Bank of England’s Bailey under pressure from Government over food price warning

Downing Street said it is up to Bank of England Governor Andrew Bailey to justify his choice of words after he issued an “apocalyptic” warning about rising food prices.

In a sign of the tension between the Government and the Bank, Cabinet minister Brandon Lewis said he was “surprised” by the language Mr Bailey used to describe the rising cost of living.

Mr Bailey delivered a series of bombshell warnings about the impact of rising inflation and admitted he feels “helpless” in the face of global pressures during an appearance before MPs.

The Prime Minister’s official spokesman acknowledged people are facing “anxious times” but the impact of events including the war on Ukraine on food prices are not fully known yet.

“It’s for him to obviously justify the words he uses,” the spokesman said in response to Mr Bailey.

“We obviously wouldn’t seek to underplay some of the challenges that people the world over are facing as a result of the pandemic and the war in Ukraine and inflationary pressures.

“I think the exact impact of that as regards food prices are not quite known, you would have seen the head of M&S giving a slightly different view this morning.”

Marks and Spencer chairman Archie Norman acknowledged food prices could rise by as much as 10% this year, which is “very negative for consumer discretionary income but it’s perhaps not apocalyptic”.

The Government has insisted it supports the Bank of England’s independence, but behind the scenes, ministers have been critical of the failure to curb spiralling inflation.

Mr Lewis’s public comments a day after the Governor’s appearance before MPs are a signal of the private concerns being expressed within the Cabinet about his effectiveness.

Northern Ireland Secretary Mr Lewis told the BBC on Tuesday: “I was surprised to see that particular turn of phrase, I have to say.

“But the Bank of England is independent, they will have their view of their assessment, their economic view of where things are and where things are going.”

A Downing Street insider was more critical of Mr Bailey, saying “you need to be cautious with your language when you’re talking about that kind of stuff”.

The Bank of England operates independently of government but has a mandate to keep inflation below a 2% target set by ministers.

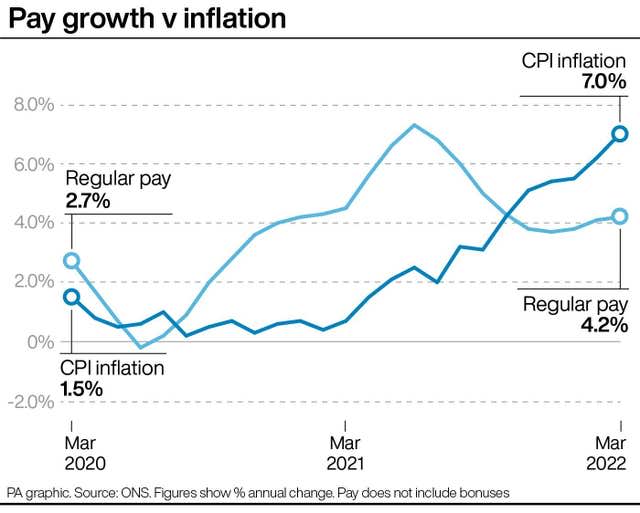

The Office for National statistics recorded inflation at 7% in March and on Wednesday it is expected to unveil a figure of 8% for April.

The Bank of England has said inflation is likely to peak at 10.25% during the final quarter of 2022.

Mr Lewis’ public comments follow a Sunday Telegraph article which quoted unnamed Cabinet ministers criticising the Bank and suggesting its independence was being questioned within Government.

One said the Bank had been failing to “get things right” and another suggested that it had failed a “big test”.

In his evidence to the Commons Treasury Committee on Monday, the Governor stressed that the war in Ukraine has resulted in an unpredictable jump in inflation, highlighting that there is still a “major worry” over further rises in food prices due to the conflict.

“It is a major worry for this country and a major worry for the developing world,” Mr Bailey said.

“Sorry for being apocalyptic but that is a major concern.”

He said the main driver of inflation is “the very big, real income shock which is coming from outside forces and, particularly, energy prices and global goods prices”.

He warned: “That will have an impact on domestic demand and it will dampen activity, and I’m afraid it looks like it will increase unemployment.”

Yahoo Finance

Yahoo Finance