Baillie Gifford was just the first: Climate protests are coming for asset managers

While the saga of Baillie Gifford and book festivals seems to have finally petered out, the fight between City asset managers and climate protesters is only just beginning.

What began last year with Greta Thunberg pulling out of Edinburgh Book Festival due to Baillie Gifford’s investment in fossil fuels is now spreading further across the industry.

Pressure groups are ramping up their focus on asset managers to divest from fossil fuel companies, staging protests and campaigns against anyone with money in polluting stocks.

Abrdn was the movement’s most recent target on Thursday, with protesters waiting outside the asset manager’s office, along with billboards in Edinburgh.

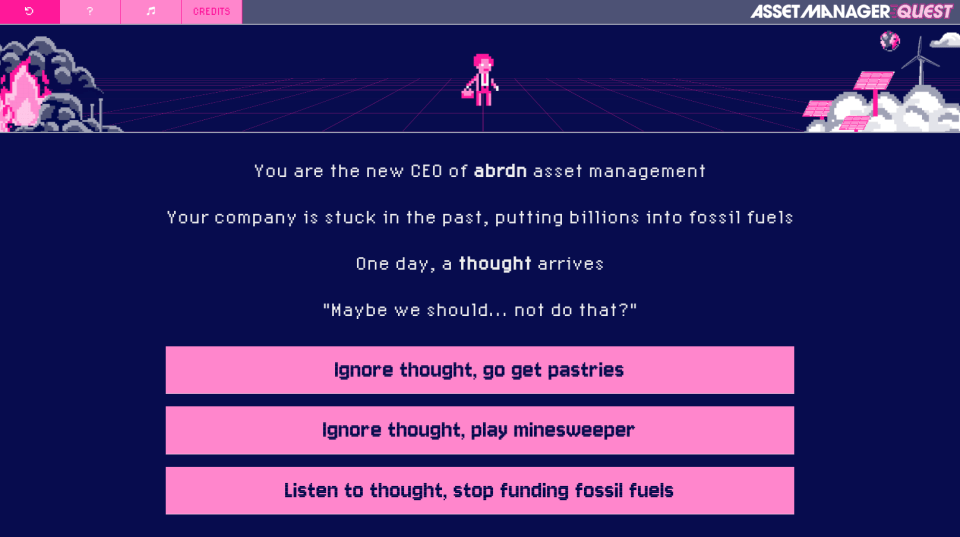

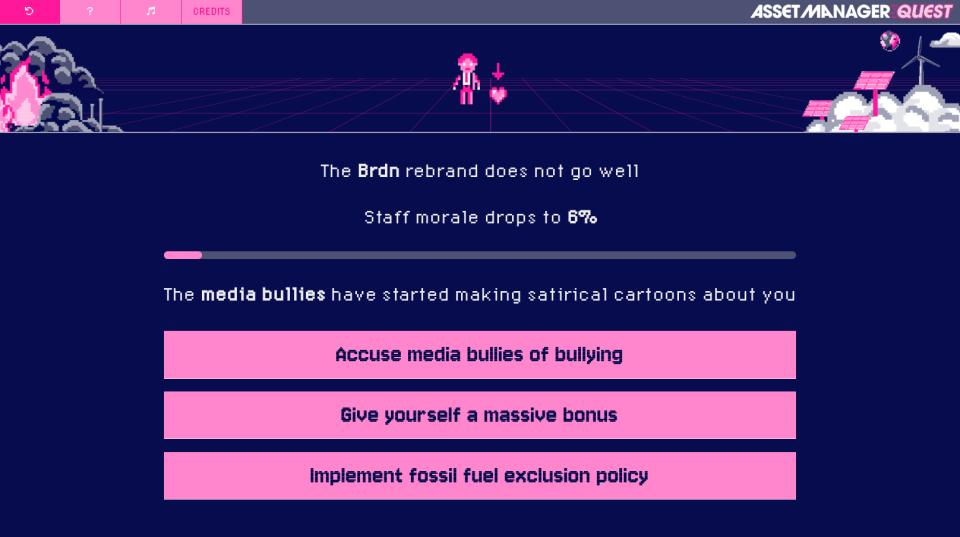

The protesters chose an unusual tactic to target Abrdn, creating a role-playing video game where the company’s CEO must decide whether or not to divest from fossil fuels.

“Abrdn is stuck in the past, pumping billions into fossil fuel companies while the planet heats up,” argued Jamie Inman, founder of the protest group ‘Serious People’.

“Abrdn are toying with our future, so we thought we would play with theirs. Having tried every turnaround plan except this one, it’s time for Abrdn’s chair and board to take a bold leap into the future and walk away from fossil fuel bonds.”

The group’s annual general meeting was also interrupted by climate protesters in April.

An Abrdn spokesperson said: “At Abrdn, we are committed to driving the change required to reach net zero targets. This means decarbonising portfolios where we have the discretion to do so; actively engaging with the highest financed emitters; actively developing net zero solutions and engaging with clients to ensure they understand the work we are doing.

“As a responsible investor, we work with our clients to determine whether it is appropriate to impose targets and restrictions on their portfolios. We offer a variety of funds and investments for clients who wish to invest in line with specific sustainable criteria. Where clients mandate, we will mitigate exposure to coal and fossil fuels.”

Screenshots from the video game targeted at Abrdn

Abrdn is not the only asset manager being targeted, and the movement is now international. Last month, hundreds of climate activists broke into the offices of French asset manager Amundi to denounce its holding in oil major Totalenergies.

American asset managers haven’t escaped scrutiny either, with constant protests raging outside of Vanguard’s offices.

Asset managers are going to have to get used to this new normal: If you invest in fossil fuels, in any capacity, you will have protesters at your doors soon.

The protests mirror those done by climate groups like Extinction Rebellion, which have targeted insurers and other financial institutions it sees as being in league with fossil fuel companies.

It feels like the City is sick of these protests, but it appears they’re only going to ramp up, no matter the institution.

The Baillie Gifford boycotts came under fire for targeting the asset manager despite investing only two per cent of its cash in fossil fuel companies, well below the industry average.

If companies like Baillie Gifford, which invest comparatively little in fossil fuels, are coming under such harsh criticism, what’s next for the largest investors in fossil fuels, like Legal & General?

Yahoo Finance

Yahoo Finance