Auto Roundup: GM's Buyback Boost, LAD's Buyout Binge & More

Last week, the China Passenger Car Association released vehicle sales data for May. China's retail sales of passenger vehicles were down 1.9% year over year to 1.7 million units, but 11.4% higher than in April. Retail sales of passenger vehicles in the first five months of 2024 increased 5.7% year over year to 8.07 million units. Sales of new energy vehicles in the country surged 38.5% last month to 804,000 units.

On the news front, U.S. auto giant General Motors GM provided various updates including a new authorization of stock buyback and investment in Cruise business. One of the leading US auto retailers, Lithia Motors LAD, continued with its buyout binge and forayed into the Memphis market. Japanese auto biggie Honda HMC entered into a JV with Mitsubishi to reduce EV ownership costs and develop power-supply operations for long-term battery use. Italian-American automaker Stellantis STLA held its investor day and reaffirmed its 2024 outlook.

While HMC holds a Zacks Rank #2 (Buy), GM and STLA currently carry a Zacks Rank #3 (Hold) each. Meanwhile, LAD is Ranked #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Last Week’s Top Stories

General Motors approved a new $6 billion stock repurchase authorization. This follows the $10 billion in accelerated share repurchase program announced in November 2023, which is expected to be completed by the end of this month. In a separate development, the company is investing $850 million into Cruise to cover operational costs after shutting down its robotaxi service following a pedestrian accident. The investment will support Cruise as it resumes autonomous vehicle testing in several U.S. cities. Cruise is also seeking new external investors. In yet another update, GM’s joint venture facility in Ohio struck a tentative local agreement with United Auto Workers.

Lithia has expanded its presence in the U.S. Southeast Region by acquiring Sunrise Chevrolet Buick GMC at Collierville and Sunrise Buick GMC at Wolfchase in Memphis, TN, and Woodbridge Hyundai in the greater Toronto area. These new acquisitions are expected to generate more than $240 million in annualized revenues. The prominent Sunrise stores in Tennessee represent LAD's entry into the Memphis market, enhancing its footprint in one of the country's most lucrative regions. The acquisition increases LAD's total expected annualized revenues acquired this year to more than $5.6 billion. The purchases were financed through existing on-balance sheet resources.

Honda and Mitsubishi are set to form a 50/50 joint venture (JV), ALTNA Co., Ltd., in July 2024. The JV is aimed at advancing EV implementation and decarbonization. Combining Honda's EV and battery technologies with Mitsubishi's power-generation expertise, ALTNA will offer mobility services to reduce EV ownership costs and develop power-supply operations for long-term battery use. In another development, Honda has partnered with Emporia, a leader in energy management technology, to innovate in-home energy management. This collaboration includes a strategic investment by Honda in Emporia and a joint development agreement in North America focusing on smart EV charging and home energy management.

Stellantis held its investor day, wherein CEO Carlos Tavares highlighted the company’s unique differentiators that position it strongly amid industry disruptions. STLA’s multi-energy approach spans products, platforms and supply chains, enabling it to adapt to various electrification scenarios. The company reaffirmed its 2024 financial guidance. CFO Natalie Knight emphasized double-digit adjusted operating income margins and positive industrial free cash flows despite short-term headwinds. Stellantis plans to return at least €7.7 billion to shareholders through dividends and buybacks in 2024, highlighting its robust capital return strategy.

Price Performance

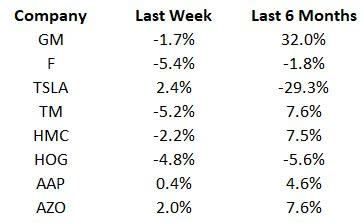

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on May new car registration data to be released by the European Automobile Manufacturers Association.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance