AU Small Finance Bank And Two More Indian Growth Companies With High Insider Stakes

Amidst the ebbs and flows of political campaigns and voter turnout debates, India's stock market has shown resilience, reflecting investor confidence in the continuity of economic policies. In such a buoyant market environment, growth companies with high insider ownership can offer compelling insights into commitment and confidence from those who know the companies best.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 27.9% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Aether Industries (NSEI:AETHER) | 31.1% | 32% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35% |

Underneath we present a selection of stocks filtered out by our screen.

AU Small Finance Bank

Simply Wall St Growth Rating: ★★★★★☆

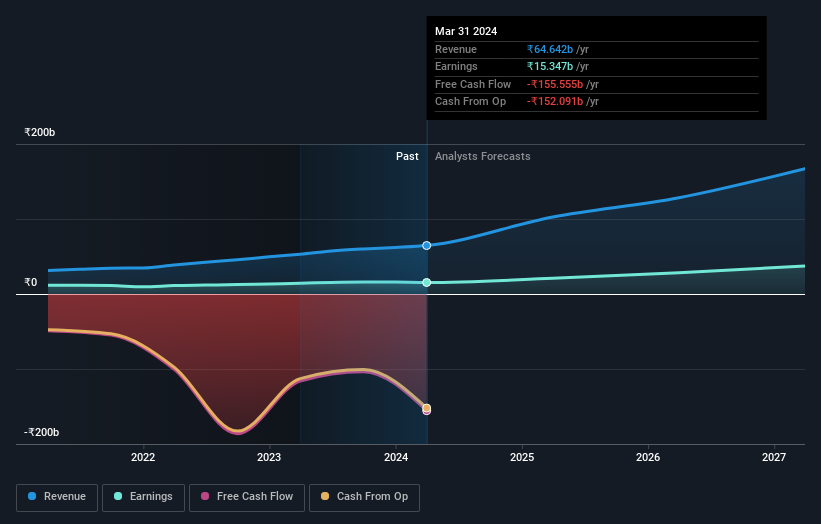

Overview: AU Small Finance Bank Limited offers a range of banking and financial services across India, with a market capitalization of approximately ₹485.21 billion.

Operations: The bank's revenue is primarily derived from three segments: Treasury (₹17.04 billion), Retail Banking (₹91.18 billion), and Wholesale Banking (₹11.61 billion).

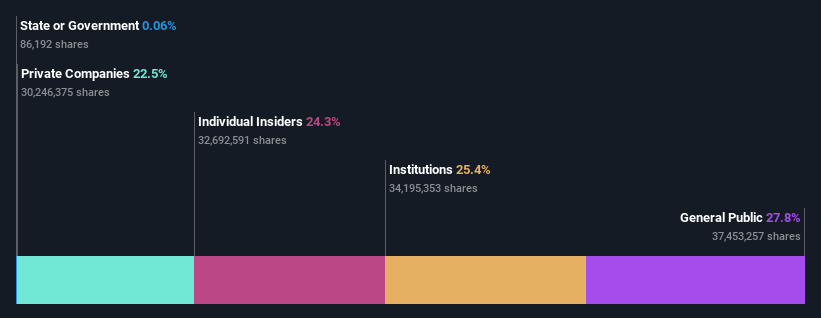

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.9% p.a.

AU Small Finance Bank is poised for significant growth, with earnings and revenue forecasted to increase by 24% and 24.9% per year respectively, outpacing the Indian market averages of 15.8% and 9.5%. Despite recent regulatory penalties totaling INR ₹5.091 million for various compliance issues, the bank has demonstrated proactive measures in training and adapting to guidelines. Insider activities have been minimal with no substantial buying or selling reported in recent months, reflecting a stable insider confidence level despite some shareholder dilution over the past year.

Jupiter Wagons

Simply Wall St Growth Rating: ★★★★★★

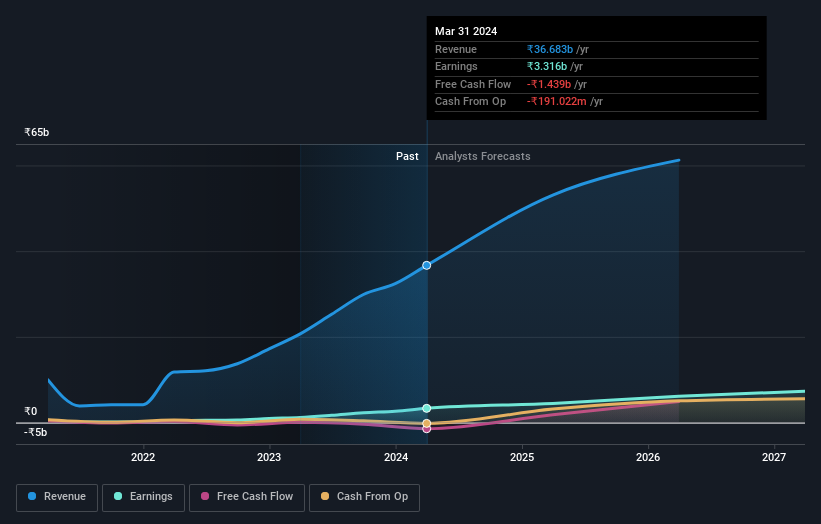

Overview: Jupiter Wagons Limited, with a market cap of ₹24.83 billion, is engaged in the manufacturing and international sale of mobility solutions.

Operations: The company generates ₹36.44 billion from its automotive manufacturing segment.

Insider Ownership: 11.1%

Revenue Growth Forecast: 21.6% p.a.

Jupiter Wagons Limited, an emerging name in the Indian railway sector, recently secured a substantial INR 9.57 billion contract for BOSM wagons, underscoring its robust market position and operational capabilities. Financially, the company has demonstrated impressive growth with a year-over-year revenue increase to INR 36.68 billion and net income rising to INR 3.32 billion. Despite high volatility in share prices and some shareholder dilution over the past year, Jupiter Wagons is expected to sustain significant annual profit growth of 27.2% and revenue growth of 21.6%, both outstripping broader market averages.

Titagarh Rail Systems

Simply Wall St Growth Rating: ★★★★★☆

Overview: Titagarh Rail Systems Limited is engaged in the manufacturing and selling of freight and passenger rail systems both in India and globally, with a market capitalization of approximately ₹190.66 billion.

Operations: The company generates ₹34.18 billion from its freight rail systems, including shipbuilding, bridges, and defense, and ₹4.36 billion from passenger rail systems.

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.2% p.a.

Titagarh Rail Systems Limited, a key contender in India's rail sector, has shown impressive financial performance with a substantial increase in annual revenue to INR 38.93 billion and net income rising to INR 2.86 billion, reflecting a strong year-over-year growth. Despite some shareholder dilution and low insider buying recently, the company is poised for significant earnings growth at an expected rate of 28.8% annually over the next three years, outperforming broader market projections. Additionally, recent leadership enhancements signal strategic positioning for continued expansion.

Make It Happen

Reveal the 79 hidden gems among our Fast Growing Indian Companies With High Insider Ownership screener with a single click here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:AUBANKNSEI:JWL and NSEI:TITAGARH

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance