Bear of the Day: Xerox Holdings (XRX)

Xerox Holdings XRX, a Zacks Rank #5 (Strong Sell), operates as a global workplace technology company that integrates hardware, services, and software for enterprises. Xerox designs, develops, and sells document systems, IT software products, and print solutions.

The company also provides graphic communications, end user computing devices, network infrastructure, commercial robotic process automation, as well as technology product support. Xerox sells its products through its direct sales force, distributors, independent agents, dealers, and e-commerce marketplaces.

Xerox continues to grapple with decreased demand for paper-related systems and products due to technological advancements. The presence of a large number of substitutes raises competitive pressure. A vulnerability to security breaches along with an inability to protect intellectual property rights represent major concerns.

The Zacks Rundown

Xerox Holdings has been severely underperforming the market over the past year. Shares represent a compelling short or hedge opportunity, even as the major indices eclipse former all-time highs.

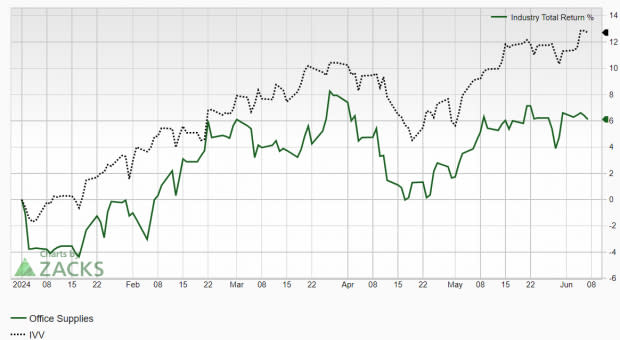

XRX stock is part of the Zacks Office Supplies industry group, which currently ranks in the bottom 8% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months. This industry has widely underperformed the market so far in 2024:

Image Source: Zacks Investment Research

While individual stocks have the ability to outperform even when included in weak industry groups, their industry association serves as a headwind for any potential rallies. Xerox continues to fight an uphill battle and the stock is confirming this notion, lagging the general market by a wide margin.

Recent Earnings and Deteriorating Forecasts

The print solutions company has missed the earnings mark in two of the past three quarters. Back in April, Xerox posted first-quarter earnings of $0.06/share, missing the $0.38/share consensus estimate by a whopping 84.2%.

Xerox has delivered a trailing four-quarter average earnings miss of 7.8%. Consistently falling short of earnings estimates is a recipe for underperformance.

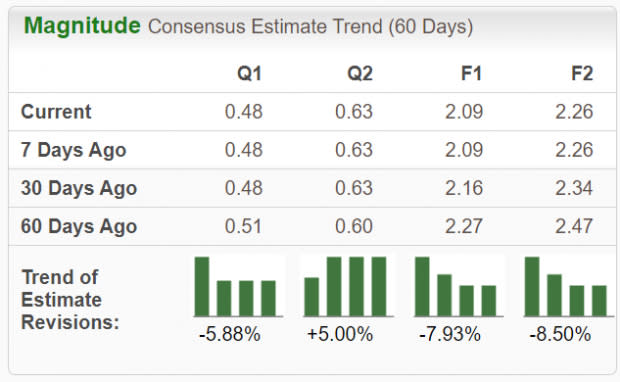

Analysts covering XRX decreased their earnings estimates recently. Looking at the current fiscal year, earnings estimates have been slashed by 7.93% in the past 60 days; the Zacks Consensus Estimate now stands at $2.09/share. Revenues are projected to decline 6.2% year-over-year to $6.46 billion.

Image Source: Zacks Investment Research

Companies like Canon, Hewlett-Packard, and Toshiba are capable of giving tough competition to Xerox. These companies are also broadening their product lines and strengthening their global presence, putting a dent in potential growth prospects for Xerox.

Technical Outlook

Xerox’s stock has been steadily falling this year after forming a bearish head-and-shoulders pattern and has now established a well-defined downtrend. Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping down. Shares have declined about 20% this year alone.

Image Source: StockCharts

XRX stock has also experienced the dreaded death cross, whereby its 50-day moving average crosses below its 200-day moving average. Xerox Holdings would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. Shares remain in negative territory this year while the general market has eclipsed its former highs.

Final Thoughts

A deteriorating fundamental and technical backdrop show that we’re not likely to see this stock print new highs anytime soon. The fact that Xerox is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns.

A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend. Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear of XRX stock until the situation shows major signs of improvement.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xerox Holdings Corporation (XRX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance