AtriCure Leads Three Undervalued Small Caps With Insider Actions In The United States

Despite a flat performance over the last week, the United States stock market has seen an impressive 24% increase over the past year with earnings expected to grow by 15% annually. In such a thriving environment, undervalued small-cap stocks like AtriCure, which show promising insider actions, could present intriguing opportunities for investors looking for potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Modiv Industrial | NA | 2.8x | 32.95% | ★★★★★☆ |

Columbus McKinnon | 21.9x | 1.0x | 40.91% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 28.39% | ★★★★★☆ |

AtriCure | NA | 2.7x | 42.89% | ★★★★★☆ |

Hanover Bancorp | 8.5x | 1.9x | 49.69% | ★★★★☆☆ |

Franklin Financial Services | 9.2x | 1.9x | 37.32% | ★★★★☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -163.41% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -148.91% | ★★★☆☆☆ |

Titan Machinery | 3.9x | 0.1x | -7.41% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

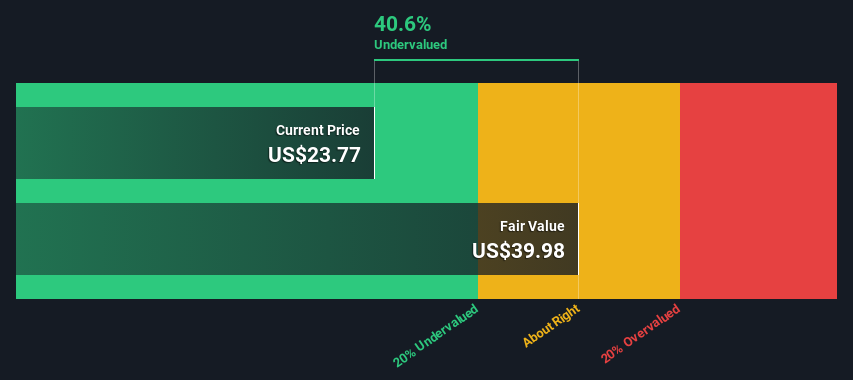

AtriCure

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure is a medical device company specializing in surgical and medical equipment, with a market capitalization of approximately $2.47 billion.

Operations: Surgical & Medical Equipment generated $414.60 million in revenue, with a gross profit margin of 75.26%. The company's net income was -$37.23 million, reflecting significant operating expenses of $348.26 million and research and development costs of $78.43 million during the most recent period reported.

PE: -29.8x

AtriCure, despite its unprofitability forecast for the next three years, shows promise with a projected annual revenue growth of 12.77%. Recently, the company has demonstrated insider confidence through share purchases, signaling strong belief in its future. Their latest product launch, cryoSPHERE+, enhances their cryoICE platform's efficiency and is expected to be fully available soon. With $108.85 million in Q1 sales reflecting a significant increase from the previous year and anticipated full-year revenues reaching up to $466 million, AtriCure’s strategic innovations seem poised to capture more market share in medical technology.

Unlock comprehensive insights into our analysis of AtriCure stock in this valuation report.

Assess AtriCure's past performance with our detailed historical performance reports.

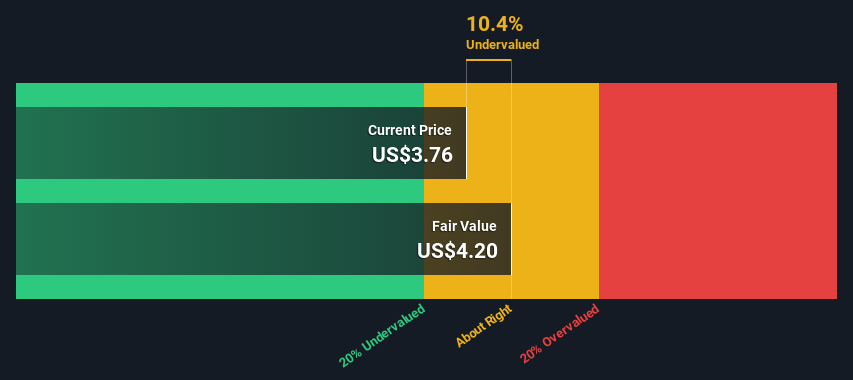

Petco Health and Wellness Company

Simply Wall St Value Rating: ★★★★☆☆

Overview: Petco Health and Wellness Company is a specialty retailer offering pet-related products and services, with a market capitalization of approximately $2.96 billion.

Operations: The company generates revenue primarily through its retail specialty segment, totaling $6.23 billion. Gross profit margin has shown a decreasing trend, moving from 43.37% in early 2019 to 37.38% by mid-2024, reflecting rising costs of goods sold which increased from approximately $2.49 billion to $3.90 billion over the same period.

PE: -0.8x

Petco Health and Wellness Company, amid leadership reshuffles and a volatile share price, remains intriguing for its potential growth. Recently, insiders demonstrated confidence by purchasing shares, signaling belief in the company's prospects despite a challenging quarter with a net loss of US$46.48 million. With expected revenue of US$1.525 billion for Q2 2024 and strategic executive appointments aimed at agility and profitability, Petco is navigating its transformation while reinforcing its market position in pet care.

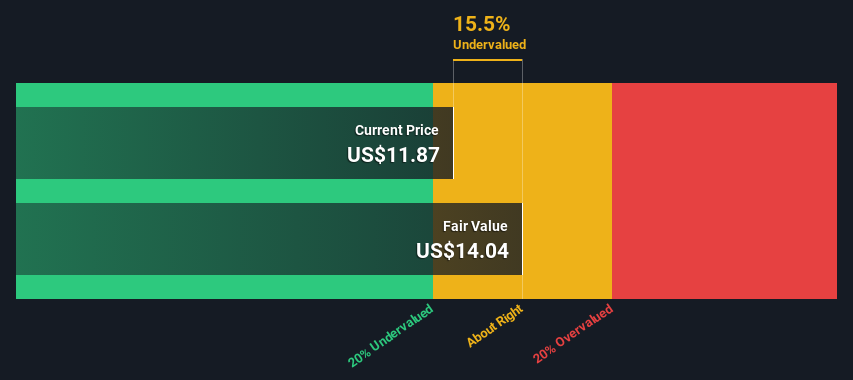

Leggett & Platt

Simply Wall St Value Rating: ★★★★☆☆

Overview: Leggett & Platt is a diversified manufacturer that designs and produces a variety of engineered components and products, including bedding components, automotive seat support systems, and furniture and flooring products, with a market capitalization of approximately $4.65 billion.

Operations: The company generates revenue primarily through three segments: Bedding Products ($1.91 billion), Specialized Products ($1.28 billion), and Furniture, Flooring & Textile Products ($1.46 billion). Gross profit margin has shown a trend of fluctuation, with recent figures around 17.83% in the latest quarter of 2024 from a high of around 24.47% in previous years, reflecting varying costs and operational efficiencies across different periods.

PE: -10.2x

Recently, Leggett & Platt has shown signs of being undervalued, with earnings projected to increase by 40.11% annually. Despite a recent drop from the S&P 400, they've been added to the S&P 600, reflecting a strategic shift. Insider confidence is evident as executives have recently purchased shares, signaling belief in the company's potential. Additionally, leadership stability is anticipated following Karl G. Glassman's reappointment as CEO, ensuring experienced oversight in navigating future growth avenues.

Dive into the specifics of Leggett & Platt here with our thorough valuation report.

Evaluate Leggett & Platt's historical performance by accessing our past performance report.

Taking Advantage

Navigate through the entire inventory of 60 Undervalued Small Caps With Insider Buying here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:ATRC NasdaqGS:WOOF and NYSE:LEG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance