Avidity (RNA) Up 33% on Rare Muscle Disease Study Results

Avidity Biosciences RNA announced encouraging initial data from the phase I/II FORTITUDE study evaluating two doses of delpacibart braxlosiran (del-brax, or formerly AOC 1020) in facioscapulohumeral muscular dystrophy (FSHD), a rare genetic disease of the muscles.

Data from the study showed that treatment with 2mg/kg dose of del-brax achieved greater than 50% mean reductions in DUX4 regulated genes for 12 patients at the four-month timepoint. The early data also showed trends of improving muscle strength and function in patients treated with this dosage.

Though Aviditydid not reveal the details of patients who received a 4mg/kg dose of del-brax, it stated that all participants who received the drug achieved reductions greater than 20% in DUX4 regulated genes. Treatment with del-brax also exhibited a favorable safety and tolerability profile, with no serious adverse events and no discontinuations.

Based on the above results, management now plans to accelerate the initiation of registrational cohorts in the FORTITUDE study.

Shares of RNA were up 32.6% on Wednesday as investors cheered the results. The results show the potential of del-brax to address the underlying cause of FHSD, which is the abnormal expression of the DUX4 gene. Currently, there are no approved therapies for FHSD.

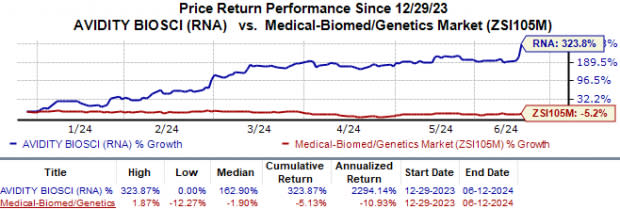

Year to date, Avidity Biosciences’ shares have skyrocketed 323.9% against the industry’s 5.1% fall.

Image Source: Zacks Investment Research

The above data will also be presented at the Annual FSHD Society International Research Congress, which is being held this week on Jun 13-14 in Colorado.

Detailed data from the FORTITUDE study could be expected next year. Per a government website, the primary completion of this study is expected in September 2025.

FHSD is a rare muscle-weakening condition marked by the life-long, relentless loss of muscle function, significant pain, fatigue and progressive disability. If approved, del-brax could cater to patients “who are desperately waiting for a treatment.” The FDA previously granted orphan drug and fast-track designations to del-brax in FHSD indication.

Avidity Biosciences, Inc. Price

Avidity Biosciences, Inc. price | Avidity Biosciences, Inc. Quote

Zacks Rank & Key Picks

Avidity Biosciences currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Arcutis Biotherapeutics ARQT, Marinus Pharmaceuticals MRNS and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have narrowed from $1.77 to $1.14. Year to date, shares of Arcutis have surged 150.8%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have improved from $2.43 to $1.87. During the same period, loss estimates for 2025 have narrowed from $1.97 to 90 cents.

Earnings of Marinus Pharmaceuticals beat estimates in two of the last four quarters and met the mark on one occasion while missing the mark on another. Marinus registered a four-quarter average earnings surprise of 3.27%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per sharehave narrowed from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, HRTX’s shares have appreciated 115.3%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avidity Biosciences, Inc. (RNA) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance