for Imfinzi in the bladder cancer indication. The drug is approved for multiple cancer indications, including three in lung cancer, one in biliary tract cancer, and one in hepatocellular carcinoma (HCC). Earlier this month, the FDA approved a combination regimen of Imfinzi plus chemotherapy to treat adult patients with mismatch repair deficient (dMMR) advanced or recurrent endometrial cancer.

Imfinzi is a key revenue driver for AZN’s oncology portfolio, having generated sales worth $1.11 billion in the first quarter of 2024, up 33% year over year at constant exchange rates. The demand for the drug is being driven by increased use in recent launches like biliary tract and HCC cancers and rising patient demand across lung cancer indications.

The drug is also being studied for multiple cancer indications, either alone or in combination with other regimens, including phase III studies in earlier settings in lung cancer, early-stage gastric and gastroesophageal junction cancer and liver cancer, among others.

In a separate press release, AstraZeneca reported disappointing results from a late-stage study that was sponsored by the Canadian Cancer Trials Group (CCTG). This study, which evaluated Imfinzi in certain patients with early-stage (IB-IIIA) non-small cell lung cancer (NSCLC), failed to achieve statistical significance for the primary endpoint of disease-free survival (DFS).

AstraZeneca is focused on strengthening its oncology business strengthening its oncology product portfolio through label expansions of existing products and progressing oncology pipeline candidates. Oncology sales now comprise around 40% of AstraZeneca‘s total revenues and rose 17% in 2021, 19% in 2022 and 21% in 2023. This strong oncology performance was driven by medicines such as Tagrisso, Lynparza, Imfinzi, Calquence, and Enhertu (in partnership with Daiichi Sankyo). Management intends to develop a treatment for every form of cancer.

AstraZeneca PLC Price

AstraZeneca PLC price | AstraZeneca PLC Quote

Zacks Rank & Key Picks

AstraZeneca currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector are Arcutis Biotherapeutics ARQT, Heron Therapeutics HRTX, and Theravance Biopharma TBPH, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.22 to $1.60. During the same period, the loss estimates per share for 2025 have narrowed from $1.37 to $1.14. Year to date, shares of Arcutis have surged 197.2%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per sharehave narrowed from 24 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 8 cents to earnings of 1 cent. Year to date, HRTX’s shares have appreciated 79.4%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

In the past 60 days, estimates for Theravance Biopharma’s 2024 have improved from a loss of 39 cents per share to earnings of 6 cents. During the same period, earnings estimates for 2025 have risen from 26 cents to 85 cents. Year to date, TBPH’s shares have lost 25.3%.

Earnings of Theravance beat estimates in each of the last four quarters. TBPH delivered a four-quarter average earnings surprise of 84.10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance