Barclays beats forecasts as it sets aside another £600m for COVID losses

Barclays (BARC.L) beat forecasts for income, profits, and loss provisions in the third quarter, but downgraded its outlook for the UK economy moving forward.

Barclays’ third quarter results showed revenue slipped 6% to £5.2bn ($6.8bn), while pre-tax profit rose over 350% to £1.1bn.

Both measures beat forecasts. Analysts had expected the bank to report net income of £4.8bn in the quarter and a pre-tax profit of £507m.

The bank set aside another £608m ($781m) to cover expected future losses, which was below the £1bn expected by analysts.

“The bank, six months into this historic time, is strong and resilient and profitable,” chief executive Jes Staley told journalists. “We have a good chance to come out of this crisis stronger than when we went in.”

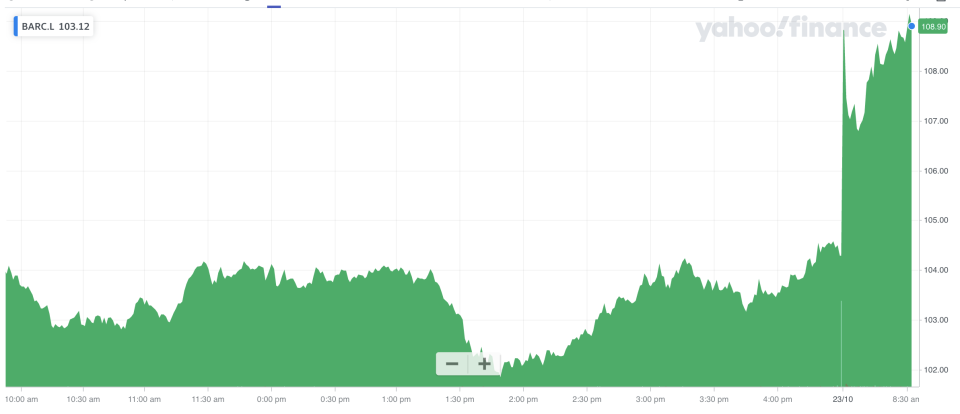

Shares rose 4.5%, topping the FTSE 100.

Barclays was boosted by buoyant activity at it investment bank and its markets business. The core UK business also returned to profit.

“The sudden glut of rights issues, bond raises and share placings means the sun is shining on the investment banking teams as they take home lucrative advice fees,” said Nicholas Hyett, an equity analyst at Hargreaves Lansdown.

“Meanwhile, the trading desks have benefitted from the spike in market volatility – delivering the bank’s best ever third quarter result.”

Watch: What is a budget deficit and why does it matter?

‘Historically challenging year’

Barclays continued to offer support to customers affected by the COVID-19 pandemic in the quarter.

The bank has provided 640,000 payment holidays to customers so far this year and has facilitated loans worth £25bn to businesses under UK government support schemes.

“In this historically challenging year for our customers and clients we have continued to provide huge support to help people through the social and economic impact of the COVID-19 pandemic,” Barclays chief executive Jes Staley said in a statement.

“This remains a priority, alongside maintaining the financial integrity of the firm and keeping our colleagues safe.”

The bank said the outlook for the UK economy was worsening. Barclays now expects UK GDP to decline by 10.3% this year, which was a downgrade from the 8.7% slump it forecast in June. The bank now expects “a more prolonged period of high unemployment in the UK.”

The revision to its forecasts was made in late September. Since then, further restrictions have been introduced in the UK, raising the prospect of further downgrades to the outlook.

Chief financial officer Tushar Morzaria said the bank’s revised numbers were already a “bleak forecast” that should encompass the current worst case scenario.

Outlook ‘remains uncertain’

The third quarter loss provision take total loss buffers to £4.3bn so far this year. Barclays said government support schemes had so far prevented any noticeable uptick in loans going bad.

The £608m loss provision taken in the most recent quarter was down 63% on the previous period’s figure.

“We expect the impairment charge in the second half of the year to be materially lower than the first half,” Staley said in a statement.

Barclays said the outlook “remains uncertain and subject to change depending on the evolution and persistence of the COVID-19 pandemic and the outcome of Brexit negotiations”.

Barclays has moved staff and assets to its Irish subsidiary to ensure continuity for European customers in all circumstances.

“Let’s see how Brexit plays out,” Staley told journalists. “We’re still quite hopeful.”

Earlier this year, the Bank of England ordered all banks to suspend dividends and share buybacks in light of the pandemic.

“The board recognises the importance of capital returns to shareholders and will provide an update on its policy and dividends at full year results,” Staley said.

Watch: European bank stocks jump on strong Barclays results

Yahoo Finance

Yahoo Finance