Bayer's (BAYRY) AskBio Advances Parkinson Disease Study

Bayer BAYRY announced that its wholly owned and independently operating subsidiary, Asklepios BioPharmaceutical, Inc. (AskBio), initiated recruitment in the mid-stage study REGENERATE-PD.

REGENERATE-PD is a phase II study evaluating the efficacy and safety of AB-1005, an investigational adeno-associated virus 2 (AAV2) glial cell line-derived neurotrophic factor (GDNF) gene therapy for the treatment of moderate-stage Parkinson’s disease.

Subjects will receive either bilateral image-guided infusion of AAV2-GDNF into the putamen, single dose (active treatment arm) or bilateral partial burr/twist holes (control arm). The trial will include an estimated 87 subjects with study sites located in the United States, the UK and Europe.

Enrolment will initially begin in the United States and eventually move on to other sites.

The decision to advance the candidate to phase II followed encouraging results from the phase Ib study and the presentation of 18-month data at the American Association of Neurology meeting in April.

In January, AskBio reported that the phase Ib study achieved its primary endpoint, which was to evaluate the safety of a one-time bilateral delivery of AB-1005 directly to the putamen.

The experimental gene therapy was well tolerated with no serious adverse events that were considered related to AB-1005 in all 11 patients at 18 months.

Per the Parkinson’s Foundation, more than 10 million people suffer from Parkinson’s disease globally.

Bayer expects AB-1005 to have a transformative impact on the treatment of Parkinson’s disease patients.

AskBio is a fully integrated gene therapy, with a portfolio of clinical programs across a range of neuromuscular, central nervous system, cardiovascular and metabolic disease indications with a clinical-stage pipeline that includes therapeutics for congestive heart failure, Huntington’s disease, limb-girdle muscular dystrophy, multiple system atrophy, Parkinson’s disease and Pompe disease.

AskBio is assessing GDNF therapy beyond Parkinson’s disease. It is currently enrolling patients with the parkinsonian subtype of multiple system atrophy (MSA-P) in a phase I study to assess the preliminary safety, tolerability and efficacy of GDNF therapy for this rapidly progressing condition.

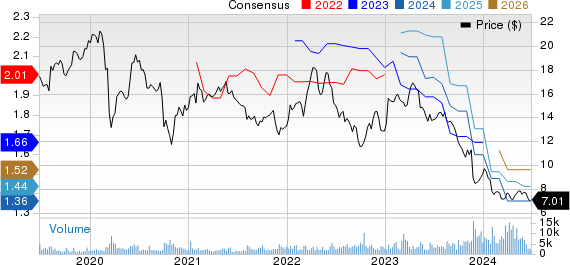

Year to date, shares of Bayer have lost 24.1% against the industry’s growth of 23.1%.

Image Source: Zacks Investment Research

Bayer acquired Asklepios BioPharmaceutical in 2020 to advance the establishment of a cell and gene therapy platform.

Last month, Bayer and its wholly owned, independently operating subsidiary BlueRock Therapeutics, announced that BlueRock’s investigational cell therapy, bemdaneprocel, has been granted the Regenerative Medicine Advanced Therapy designation from the FDA for the treatment of

Parkinson’s disease.

Pipeline setbacks and regulatory setbacks have weighed on the stock in recent times. Bayer’s pipeline needs to deliver amid current circumstances.

The late-stage study, OCEANIC-AF, investigating asundexian compared with direct oral anticoagulant Eliquis (apixaban) in patients with atrial fibrillation and at risk for stroke, was stopped early due to the lack of efficacy. This was a major setback, given the candidate’s potential.

Bayer Aktiengesellschaft Price and Consensus

Bayer Aktiengesellschaft price-consensus-chart | Bayer Aktiengesellschaft Quote

Nonetheless, the company had earlier announced positive top-line results of the phase III study, OASIS 3, evaluating the efficacy and long-term safety of pipeline candidate elinzanetant compared to placebo.

Elinzanetant, a dual neurokinin-1,3 (NK-1,3) receptor antagonist, is in late-stage clinical development for the non-hormonal treatment of moderate to severe vasomotor symptoms (VMS) associated with menopause, administered orally once daily.

The company plans to submit data from a number of studies to health authorities for approval of marketing authorizations of elinzanetant for the treatment of moderate to severe VMS associated with menopause.

Zacks Rank & Stocks to Consider

BAYRY currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Compugen CGEN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73.

ALX Oncology’s earnings beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has remained constant at $2.46. During the same period, the consensus estimate for 2025 loss per share has remained constant at $1.95.

ANVS beat on earnings in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has increased from 2 to 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have lost 8.5%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance