Bear of the Day: Estee Lauder (EL)

Company Overview

Zacks Rank #5 (Strong Sell) Estee Lauder (EL) is a renowned beauty and cosmetics company specializing in the manufacturing and marketing of skincare, makeup, fragrance, and hair care products. Founded by Estee Lauder herself, the company has become a global leader in the beauty industry. Estee Lauder offers a wide range of high-quality beauty products under various brands, including Estee Lauder, Clinique, MAC, Bobbi Brown, and others. Most of Estee Lauder’s products are available at department stores, specialty retailers, and online, catering to a diverse customer base.

International Exposure Weighs on Growth

Weakness in Asia, particularly in China, is weighing on EL shares. Unfortunately, China’s economic woes have dragged on for years with no end in sight. For example, the iShares China ETF (FXI), a proxy for large-cap Chinese equities, is working on its fifth consecutive monthly loss and is down ~18% year-to-date. Meanwhile, the earnings picture looks bleak. For the December quarter, Zacks Consensus Analyst Estimates anticipate EPS growth to slow by a whopping 64.29%

Image Source: Zacks Investment Research

Stretched Valuation Despite Drop in Shares

Though shares of Estee Lauder have plummeted 46% year-to-date, they remain unattractive from a valuation perspective. Estee Lauder’s p/e ratio of 57x is much higher than that of the S&P 500 Index and its peers. Slowing growth coupled with a rich valuation is not a good sign for EL investors.

Image Source: Zacks Investment Research

Competition is Taking its Toll

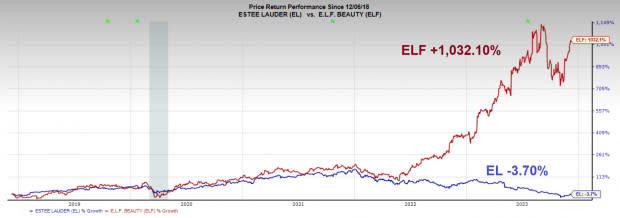

A slew of new, innovative, and flexible competitors has entered the market and is stealing market share from old, legacy, and less “cool” brands like EL. For example, over the past five years, E.L.F Beauty (ELF) have increased by over 1,000%, while Estee Lauder shares are lower. Unfavorable global currency trends and geopolitical disruptions in critical areas like the Middle East are making it more challenging for more prominent players like EL.

Image Source: Zacks Investment Research

Bottom Line

Estee Lauder faces significant challenges as it navigates a landscape market by international economic uncertainties, a stretched valuation, and fierce competition. Once a global leader, the company is grappling with the impact of China’s economic struggles, a concerning earnings outlook, and increased competition from innovative rivals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

iShares China Large-Cap ETF (FXI): ETF Research Reports

e.l.f. Beauty (ELF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance