Bank prepares to raise rates as borrowing spree continues

Credit card lending is growing at a faster pace than other forms of lending, data from the Bank of England showed in the week that interest rates are expected to rise to their highest level since the financial crisis.

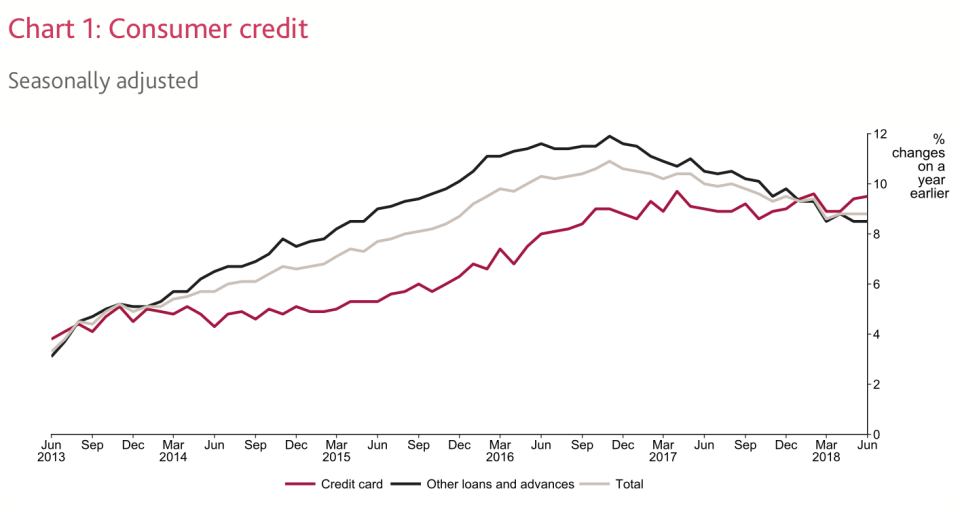

Annual credit card growth was 9.5% in June, fuelling the growth in consumer borrowing, which also includes personal loans, overdrafts and car finance, which rose at 8.8%.

Consumers borrowed another £1.6bn in June, while the total amount of borrowing outstanding that month was £213.2bn, another record level.

“Credit cards have been accounting for an increasing share of consumer credit growth over the past couple of years and the growth rate of credit card lending has exceeded that of other loans and advances (which includes personal loans, overdrafts and car finance) since January 2018,” the Bank of England said.

While credit card growth was 9.5% in June, the growth rate of other forms of unsecured lending was 8.5%.

“Continued strength in unsecured borrowing is symptomatic of the pressure on consumers’ finances, rather than rising confidence about the outlook for their incomes,” said Samuel Tombs, chief UK economist at Pantheon Economics.

On Thursday, the Bank of England is expected to increase interest rates from 0.5% to 0.75% – the highest level since March 2009. Rates stayed at that historic low until they were cut to 0.25% after the EU referendum and then raised for the first time in more than a decade in November 2017, back to 0.5%.

A rise on Thursday would push up the cost of borrowing for households, which are now borrowing more than their annual income for the first time in 30 years.

Warning against a rate rise: ‘unnecessary risk’

Some market commentators are warning about the impact of a rate rise. Inflation is not rising as fast as the Bank had expected – at 2.4% when the Bank is estimating 2.5%, noted Sajiv Vaid, portfolio manager at Fidelty’s moneybuilder income fund.

“Wage growth also remains subdued with little sign of the pressure easing on UK households in in the near-term,” Vaid added.

“Mindful of the global and domestic macro and political backdrop, namely ongoing UK government stability, I continue to believe that a prospective rate hike is an unnecessary risk.”

The debt charity StepChange warned of households living on a “financial knife edge”, with 9 million people already using credit to make ends to meet.

“Whilst the growth in consumer credit recently stabilised, households are still at risk of being tipped into severe problem debt,” said Petter Tutton, head of policy at StepChange.

Housing market ‘struggling’

The Bank of England also released data on the housing market. The number of mortgages approved for house purchase increased slightly in June to 66,000, close to the average since 2013. The average growth rate for mortgage lending in June was 3.2% – above the average growth rate for between June 2009 and 2013 but “modest” compared to the levels before the financial crisis.

Howard Archer, chief economic adviser to the EY ITEM Club, said: “While housing market activity has climbed off its 2018 lows, the impression remains that it is struggling in the face of still limited consumer purchasing power, fragile confidence and likely further gradual Bank of England interest rate rises over the coming months.”

The slowdown in the London house market was reflected in the results of estate agents Foxtons which reported a £2.5m loss for the first six months year, compared with a £3.8m profit a year earlier. Sales revenue was down 23%.

“The property sales market in London is undergoing a period of very low activity levels with longer and less visible transaction outcomes, which clearly impacts our business,” said Nic Budden, chief executive of Foxtons.

Research last month showed house price growth in London was at a nine-year low.

Yahoo Finance

Yahoo Finance