£17,773 to invest? These 2 FTSE 100 shares could provide a £1,457 passive income!

The average person in the UK has savings of £17,773, according to consumer finance website Finder. This sort of lump sum could make me healthy passive income if I invested it wisely in FTSE 100 shares.

Buying stocks with high dividend yields can be exhilarating. The thought of large income flows that I can use to buy things or to reinvest is naturally very attractive.

But many investors fall into a trap by focusing too much on yield. Many large dividends today are unsustainable, and over the long term, high-yielding shares can deliver disappointing returns.

A £1,457 passive income

However, I think I’ve found two high-dividend shares that could deliver a stunning second income for years to come. And for this year, a £1,457 investment spread equally among them could provide me with a stunning £1,457 passive income, if City forecasts prove accurate.

Their identity, and their huge dividend yields, can be seen in the table below.

FTSE 100 stock | Forward dividend yield |

|---|---|

Legal & General Group (LSE:LGEN) | 9.2% |

Aviva (LSE:AV.) | 7.2% |

Legal & General is a share I’ve actually piled into following recent share price falls. It’s now my second-largest holding, and one I expect to deliver a huge passive income for years to come.

The financial services giant is a cash machine, with a Solvency II capital ratio of 224%, one of the best in the business. In recent days, it vowed to continue raising the annual dividend through to 2027, too.

Except for during the pandemic (when it froze dividends), payouts from Legal & General shares have risen every year since the 2008 financial crisis. I think it has an enormous opportunity to keep this proud record going as demographic changes drive demand for wealth and retirement products.

Remember that dividends are never guaranteed, though. And a failure to keep up with the competition could harm future payouts.

Another top FTSE stock

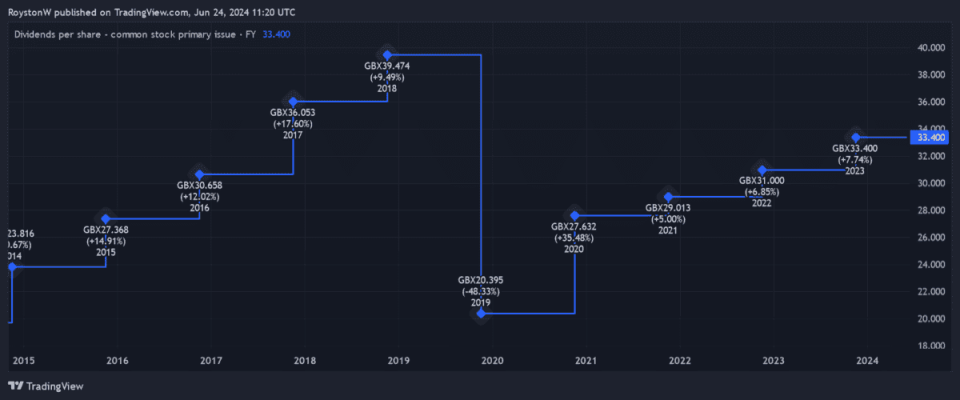

Aviva also has a largely solid record of dividend growth over the past decade, as seen below. This reflects the steps it’s undertaken to improve the balance sheet, namely through cost efficiencies and asset sales.

With a Solvency II ratio of 204%, it also looks in good shape to continue growing dividends. And like Legal & General, it operates in a market with significant scope for structural growth as the number of elderly people in its markets steadily rises.

In Aviva’s core UK market, for instance, the number of 65-to-79 year olds is tipped to rise 30% over the next 40 years. Meanwhile, the number of over 80s is predicted to double. That’s according to the Center for Ageing Better.

Don’t get me wrong. The near-term outlook for these two UK shares remains uncertain given the current level of interest rates. If consumers continue to feel the pinch, demand for discretionary financial services could remain under pressure.

But these companies still have significant financial strength to continue paying a large and growing dividends. And I expect both to also increase earnings strongly over the long term.

The post £17,773 to invest? These 2 FTSE 100 shares could provide a £1,457 passive income! appeared first on The Motley Fool UK.

More reading

Royston Wild has positions in Aviva Plc and Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance