Mark Carney warns of 'uncomfortably high' risk of no-deal Brexit

The governor of the Bank of England warned on Friday that the risk of a no-deal Brexit was “uncomfortably high”.

Mark Carney, speaking on BBC Radio 4’s Today Programme, said that while he thought it was unlikely that the UK would crash out of the EU without a deal, the banking system had been tested to ensure it was strong enough to survive such an eventuality.

The day after the Bank of England raised interest rates to their highest level since the financial crisis, Carney said a no-deal Brexit was “highly undesirable”.

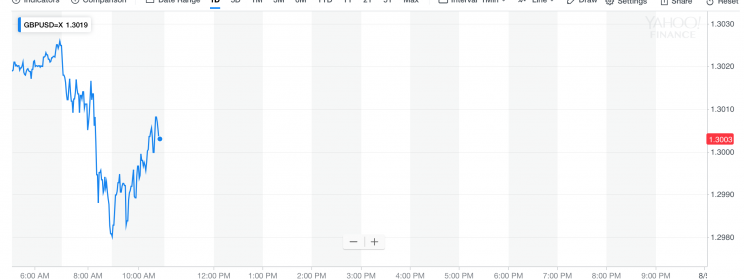

His remarks pushed down the pound against the dollar (GBP/USD) to below $1.30, amid fresh fears about the impact of Brexit on the UK economy and the slow pace of interest rate rises in the years ahead.

They also sparked an angry reaction from Brexit-supporting MPs, including Jacob-Rees Mogg who accused him of being “the high priest of project fear”.

Mark Carney has long been the high priest of project fear whose reputation for inaccurate and politically motivated forecasting has damaged the reputation of the Bank of England.https://t.co/OZMpP8npmV

— Jacob Rees-Mogg (@Jacob_Rees_Mogg) August 3, 2018

Iain Duncan Smith, another Conservative MP who supports Brexit, said: “No deal is the language of Project Fear.”

Carney – referring to last year’s stress tests on the banking system – said: “We’ve put the banks through the wringer to make sure that they have the capital.”

The banks have been tested to ensure they have enough capital to cope with a scenario of a 4.7% fall in UK GDP, a 33% fall in house prices, interest rates rising to 4%, unemployment rising to above 9% and the pound falling further.

After Thursday’s interest rate rise, interest rates stand at 0.75%, unemployment is forecast to fall below 4% and the UK economy expected to grow faster than the 0.2% in the first quarter of the year.

The Brexit negotiations were entering a “crucial phase” he said and there was a broad range of potential outcomes to the discussions with the remaining members of the EU.

“Parties should do all things” to avoid the UK leaving the EU without a deal.

Asked about whether a two-year transition period was sufficient, he said “we’ll make it enough” as he did not want to “add to the pile” of issues that needed to be negotiated.

But, he said, there could be disruption to trade and the economy and inflation could rise if the UK leaves the EU without a deal.

“Our job at the Bank of England is to make sure those issues don’t happen in the financial system,” said Carney.

“We have made sure that banks have the capital, the liquidity that they need and we have the contingency plans in place,” he said, in case there is not a deal when the UK leaves the EU in March 2019.

“The financial system will be ready,” he said, so that people would not have to worry about about their money in the bank and be able to get loans.

“We have prepared the financial institutions for very difficult circumstances.”

After the result of the referendum, the Bank of England cut interest rates to 0.25% – and raised them back again last November – and Carney said this action had been justified as the UK economy had grown less quickly than the Bank would have expected without Brexit.

The UK had gone from the fastest growing economy in the G7 countries to the slowest, he said.

Even so, the Bank has faced criticism for raising interest rates at this time. The Institute of Directors said the bank had “jumped the gun” and the debt charity StepChange is concerned about the impact on families already struggling with their debts.

Carney said that rates would rise only slowly, reaching 1.5% over the next three years. That compares with the long-term average of 5%.

Yahoo Finance

Yahoo Finance