Avery Dennison (AVY) to Report Q3 Earnings: What's in Store?

Avery Dennison Corporation AVY is scheduled to report third-quarter 2023 results before the opening bell on Oct 25.

Q3 Estimates

The Zacks Consensus Estimate for third-quarter total sales is pegged at $2.13 billion, suggesting a decline of 8.3% from the prior-year quarter’s reported figure. The consensus mark for the company’s earnings per share is pinned at $2.08, indicating a year-over-year decrease of 15.4%. Earnings estimates have been unchanged in the past 60 days.

Avery Dennison Corporation Price and EPS Surprise

Avery Dennison Corporation price-eps-surprise | Avery Dennison Corporation Quote

Q2 Performance

Avery Dennison’s revenues and earnings declined year over year in the second quarter of 2023. The bottom and top lines missed the Zacks Consensus Estimate. AVY has a trailing four-quarter negative earnings surprise of 6.4%, on average.

Factors at Play

Avery Dennison has been witnessing solid demand for the labeling of non-durable consumer goods like food, beverage, home and personal care products. However, the ongoing inventory reduction for apparel is expected to have negated these gains on the company's top line. Also, supply constraints, and elevated raw material, labor and freight costs are expected to have impacted margins in the quarter under review.

Nonetheless, Avery Dennison has been executing several pricing and re-engineering actions to mitigate inflationary cost pressure. It has also announced additional price increases in most of its businesses worldwide.

However, in the first quarter of 2023, apparel inventory reductions were widespread across all segments, which led to a decline in volumes. The destocking is likely to have continued in the Materials Group segment in the third quarter as retailers work through their high inventories. Our model predicts Materials Group’s organic sales to be down 8.8% year over year in the quarter.

The Solutions Group segment is likely to have benefited from solid margin expansions, driven by strength in high-value categories and the base business. However, cost and supply-chain headwinds are expected to have offset the benefits in the second quarter. We expect the segment’s organic sales to be down 5.7% year over year in the third quarter.

Currency translation is also likely to have hurt the company’s top-line growth in the quarter. We expect a 1.1% headwind from unfavorable currency translation in the third quarter of 2023.

What the Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for Avery Dennison this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, but that is not the case here.

You can uncover the best stocks before they're reported with our Earnings ESP Filter.

Earnings ESP: Avery Dennison has an Earnings ESP of 0.00%.

Zacks Rank: Avery Dennison currently carries a Zacks Rank of 3.

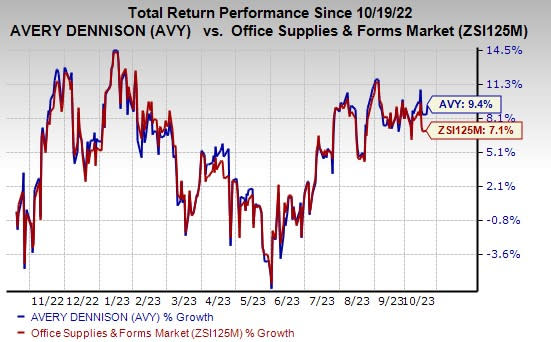

Price Performance

Avery Dennison’s shares have gained 9.4% in the past year compared with the industry’s growth of 7.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

ESAB Corporation ESAB, scheduled to release earnings on Nov 1, has an Earnings ESP of +0.81% and sports a Zacks Rank of 1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ESAB’s third-quarter earnings is pegged at 92 cents per share. Earnings estimates have been unchanged in the past 60 days. It has an average trailing four-quarter earnings surprise of 13.6%.

H&E Equipment Services, Inc. HEES, expected to release earnings on Oct 10, has an Earnings ESP of +14.79% and a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for HEES’ earnings for the third quarter is pegged at $1.31 per share. The consensus estimate for 2023 earnings has moved 8% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 24.1%.

Ingersoll Rand Inc. IR, expected to release earnings on Nov 1, has an Earnings ESP of +1.00%. IR currently carries a Zacks Rank of 3.

The consensus estimate for Ingersoll Rand’s earnings for the third quarter is pegged at 70 cents per share. Earnings estimates have been unchanged in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

ESAB Corporation (ESAB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance