AZUL September Passenger Traffic Increases From 2022 Levels

Azul S.A. AZUL reported double-digit year-over-year increases in traffic and capacity for September 2023.

In September, the Brazilian carrier’s consolidated revenue passenger kilometers (a measure of air traffic) and available seat kilometers (a measure of capacity) increased 18.7% and 15%, respectively, on a year-over-year basis. With consolidated passenger traffic growth outpacing capacity expansion, the load factor (the percentage of seats filled by passengers) improved to 81.7% from 79.1% in September 2022.

On the domestic front, with revenue passenger kilometers (10.6%) outpacing available seat kilometers (7.4%), the load factor increased to 79.4% from 77.1% in September 2022.

Internationally, revenue passenger kilometers and available seat kilometers increased 51.1% and 49.7%, respectively, on a year-over-year basis. The load factor increased to 89.1% from 88.3% in September 2022.

Azul’s chief executive officer, John Rodgerson, stated, “In September we continued to demonstrate our ability to match capacity with demand, which allows us to maintain sustainable load factors and record RASK. We expect these positive trends to continue into our peak summer season.”

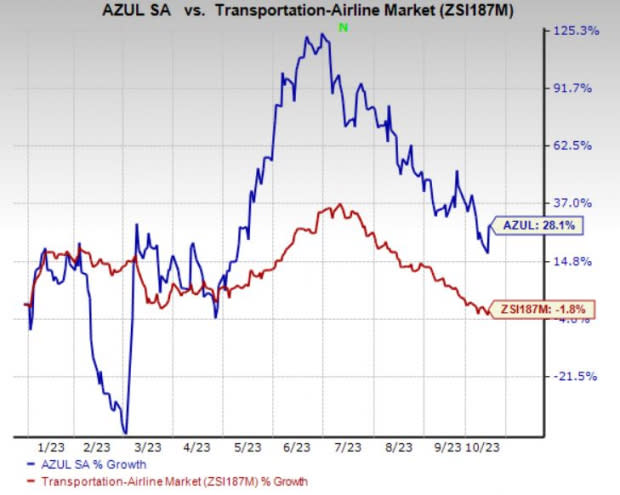

Impressive air traffic has led to a 28.1% year-to-date appreciation in the AZUL stock. This northward movement compares favorably with the 1.8% decline recorded by the Zacks Airline industry in the same time frame.

Image Source: Zacks Investment Research

Azul currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Given the buoyant traffic scenario, Azul is not the only airline to report impressive traffic numbers for September. Driven by high passenger volumes, Copa Holdings, S.A. CPA revenue passenger miles (a measure of traffic) rose in double digits in September on a year-over-year basis. To match the demand swell, CPA is increasing its capacity. In September, available seat miles (a measure of capacity) increased 13.6% year over year. Revenue passenger miles increased 14.1%. With traffic growth outpacing capacity expansion, the load factor (percentage of seats filled by passengers) improved to 87.3% from 86.9% in September 2022.

Gol Linhas Aereas Inteligentes S.A. (GOL) recently reported a double-digit year-over-year increase in traffic and capacity for September 2023.

In September, consolidated revenue passenger kilometers (a measure of air traffic) and available seat kilometers (a measure of capacity) increased 6.7% and 4.7%, respectively, on a year-over-year basis. With traffic growth outpacing capacity expansion, the load factor (percentage of seats filled by passengers) for September 2023 improved to 83.3% from 81.7% in September 2022. The number of flight departures at GOL in September registered an 11.2% year-over-year increase. Consolidated passengers on board rose 14.1% year over year.

On the domestic front, with revenue passenger kilometers (8.4%) outpacing available seat kilometers (6.1%), the load factor increased to 83.4% from 81.7% in September 2022.

Internationally also, the load factor increased to 82.2% from 82.0% in September 2022.

Ryanair HoldingsRYAAY, a European carrier, also reported impressive traffic numbers for September 2023, driven by upbeat air-travel demand. The number of passengers ferried on RYAAY flights in September was 17.4 million, implying that 9% more passengers flew than a year ago. The load factor (percentage of seats filled by passengers) was high at 94% in September 2023. The reading was similar in the year-ago period. RYAAY operated more than 97,350 flights in September 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

AZUL (AZUL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance