Aviva’s share price is tipped to rise 17%! Time to buy?

The Aviva (LSE:AV.) share price has enjoyed some impressive gains as hopes of interest rate cuts have risen. At 491.2p per share, the FTSE 100 life insurer is now up 13% since the beginning of 2024.

UK share prices in general have soared sharply, raising fears of a bubble. Higher-than-forecast inflation and economic uncertainty mean that some believe recent price gains are hard to justify.

But City analysts don’t believe Aviva’s share price is about to come crashing down. Instead, they predict that it will continue rising.

Fifteen analysts currently have ratings on Aviva shares. And the average 12-month price target among them stands at 510p per share. That suggests a rise of 4% from current levels.

Some number crunchers are even more optimistic. The highest price target is 575p, which represents a whopping 17% premium to recent levels.

But how realistic are such predictions? And should I buy Aviva shares today?

Good trading numbers

While conditions remain tough in its core markets, Aviva continues to perform robustly, as latest trading numbers this week show. If this continues, further share price gains could well be on the cards.

General Insurance gross written premiums (GWPs) at Aviva rose 16% in the first quarter, to £2.7bn, thanks to positive pricing initiatives and new business growth. In the UK and Canada, GWPs increased 19% and 11%, respectively.

Strong demand for its protection products drove Protection and Health sales 5%. Meanwhile, higher bulk purchase annuity (BPA) volumes pushed turnover at its Retirement division 19% higher.

Finally, Aviva’s asset management division also continued to perform well. Wealth net flows rose 15% year on year, to £2.7bn.

In great shape

I wasn’t surprised by the strength of the firm’s latest update.

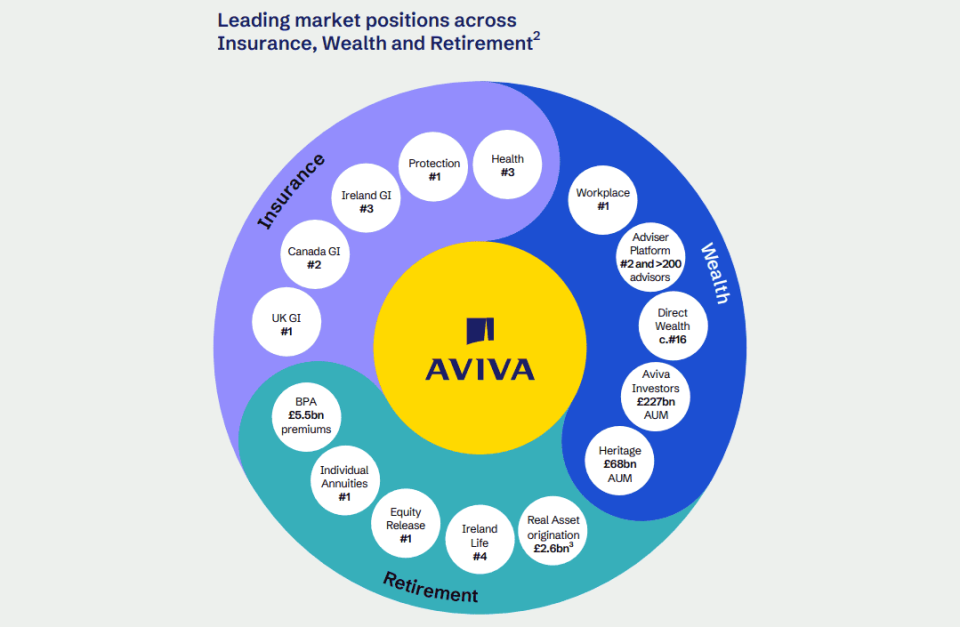

Yes, consumers have less money to play around with at the moment. But Aviva’s a market leader across multiple product categories, as the graphic above shows. It has the brand power to perform robustly, even when the broader industry is struggling.

I believe the business is in good shape to continue growing revenues, too. The insurance, wealth, and retirement segments are tipped for steady growth thanks to demographic changes (i.e., a rapidly ageing population).

On top of this, Aviva’s drive to digitalise its operations is also paying off handsomely. Its AI-driven pensions tracing service, Fabric, reported a 50%-plus increase in transfer inflows in 2023.

Too cheap to ignore

But can Aviva’s share price continue rising over the next year, or is the good news priced in?

An uncertain economic outlook and interest rate environment could also hamper near-term price growth. Still, I think the cheapness of Aviva’s shares leaves plenty of scope for it to continue rising.

On the one hand, they now trade on a forward price-to-earnings (P/E) ratio of 11.7 times. This is slightly above the FTSE 100 average of 11 times.

But they also deal on a corresponding price-to-earnings growth (PEG) ratio of 0.8. Any sub-1 reading suggests that a stock is undervalued.

Finally, Aviva’s 7.2% forward yield also illustrates brilliant value for money. The Footsie equivalent sits below half this level, at 3.5%.

With the company looking so cheap — and looking good to continue growing profits over the long term — I think it’s a top stock to seriously consider today.

The post Aviva’s share price is tipped to rise 17%! Time to buy? appeared first on The Motley Fool UK.

More reading

Royston Wild has positions in Aviva Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance