Bank of Mum and Dad is not just buying homes - it's now funding rents too

Parents are not just helping their children get on to the housing ladder by buying them a home, but are now increasingly paying for their rents too.

Research by Legal & General has found that the so-called “bank of mum and dad” will fund £2.3bn of rental payments in 2017.

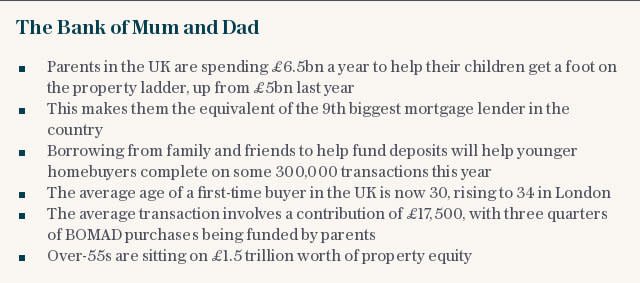

This is on top of the £6.5bn parents are forecast to pay out this year in deposits and mortgage repayments on behalf of their children.

The report, carried out by the Centre for Economics and Business Research, has found that the bank of mum and dad is now financially helping 9pc of renters across the UK, on nearly 460,000 properties.

Previous research also by L&G found that the bank of mum and dad was equivalent to the ninth biggest lender, lending the same amount as Yorkshire Building Society. This year’s total is up 30pc on last year. Earlier this year, the Social Mobility Commission found that 34pc of first-time buyers were using a gift from family or friends to help them purchase property.

This brings the total payout to roughly £8.8bn this year, and helping a combined 938,000 properties with either rent or payments for a mortgage or deposit.

The bank of mum and dad has also helped 10pc of renters to pay for a security deposit, as well as moving expenses and letting agent fees. A quarter of those aged 25-44 said that they had received help from a parent to pay rent.

L&G calculated that with each payment, parents contribute an average of £415, and one in 10 renters receives such financial assistance to pay for rent of between £500 and £1,500 a month. Payments to cover rent are at the highest level in London, where the total payout by parents is £626m, followed by the East of England, at £604m. Here, house prices and rents have increased steeply in recent years.

Rents are often much higher than mortgage repayments, particularly due to low interest rates, and property portal Zoopla has found that this is the case in two thirds of British cities.

Research by the Resolution Foundation has found that millennials have paid on average £44,000 more in rent by the age of 30 than the baby-boomers did. At this age, just 42pc of millennials own their own home, compared to 63pc of baby-boomers.

Dan Batterton, a fund manager at L&G, said: “The lack of affordable housing, low wage growth relative to inflation and burdens of student debt mean that many kids can’t even rent somewhere without significant contributions from their family.”

He added: “Parents want to help their kids get on in life, and the bank of mum and dad is a testament to their generosity.”

The report added that parents were expected to play a bigger role in years to come as renting became more prevalent. PwC has forecast that by 2025, 60pc of Londoners will be renters.

L&G is involved in the building of more than 70,000 new homes over the next five to 10 years, and Nigel Wilson, its chief executive, has said that the bank of mum and dad is “a symptom of our broken housing market”.

Yahoo Finance

Yahoo Finance