The Baldwin Insurance Group Inc (BRP) Q1 Earnings: Adjusted EPS Outperforms Amidst Strong ...

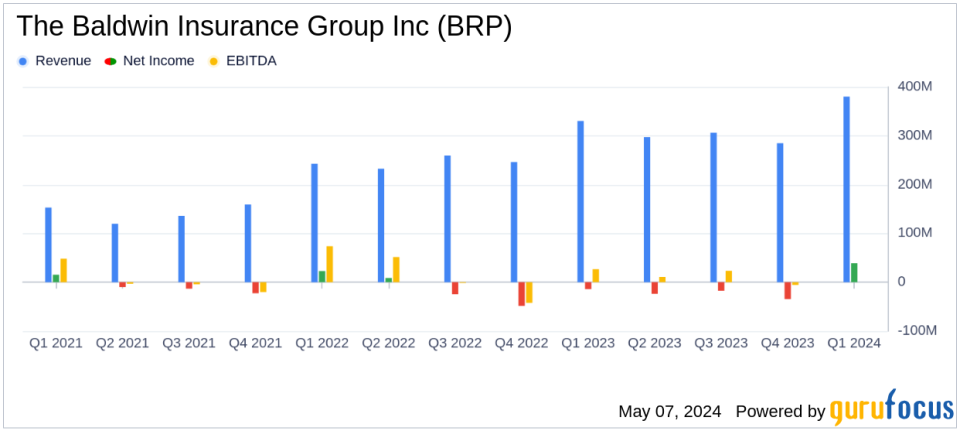

Revenue: Reported at $380.4 million, a 15% increase year-over-year, surpassing the estimate of $375.77 million.

Net Income: Posted at $39.1 million, significantly below the estimated $62.01 million.

Earnings Per Share (EPS): Reported GAAP EPS of $0.33, falling short of the estimated $0.52.

Adjusted EBITDA: Grew 29% year-over-year to $101.7 million, with an EBITDA margin expansion of 280 basis points to 27%.

Free Cash Flow: Increased by 51% year-over-year to $53.3 million.

Organic Revenue Growth: Achieved a 16% increase, indicating strong underlying business performance.

On May 7, 2024, The Baldwin Insurance Group Inc (NASDAQ:BRP), a leading U.S.-based insurance distribution firm, announced its financial results for the first quarter of 2024. The company, which recently rebranded from BRP Group, Inc. to The Baldwin Group, disclosed these figures in its 8-K filing. The Baldwin Insurance Group operates across various segments, including Business Insurance, Benefits Consulting, and Personal Insurance, providing tailored solutions to a broad client base.

Financial Highlights and Performance Metrics

The first quarter saw The Baldwin Insurance Group achieve a total revenue of $380.4 million, marking a 15% increase year-over-year, and surpassing the estimated revenue of $375.77 million. This growth was significantly driven by an organic revenue increase of 16%. However, the GAAP net income stood at $39.1 million with a diluted earnings per share (EPS) of $0.33, which did not meet the analyst's EPS expectation of $0.52.

Adjusted for non-GAAP measures, the diluted EPS was $0.56, reflecting a 33% growth from the previous year, and surpassing the estimated EPS. Adjusted EBITDA also saw a substantial rise, growing 29% to $101.7 million, with the adjusted EBITDA margin expanding by 280 basis points to 27%.

Strategic Developments and Market Expansion

CEO Trevor Baldwin highlighted the quarter's success, attributing it to robust client growth and the strategic expansion into new markets, including the multifamily insurance sector in Canada. The company's rebranding to The Baldwin Group is seen as a move to better align with its market identity and legacy.

"We are thrilled with our start to 2024, as we delivered another quarter of strong, double-digit organic growth and significantly expanded our adjusted EBITDA margin, profitability and free cash flow generationa significant testament to the scalability and earnings power of our business model," said Trevor Baldwin, Chief Executive Officer of The Baldwin Group.

The company also announced a forthcoming change in its NASDAQ ticker symbol to BWIN, effective from May 20, 2024, further emphasizing its new brand identity.

Liquidity and Capital Resources

As of March 31, 2024, The Baldwin Insurance Group reported cash and cash equivalents of $112.1 million, with an additional borrowing capacity of $266.0 million under its revolving credit facility. This positions the company well for future investments and acquisitions.

Operational and Financial Challenges

Despite the strong financial performance, the company faces challenges, including the integration of recent acquisitions and market expansions which could impact operational efficiency. Moreover, the actual GAAP net income and EPS fell short of expectations, highlighting potential areas for financial tightening and performance enhancement.

Looking Forward

The Baldwin Insurance Group remains optimistic about maintaining its growth trajectory through strategic initiatives and market expansion. With a solid start to the year and a strong financial position, the company is well-prepared to navigate the dynamic insurance market and deliver continued value to its shareholders.

Conclusion

The Baldwin Insurance Group's first quarter of 2024 sets a promising tone for the year, with significant revenue growth and strategic expansions underscoring its market resilience and operational strength. Investors and stakeholders may look forward to the company's continued progress and adaptations in the evolving insurance landscape.

Explore the complete 8-K earnings release (here) from The Baldwin Insurance Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance