ASX Growth Companies With High Insider Ownership In June 2024

In the past year, the Australian market has shown a robust increase of 8.9%, with expectations of earnings growing by 14% annually. Given this positive backdrop, growth companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Biome Australia (ASX:BIO) | 34.9% | 114.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 62.3% |

Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

We're going to check out a few of the best picks from our screener tool.

Botanix Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★★

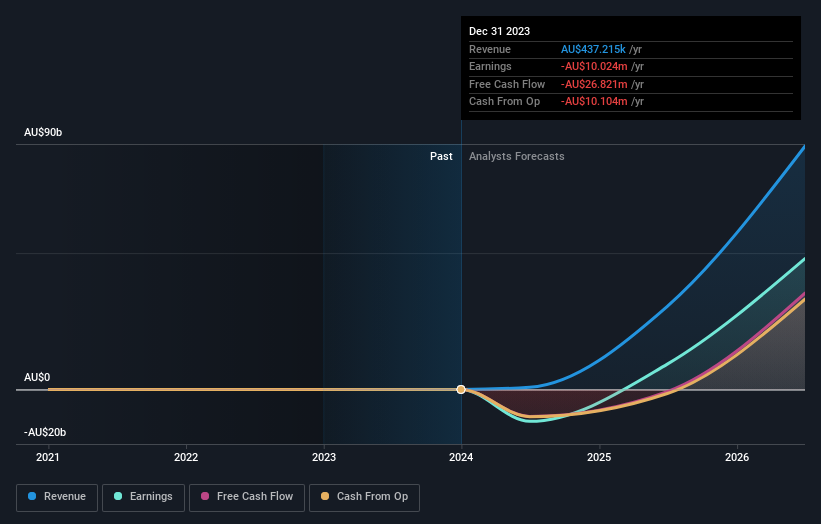

Overview: Botanix Pharmaceuticals Limited, based in Australia, focuses on the research and development of dermatology and antimicrobial products with a market capitalization of approximately A$574.93 million.

Operations: The company generates revenue primarily from its research and development activities in dermatology and antimicrobial products, totaling A$0.44 million.

Insider Ownership: 11.4%

Botanix Pharmaceuticals, despite its modest revenue of A$437K, is positioned for significant growth with expected annual revenue increases of 120.4% and profit projections turning positive within three years. The company's anticipated Return on Equity is very high at 43.9%. However, recent activities including a follow-on equity offering of A$70 million suggest some financial strain, as indicated by less than one year of cash runway and shareholder dilution over the past year.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally, with a market capitalization of approximately A$4.41 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel services, amounting to A$1.28 billion and A$1.06 billion respectively.

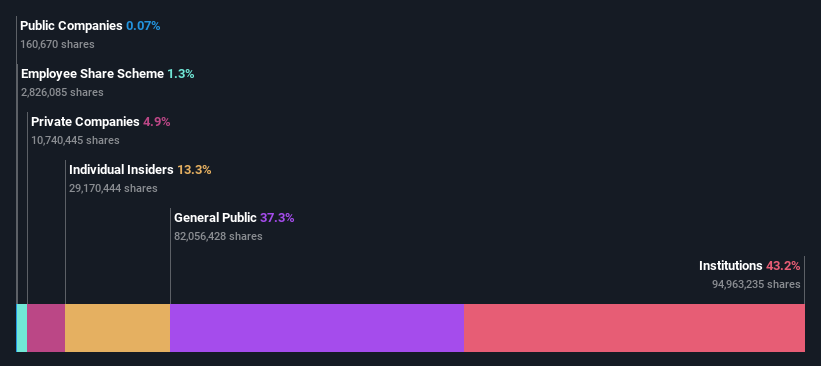

Insider Ownership: 13.3%

Flight Centre Travel Group has recently become profitable and is trading at 19% below its estimated fair value, highlighting potential undervaluation. The company's earnings are expected to grow by 18.81% annually, outpacing the Australian market's forecast of 13.6%. Additionally, revenue growth projections of 9.7% per year also exceed the national average of 5.4%. Despite these positive indicators, Flight Centre's insider ownership dynamics remain static with no significant buying or selling reported in the past three months.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of A$6.01 billion.

Operations: The revenue for Technology One is primarily derived from three segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Technology One, an Australian software firm, showcases strong insider ownership and robust growth metrics. Its earnings are projected to increase by 14.3% annually, surpassing the broader Australian market's growth rate of 13.6%. Additionally, its revenue is expected to grow at 11.1% per year, outpacing the national average of 5.4%. Despite a high Price-To-Earnings ratio of 54.8x compared to its industry average of 60.2x, the company has demonstrated solid profitability with significant recent increases in both revenue and net income as reported in its latest half-year results.

Taking Advantage

Click here to access our complete index of 90 Fast Growing ASX Companies With High Insider Ownership.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BOT ASX:FLT and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance